3.

A)

B)

C)

D)

4.

A)

B)

C)

1.

2.

D)

E)

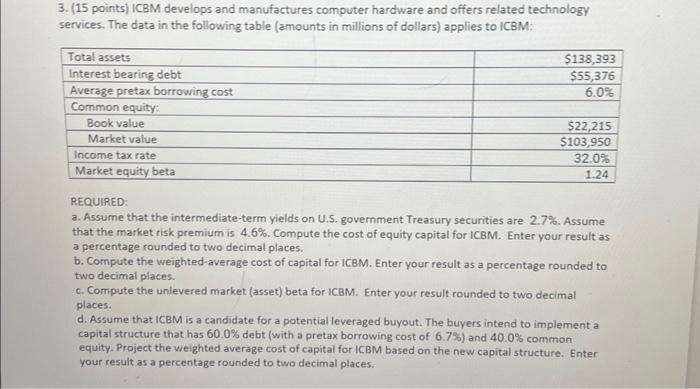

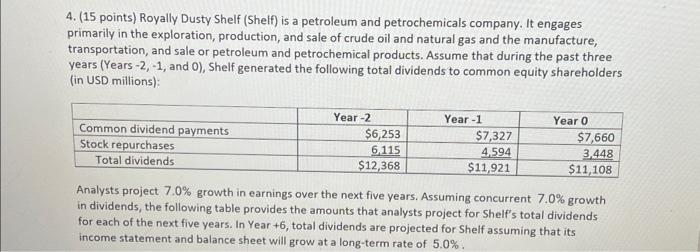

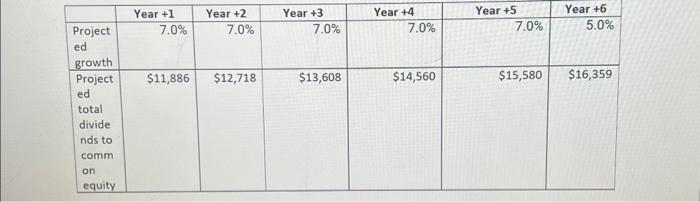

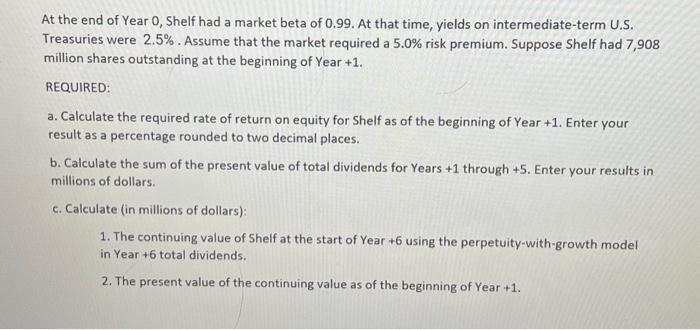

3. (15 points) ICBM develops and manufactures computer hardware and offers related technology services. The data in the following table (amounts in millions of dollars) applies to ICBM: REQUIRED: a. Assume that the intermediate-term yields on U.S. government Treasury securities are 2.7%. Assume that the market risk premium is 4.6%. Compute the cost of equity capital for ICBM. Enter your result as a percentage rounded to two decimal places. b. Compute the weighted-average cost of capital for ICBM. Enter your result as a percentage rounded to two decimal places. c. Compute the unlevered market (asset) beta for ICBM. Enter your result rounded to two decimal places: d. Assume that ICBM is a candidate for a potential leveraged buyout. The buyers intend to implement a capital structure that has 60.0% debt (with a pretax borrowing cost of 6.7% ) and 40.0% common equity. Project the weighted average cost of capital for ICBM based on the new capital structure. Enter your result as a percentage rounded to two decimal places. 4. (15 points) Royally Dusty Shelf (Shelf) is a petroleum and petrochemicals company. It engages primarily in the exploration, production, and sale of crude oil and natural gas and the manufacture, transportation, and sale or petroleum and petrochemical products. Assume that during the past three years (Years 2,1, and 0 ), Shelf generated the following total dividends to common equity shareholders (in USD millions): Analysts project 7.0% growth in earnings over the next five years. Assuming concurrent 7.0% growth in dividends, the following table provides the amounts that analysts project for Shelf's total dividends for each of the next five years. In Year +6 , total dividends are projected for Shelf assuming that its income statement and balance sheet will grow at a long-term rate of 5.0%. \begin{tabular}{|c|c|c|c|c|c|c|} \hline & Year +1 & Year +2 & Year +3 & Year +4 & Year +5 & Year +6 \\ \hline \begin{tabular}{l} Project \\ ed \\ growth \end{tabular} & 7.0% & 7.0% & 7.0% & 7.0% & 7.0% & 5.0% \\ \hline \begin{tabular}{l} Project \\ ed \\ total \\ divide \\ nds to \\ comm \\ on \\ equity \end{tabular} & $11,886 & $12,718 & $13,608 & $14,560 & $15,580 & $16,359 \\ \hline \end{tabular} At the end of Year 0 , Shelf had a market beta of 0.99. At that time, yields on intermediate-term U.S. Treasuries were 2.5%. Assume that the market required a 5.0% risk premium. Suppose Shelf had 7,908 million shares outstanding at the beginning of Year +1 . REQUIRED: a. Calculate the required rate of return on equity for Shelf as of the beginning of Year +1 . Enter your result as a percentage rounded to two decimal places. b. Calculate the sum of the present value of total dividends for Years +1 through +5 . Enter your results in millions of dollars. c. Calculate (in millions of dollars): 1. The continuing value of Shelf at the start of Year +6 using the perpetuity-with-growth model in Year +6 total dividends. 2. The present value of the continuing value as of the beginning of Year +1 . d. Compute (in millions of dollars) the total present value of dividends for Shell as of the beginning of Year +1 . Remember to adjust the present value for midyear discounting. e. Compute the value per share of Shelf as of the beginning of Year 1