Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. (a) A company is deciding whether or not to buy a machine costing 160,000. The machine has maintenance costs of 10,000 in year

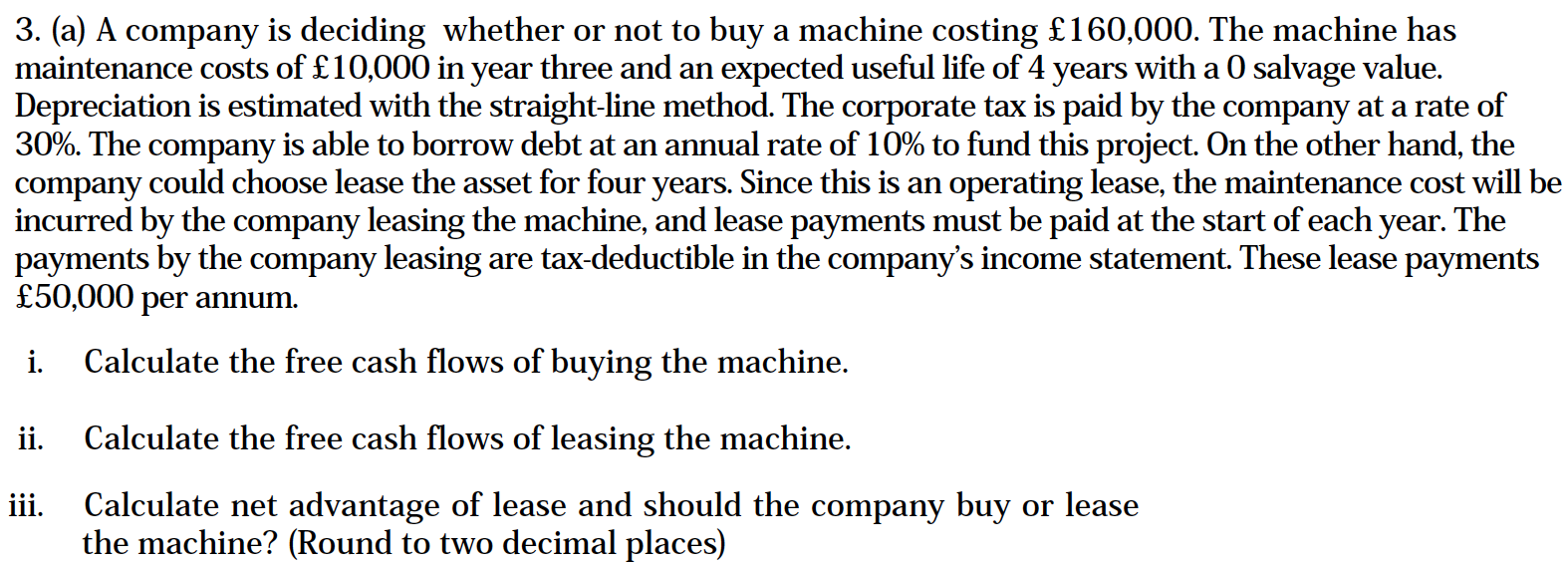

3. (a) A company is deciding whether or not to buy a machine costing 160,000. The machine has maintenance costs of 10,000 in year three and an expected useful life of 4 years with a 0 salvage value. Depreciation is estimated with the straight-line method. The corporate tax is paid by the company at a rate of 30%. The company is able to borrow debt at an annual rate of 10% to fund this project. On the other hand, the company could choose lease the asset for four years. Since this is an operating lease, the maintenance cost will be incurred by the company leasing the machine, and lease payments must be paid at the start of each year. The payments by the company leasing are tax-deductible in the company's income statement. These lease payments 50,000 per annum. i. Calculate the free cash flows of buying the machine. ii. Calculate the free cash flows of leasing the machine. iii. Calculate net advantage of lease and should the company buy or lease the machine? (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Ill answer each question step by step a i Calculate the free cash flows of buying the machine Year 0 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started