Answered step by step

Verified Expert Solution

Question

1 Approved Answer

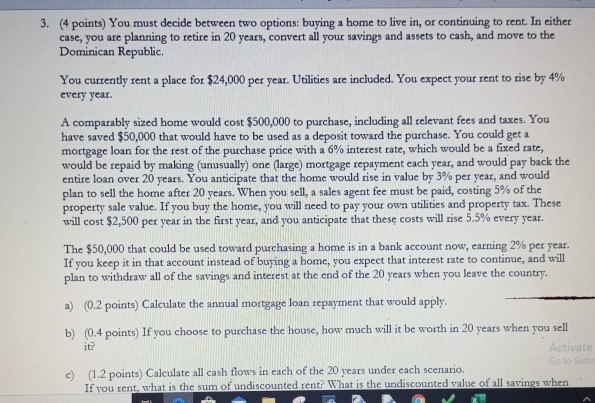

3. (4 points) You must decide between two options: buying a home to live in, or continuing to rent. In either case, you are planning

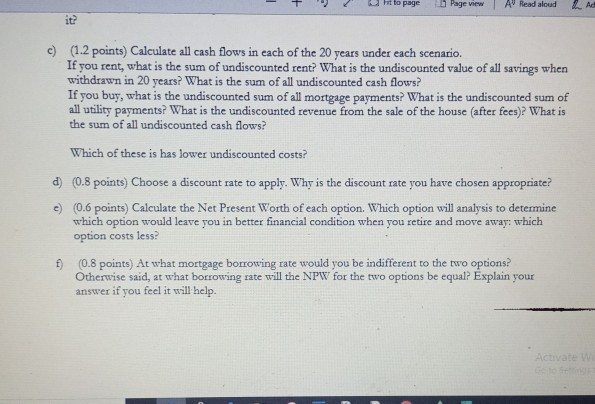

3. (4 points) You must decide between two options: buying a home to live in, or continuing to rent. In either case, you are planning to retire in 20 years, convert all your savings and assets to cash, and move to the Dominican Republic You currently rent a place for $24,000 per year. Utilities are included. You expect your rent to rise by 4% every year. A comparably sized home would cost $500,000 to purchase, including all relevant fees and taxes. You have saved $50,000 that would have to be used as a deposit toward the purchase. You could get a mortgage loan for the rest of the purchase price with a 6% interest rate, which would be a fixed rate, would be repaid by making (unusually) one large) mortgage repayment each year, and would pay back the entire loan over 20 years. You anticipate that the home would rise in value by 3% per year, and would plan to sell the home after 20 years. When you sell, a sales agent fee must be paid, costing 5% of the property sale value. If you buy the home, you will need to pay your own utilities and property tax. These will cost $2,500 per year in the first year, and you anticipate that these costs will rise 5.5% every year. The $50,000 that could be used toward purchasing a home is in a bank account now, earning 2% per year. If you keep it in that account instead of buying a home, you expect that interest rate to continue, and will plan to withdraw all of the savings and interest at the end of the 20 years when you leave the country, a) (0.2 points) Calculate the annual mortgage loan repayment that would apply. b) (0.4 points) If you choose to purchase the house, how much will it be worth in 20 years when you sell it? Activate c) (1.2 points) Calculate all cash flows in each of the 20 years under each scenario. If you rent, what is the sum of undiscounted rent? What is the undiscounted value of all savings when sat Ft to page Page view AV Read aloud Ad it? (1.2 points) Calculate all cash flows in each of the 20 years under each scenario. If you rent, what is the sum of undiscounted rent? What is the undiscounted value of all savings when withdrawn in 20 years? What is the sum of all undiscounted cash flows? If you buy, what is the undiscounted sum of all mortgage payments? What is the undiscounted sum of all utility payments? What is the undiscounted revenue from the sale of the house (after fees)? What is the sum of all undiscounted cash flows? Which of these is has lower undiscounted costs? d) (0.8 points) Choose a discount rate to apply. Why is the discount rate you have chosen appropriate? c) (0.6 points) Calculate the Net Present Worth of each option. Which option will analysis to determine which option would leave you in better financial condition when you retire and move away: which option costs less? f) (0.8 points) At what mortgage borrowing rate would you be indifferent to the two options? Otherwise said, at what borrowing rate will the NPW for the two options be equal? Explain your answer if you feel it will help. Activate We 3. (4 points) You must decide between two options: buying a home to live in, or continuing to rent. In either case, you are planning to retire in 20 years, convert all your savings and assets to cash, and move to the Dominican Republic You currently rent a place for $24,000 per year. Utilities are included. You expect your rent to rise by 4% every year. A comparably sized home would cost $500,000 to purchase, including all relevant fees and taxes. You have saved $50,000 that would have to be used as a deposit toward the purchase. You could get a mortgage loan for the rest of the purchase price with a 6% interest rate, which would be a fixed rate, would be repaid by making (unusually) one large) mortgage repayment each year, and would pay back the entire loan over 20 years. You anticipate that the home would rise in value by 3% per year, and would plan to sell the home after 20 years. When you sell, a sales agent fee must be paid, costing 5% of the property sale value. If you buy the home, you will need to pay your own utilities and property tax. These will cost $2,500 per year in the first year, and you anticipate that these costs will rise 5.5% every year. The $50,000 that could be used toward purchasing a home is in a bank account now, earning 2% per year. If you keep it in that account instead of buying a home, you expect that interest rate to continue, and will plan to withdraw all of the savings and interest at the end of the 20 years when you leave the country, a) (0.2 points) Calculate the annual mortgage loan repayment that would apply. b) (0.4 points) If you choose to purchase the house, how much will it be worth in 20 years when you sell it? Activate c) (1.2 points) Calculate all cash flows in each of the 20 years under each scenario. If you rent, what is the sum of undiscounted rent? What is the undiscounted value of all savings when sat Ft to page Page view AV Read aloud Ad it? (1.2 points) Calculate all cash flows in each of the 20 years under each scenario. If you rent, what is the sum of undiscounted rent? What is the undiscounted value of all savings when withdrawn in 20 years? What is the sum of all undiscounted cash flows? If you buy, what is the undiscounted sum of all mortgage payments? What is the undiscounted sum of all utility payments? What is the undiscounted revenue from the sale of the house (after fees)? What is the sum of all undiscounted cash flows? Which of these is has lower undiscounted costs? d) (0.8 points) Choose a discount rate to apply. Why is the discount rate you have chosen appropriate? c) (0.6 points) Calculate the Net Present Worth of each option. Which option will analysis to determine which option would leave you in better financial condition when you retire and move away: which option costs less? f) (0.8 points) At what mortgage borrowing rate would you be indifferent to the two options? Otherwise said, at what borrowing rate will the NPW for the two options be equal? Explain your answer if you feel it will help. Activate We

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started