Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. A resident Filipino received an income from China. The income received was subjected to withholding tax with respect to a non-resident alien in

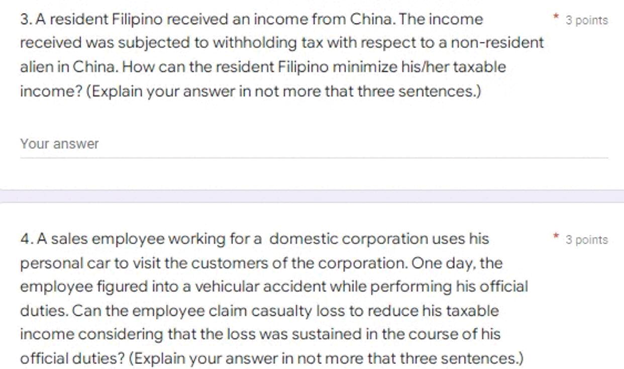

3. A resident Filipino received an income from China. The income received was subjected to withholding tax with respect to a non-resident alien in China. How can the resident Filipino minimize his/her taxable income? (Explain your answer in not more that three sentences.) Your answer 4. A sales employee working for a domestic corporation uses his personal car to visit the customers of the corporation. One day, the employee figured into a vehicular accident while performing his official duties. Can the employee claim casualty loss to reduce his taxable income considering that the loss was sustained in the course of his official duties? (Explain your answer in not more that three sentences.) 3 points 3 points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Minimizing Taxable Income for Resident Filipino Receiving Income from China 1 Claim tax treaty benef...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started