Answered step by step

Verified Expert Solution

Question

1 Approved Answer

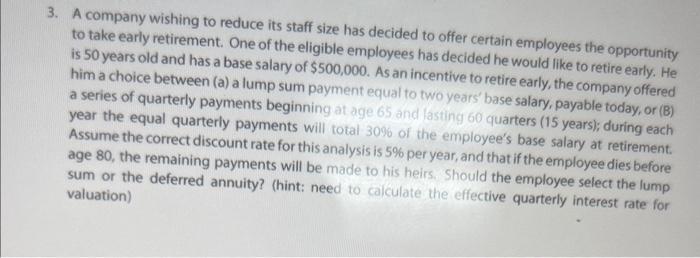

3. A company wishing to reduce its staff size has decided to offer certain employees the opportunity to take early retirement. One of the

3. A company wishing to reduce its staff size has decided to offer certain employees the opportunity to take early retirement. One of the eligible employees has decided he would like to retire early. He is 50 years old and has a base salary of $500,000. As an incentive to retire early, the company offered him a choice between (a) a lump sum payment equal to two years' base salary, payable today, or (B) a series of quarterly payments beginning at age 65 and lasting 60 quarters (15 years); during each year the equal quarterly payments will total 30% of the employee's base salary at retirement. Assume the correct discount rate for this analysis is 5% per year, and that if the employee dies before age 80, the remaining payments will be made to his heirs. Should the employee select the lump sum or the deferred annuity? (hint: need to calculate the effective quarterly interest rate for valuation)

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To compare the two options we need to calculate the present value of each option at retirement age 5...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started