Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 a. On December 31, 2016, the Notes Receivable account at Manton Materials had a balance of $20,500, which represented a six-month, 12 percent note

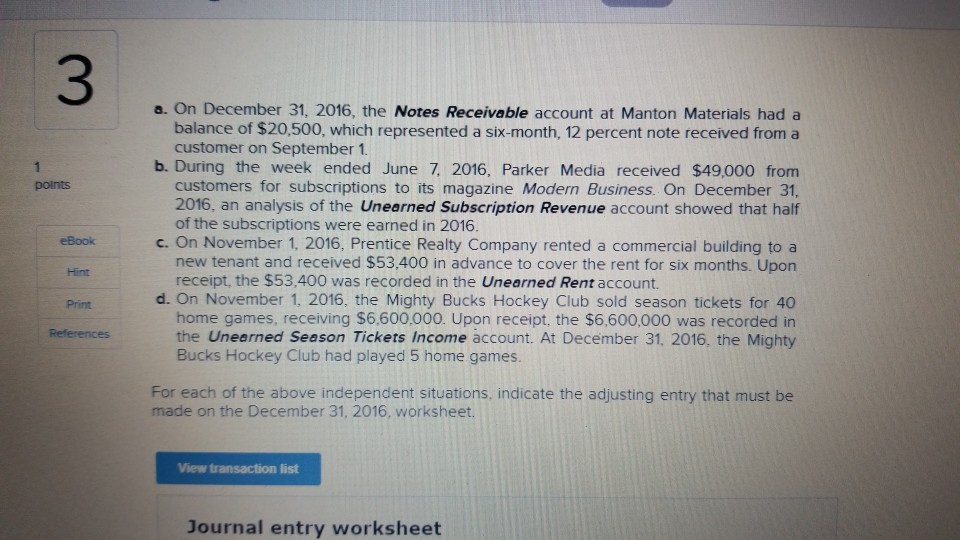

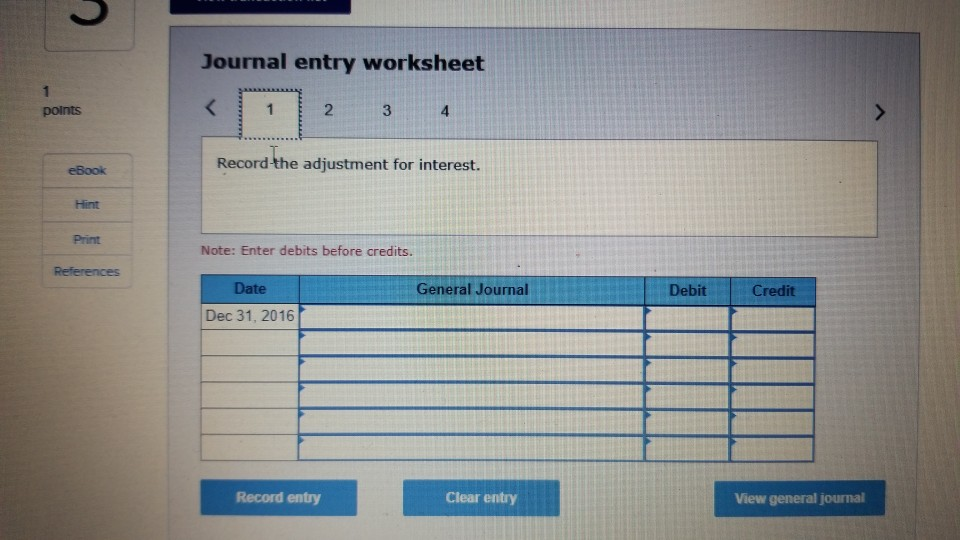

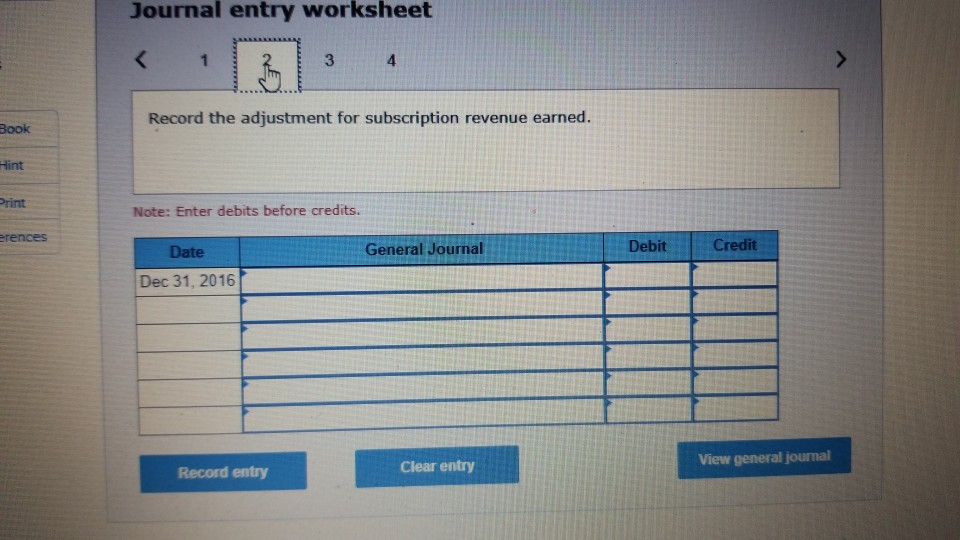

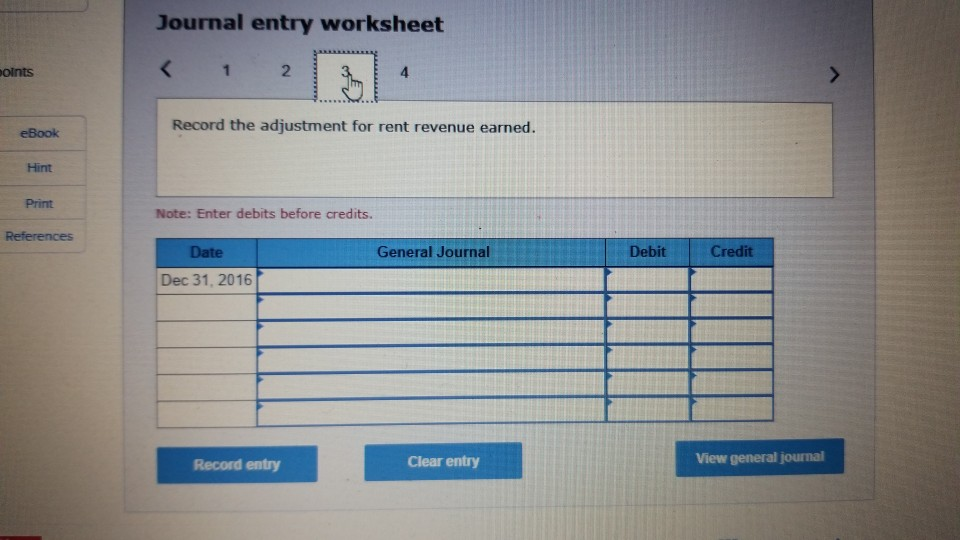

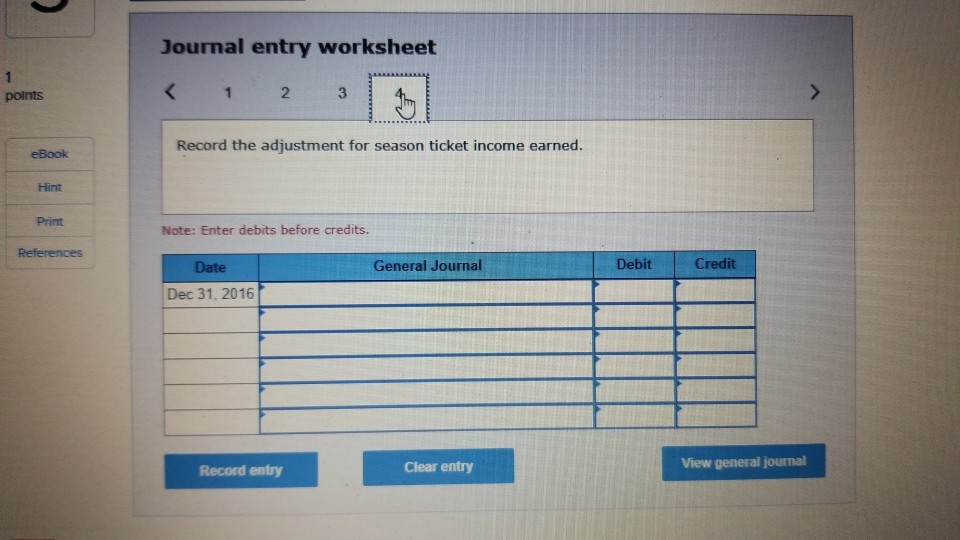

3 a. On December 31, 2016, the Notes Receivable account at Manton Materials had a balance of $20,500, which represented a six-month, 12 percent note received from a customer on September 1 b. During the week ended June 7, 2016, Parker Media received $49,000 from customers for subscriptions to its magazine Modern Business. On December 31, 2016, an analysis of the Unearned Subscription Revenue account showed that half points of the subscriptions were earned in 2016 c. On November 1, 2016, Prentice Realty Company rented a commercial building to a new tenant and received $53,400 in advance to cover the rent for six months. Upon eBook Hint receipt, the $53,400 was recorded in the Unearned Rent account d. On November 1, 2016, the Mighty Bucks Hockey Club sold season tickets for 40 home games, receiving $6,600.000. Upon receipt, the $6,600,000 was recorded in the Uneerned Season Tickets Income account. At December 31, 2016, the Mighty Print Bucks Hockey Club had played 5 home games For each of the above independent situations, indicate the adjusting entry that must be made on the December 31, 2016, worksheet. View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started