Question

3. (a) [12] WestJet Airlines Ltd. is considering adding a new short-haul, lowcost, regional airline to its fleet. The regional airline would use a turbo-prop

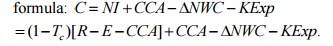

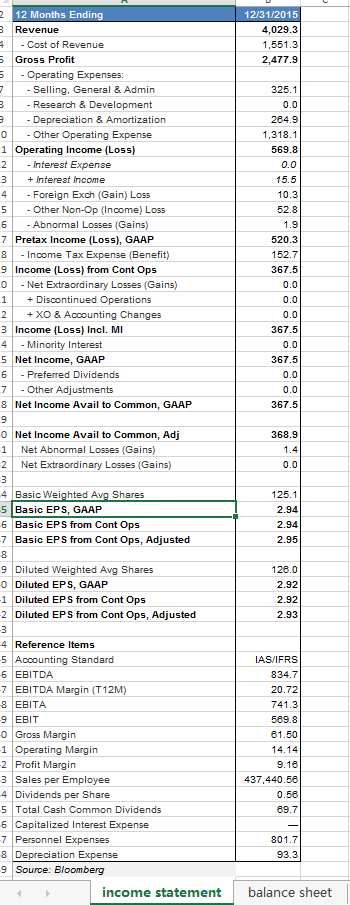

3. (a) [12] WestJet Airlines Ltd. is considering adding a new short-haul, lowcost, regional airline to its fleet. The regional airline would use a turbo-prop aircraft, allowing WestJet to provide service to new, smaller communities where the larger 737 aircraft did not make sense economically. You have been assigned the task of determining the net cash flows, NPV, and IRR of the proposed regional airline. To conduct the required analysis, refer to the financial statements given in the Excel file Assignment1Q3w17DATA posted to the class website in uLearn, under Assignments. Use the data for FY 2015. Build an Excel worksheet with a column for each year of the expected life of the project. (Note: Consider how depreciation is to be measured when identifying the number of columns to include in the worksheet.) For each year, derive free cash flow using the formula:

Assumptions are as follows:

The project is evaluated on the basis of a five-year life.

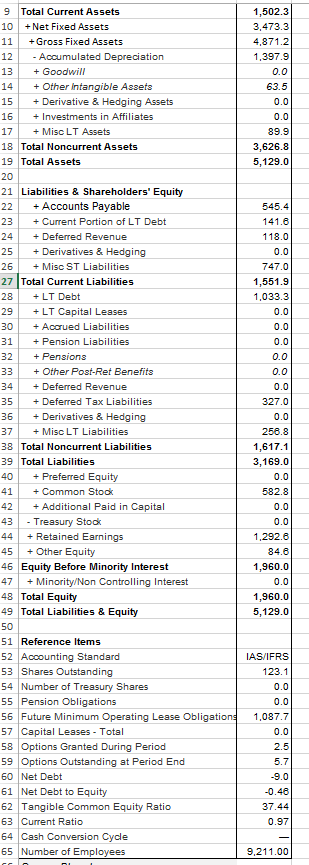

Development of the new airline will require an initial investment equal to 9% of Net Fixed Assets for the fiscal year 2015. The project will then require an additional investment equal to 6% of initial investment after the first year, a 4% increase after the second year, and a 2% increase after the third, fourth, and fifth years. See below for a HINT on the calculation.

First-year revenues for the new airline are expected to be 11% of total revenue for the fiscal year 2015. The new airlines revenues are expected to grow at 16% for the second year, then 11% for the third year, and 6% annually for the final two years.

The new airlines profitability will be similar to WestJets existing projects in 2015, so estimate [R E] (or gross profit) each year using the 2015 EBITDA/Sales profit margin. Note that this is equivalent to the 2015 EBITDA/Sales ratio.

Determine annual depreciation by assuming WestJet depreciates the assets by the straight-line method over a 10-year life, that is, assume that capital expenditures made in years 0, 1, 2, 3, 4, and 5 will be depreciated on a straight-line basis over the following periods, respectively: years 1-10, years 2-11, years 3-12, years 4-13, years 5-14, and years 6-15. (Assume the 50% rule does not apply.)

Determine WestJets tax rate by using the income tax rate in 2015.

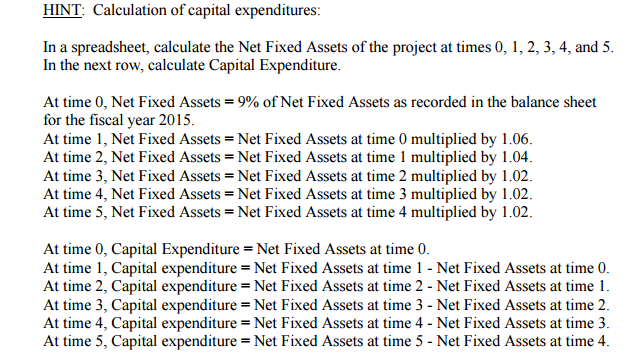

Calculate the net working capital (NWC) required each year by assuming that the level of NWC will be a constant percentage of the projects sales. Use WestJets 2015 NWC/Sales ratio to estimate the required percentage. (Use only accounts receivable, account payable, and inventory to measure working capital. Other components of current assets and liabilities are harder to interpret and not necessarily reflective of the projects required NWC, e.g., WestJets cash holdings.) See below for a HINT on the calculation.

To determine the free cash flow, calculate the additional capital investment and the change in net working capital each year. WestJet has an estimated cost of capital of 10%.

In years 6-15, the company will generate sufficient taxable income from its other projects to use in full the depreciation tax shields that this project will make available.

(b) [1] If you assume that development of the new airline will require an initial investment equal to 10% of Net Fixed Assets for the fiscal year 2015 (rather than 9%), holding all other assumptions the same as in (a), what is the NPV of the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started