Answered step by step

Verified Expert Solution

Question

1 Approved Answer

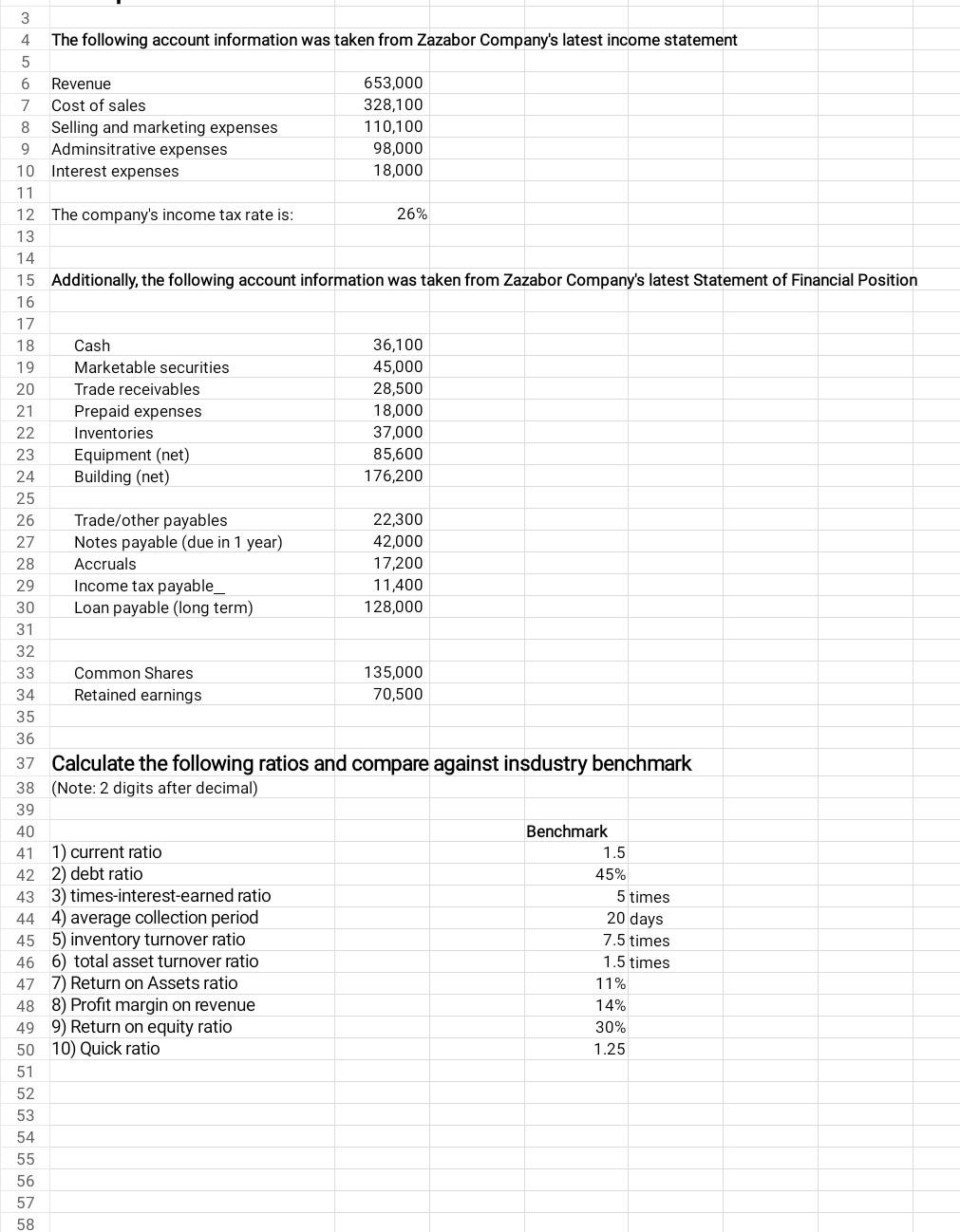

3 4 The following account information was taken from Zazabor Company's latest income statement 5 6 Revenue 653,000 7 Cost of sales 328,100 8 Selling

3 4 The following account information was taken from Zazabor Company's latest income statement 5 6 Revenue 653,000 7 Cost of sales 328,100 8 Selling and marketing expenses 110,100 9 Adminsitrative expenses 98,000 10 Interest expenses 18,000 11 12 The company's income tax rate is: 26% 13 14 15 Additionally, the following account information was taken from Zazabor Company's latest Statement of Financial Position 16 17 18 Cash 36,100 19 Marketable securities 45,000 20 Trade receivables 28,500 21 Prepaid expenses 18,000 22 Inventories 37,000 23 Equipment (net) 85,600 24 Building (net) 176,200 25 26 Trade/other payables 22,300 27 Notes payable (due in 1 year) 42,000 28 Accruals 17,200 29 Income tax payable_ 11,400 30 Loan payable (long term) 128,000 31 32 33 Common Shares 135,000 34 Retained earnings 70,500 35 36 37 Calculate the following ratios and compare against insdustry benchmark 38 (Note: 2 digits after decimal) 39 40 Benchmark 41 1) current ratio 1.5 42 2) debt ratio 45% 43 3) times-interest-earned ratio 5 times 44 4) average collection period 20 days 455) inventory turnover ratio 7.5 times 46 6) total asset turnover ratio 1.5 times 47 7) Return on Assets ratio 11% 48 8) Profit margin on revenue 14% 49 9) Return on equity ratio 30% 50 10) Quick ratio 1.25 51 52 53 54 55 56 57 58

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started