Question

3) a. Describe the systematic and nonsystematic risk components of the following assets: - A risk-free asset, such as a three-month Treasury bill -

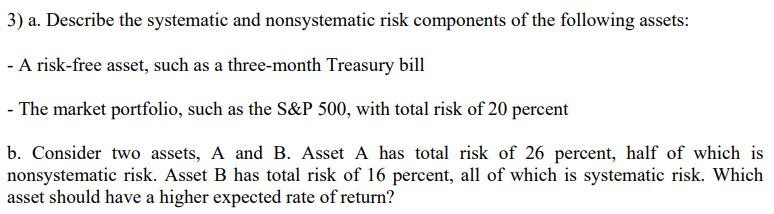

3) a. Describe the systematic and nonsystematic risk components of the following assets: - A risk-free asset, such as a three-month Treasury bill - The market portfolio, such as the S&P 500, with total risk of 20 percent b. Consider two assets, A and B. Asset A has total risk of 26 percent, half of which is nonsystematic risk. Asset B has total risk of 16 percent, all of which is systematic risk. Which asset should have a higher expected rate of return?

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer A I The risk free rate is the expected rate of return on a riskfree asset While a riskfree as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Behavioral Finance Psychology Decision-Making and Markets

Authors: Lucy Ackert

1st edition

324661177, 978-0538752862, 538752866, 978-1111781675, 1111781672, 978-1133455486, 978-0324661170

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App