Question

3) (4 pts) You buy a $1000 face value bond that mature in 3 years, pays a 5% annual coupon and is priced at

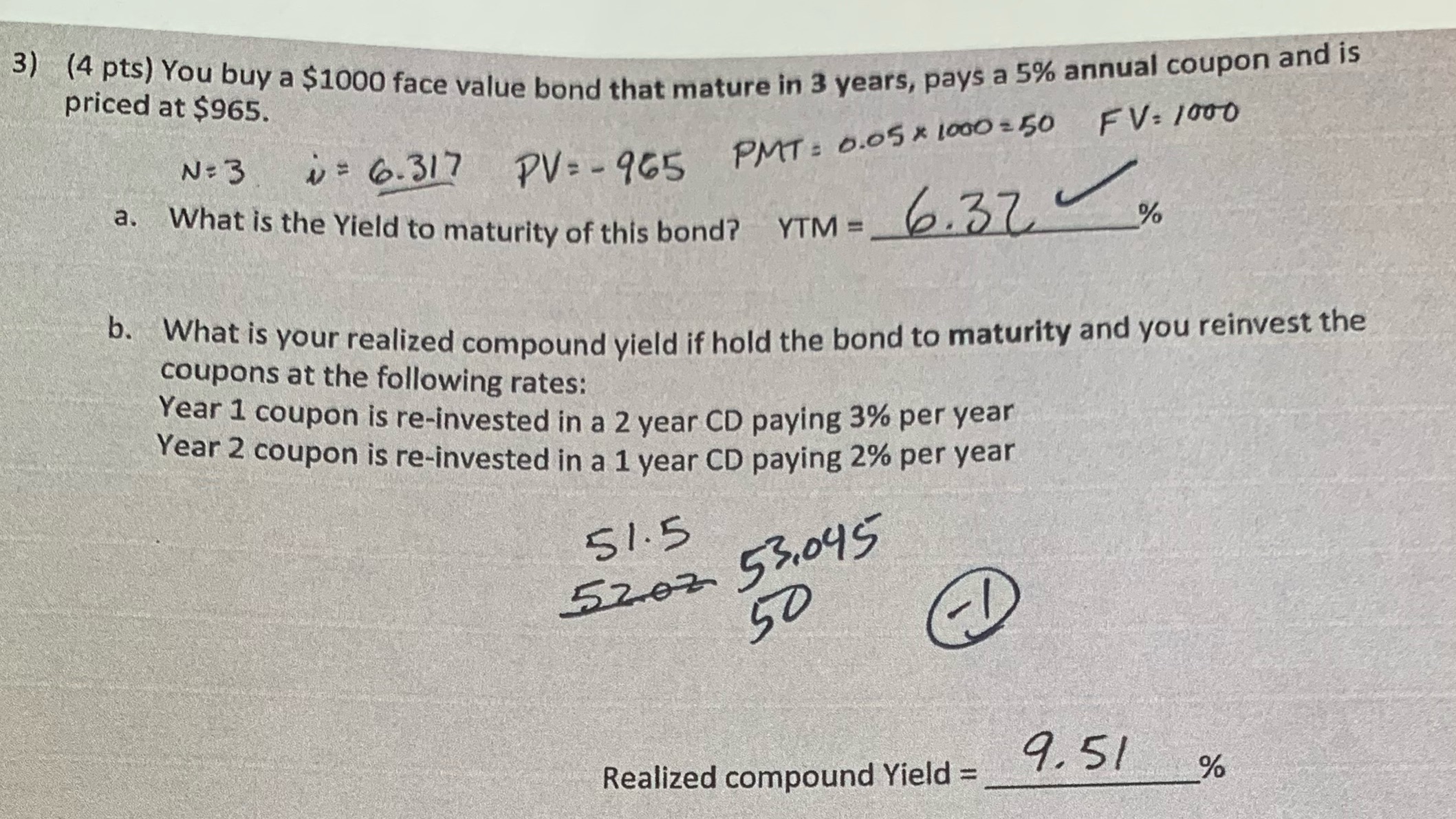

3) (4 pts) You buy a $1000 face value bond that mature in 3 years, pays a 5% annual coupon and is priced at $965. N = 3 i = 6.317 PV=-965 PMT: 0.05 1000 = 50 FV: 1000 6.32 a. What is the Yield to maturity of this bond? YTM = % b. What is your realized compound yield if hold the bond to maturity and you reinvest the coupons at the following rates: Year 1 coupon is re-invested in a 2 year CD paying 3% per year Year 2 coupon is re-invested in a 1 year CD paying 2% per year 51.5 520253.045 50 9.51 Realized compound Yield = %

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the realized compound yield when reinvesting the coupons at different rates we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Engineering Economics

Authors: Chan S. Park

5th edition

136118488, 978-8120342095, 8120342097, 978-0136118480

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App