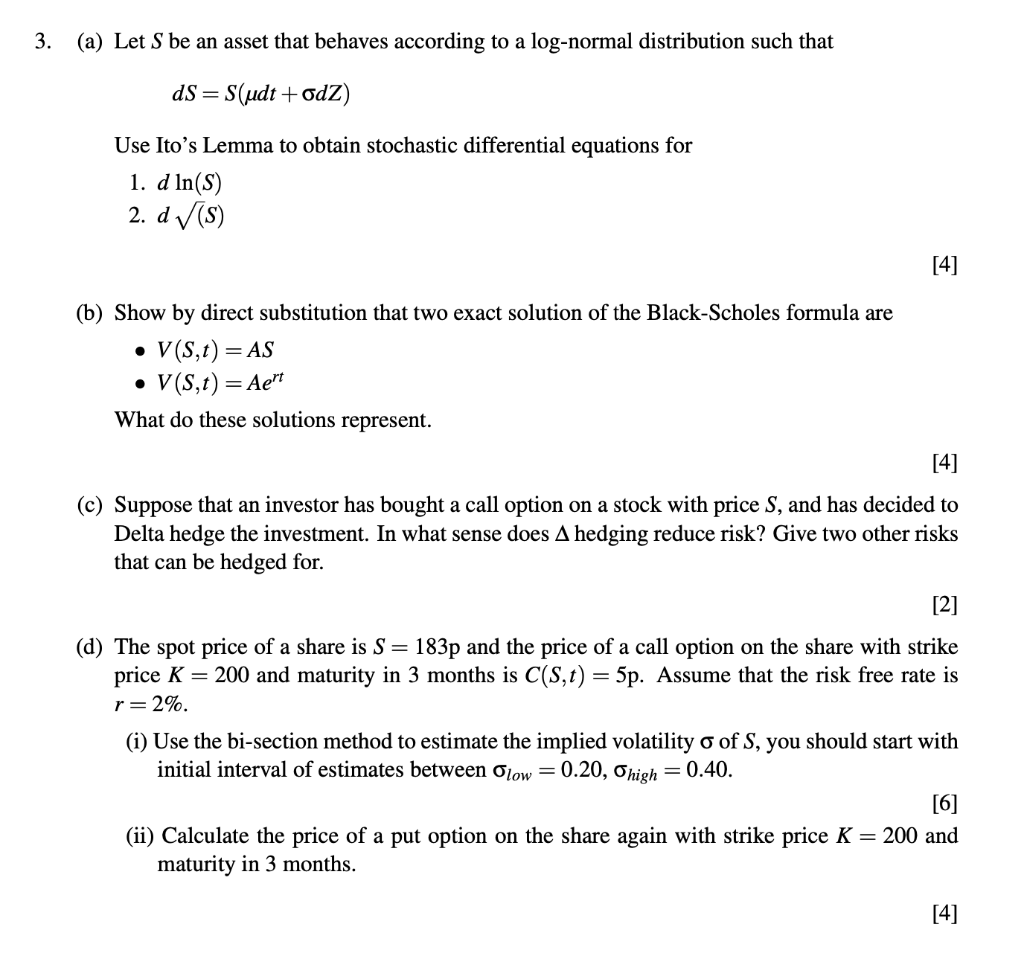

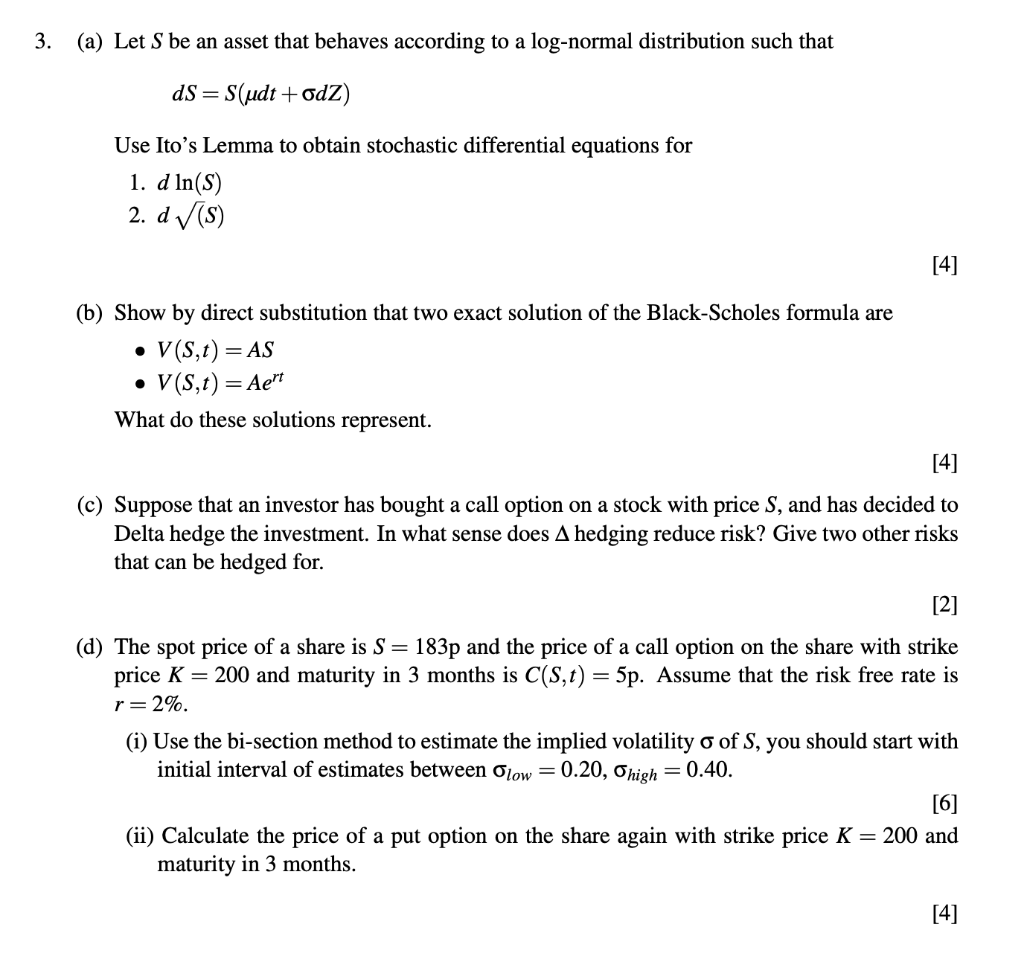

3. (a) Let S be an asset that behaves according to a log-normal distribution such that dS = S(udt + odz) Use Ito's Lemma to obtain stochastic differential equations for 1. d In(S) 2. dv(s) [4] (b) Show by direct substitution that two exact solution of the Black-Scholes formula are V(S,t) = AS V(S,t)=Aert What do these solutions represent. . = [4] (c) Suppose that an investor has bought a call option on a stock with price S, and has decided to Delta hedge the investment. In what sense does A hedging reduce risk? Give two other risks that can be hedged for. [2] (d) The spot price of a share is S = 183p and the price of a call option on the share with strike price K = 200 and maturity in 3 months is C(S,t) = 5p. Assume that the risk free rate is r= 2%. = (i) Use the bi-section method to estimate the implied volatility o of S, you should start with initial interval of estimates between low = 0.20, Ohigh = 0.40. [6] (ii) Calculate the price of a put option on the share again with strike price K = 200 and maturity in 3 months. [4] 3. (a) Let S be an asset that behaves according to a log-normal distribution such that dS = S(udt + odz) Use Ito's Lemma to obtain stochastic differential equations for 1. d In(S) 2. dv(s) [4] (b) Show by direct substitution that two exact solution of the Black-Scholes formula are V(S,t) = AS V(S,t)=Aert What do these solutions represent. . = [4] (c) Suppose that an investor has bought a call option on a stock with price S, and has decided to Delta hedge the investment. In what sense does A hedging reduce risk? Give two other risks that can be hedged for. [2] (d) The spot price of a share is S = 183p and the price of a call option on the share with strike price K = 200 and maturity in 3 months is C(S,t) = 5p. Assume that the risk free rate is r= 2%. = (i) Use the bi-section method to estimate the implied volatility o of S, you should start with initial interval of estimates between low = 0.20, Ohigh = 0.40. [6] (ii) Calculate the price of a put option on the share again with strike price K = 200 and maturity in 3 months. [4]