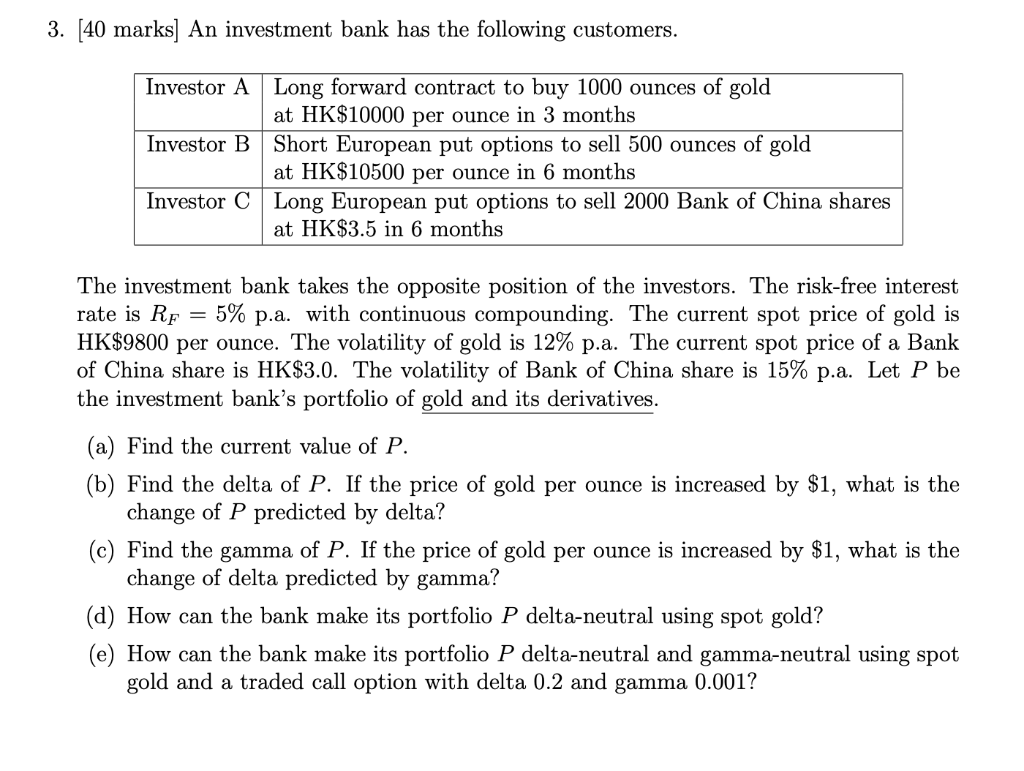

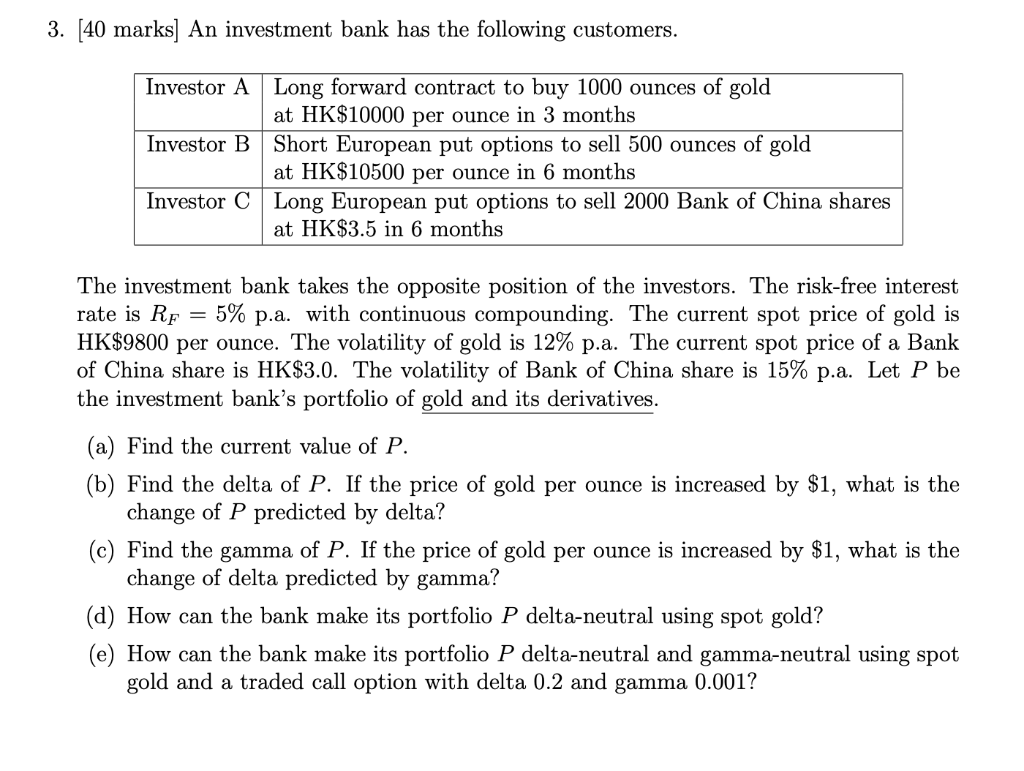

3. [40 marks] An investment bank has the following customers. Investor A Long forward contract to buy 1000 ounces of gold at HK$10000 per ounce in 3 months Investor B Short European put options to sell 500 ounces of gold at HK$10500 per ounce in 6 months Investor C Long European put options to sell 2000 Bank of China shares at HK$3.5 in 6 months The investment bank takes the opposite position of the investors. The risk-free interest rate is RF 5% p.a. with continuous compounding. The current spot price of gold is HK$9800 per ounce. The volatility of gold is 12% p.a. The current spot price of a Bank of China share is HK$3.0. The volatility of Bank of China share is 15% p.a. Let P be the investment bank's portfolio of gold and its derivatives. (a) Find the current value of P. (b) Find the delta of P. If the price of gold per ounce is increased by $1, what is the change of P predicted by delta? (c) Find the gamma of P. If the price of gold per ounce is increased by $1, what is the change of delta predicted by gamma? (d) How can the bank make its portfolio P delta-neutral using spot gold? (e) How can the bank make its portfolio P delta-neutral and gamma-neutral using spot gold and a traded call option with delta 0.2 and gamma 0.001? 3. [40 marks] An investment bank has the following customers. Investor A Long forward contract to buy 1000 ounces of gold at HK$10000 per ounce in 3 months Investor B Short European put options to sell 500 ounces of gold at HK$10500 per ounce in 6 months Investor C Long European put options to sell 2000 Bank of China shares at HK$3.5 in 6 months The investment bank takes the opposite position of the investors. The risk-free interest rate is RF 5% p.a. with continuous compounding. The current spot price of gold is HK$9800 per ounce. The volatility of gold is 12% p.a. The current spot price of a Bank of China share is HK$3.0. The volatility of Bank of China share is 15% p.a. Let P be the investment bank's portfolio of gold and its derivatives. (a) Find the current value of P. (b) Find the delta of P. If the price of gold per ounce is increased by $1, what is the change of P predicted by delta? (c) Find the gamma of P. If the price of gold per ounce is increased by $1, what is the change of delta predicted by gamma? (d) How can the bank make its portfolio P delta-neutral using spot gold? (e) How can the bank make its portfolio P delta-neutral and gamma-neutral using spot gold and a traded call option with delta 0.2 and gamma 0.001