Answered step by step

Verified Expert Solution

Question

1 Approved Answer

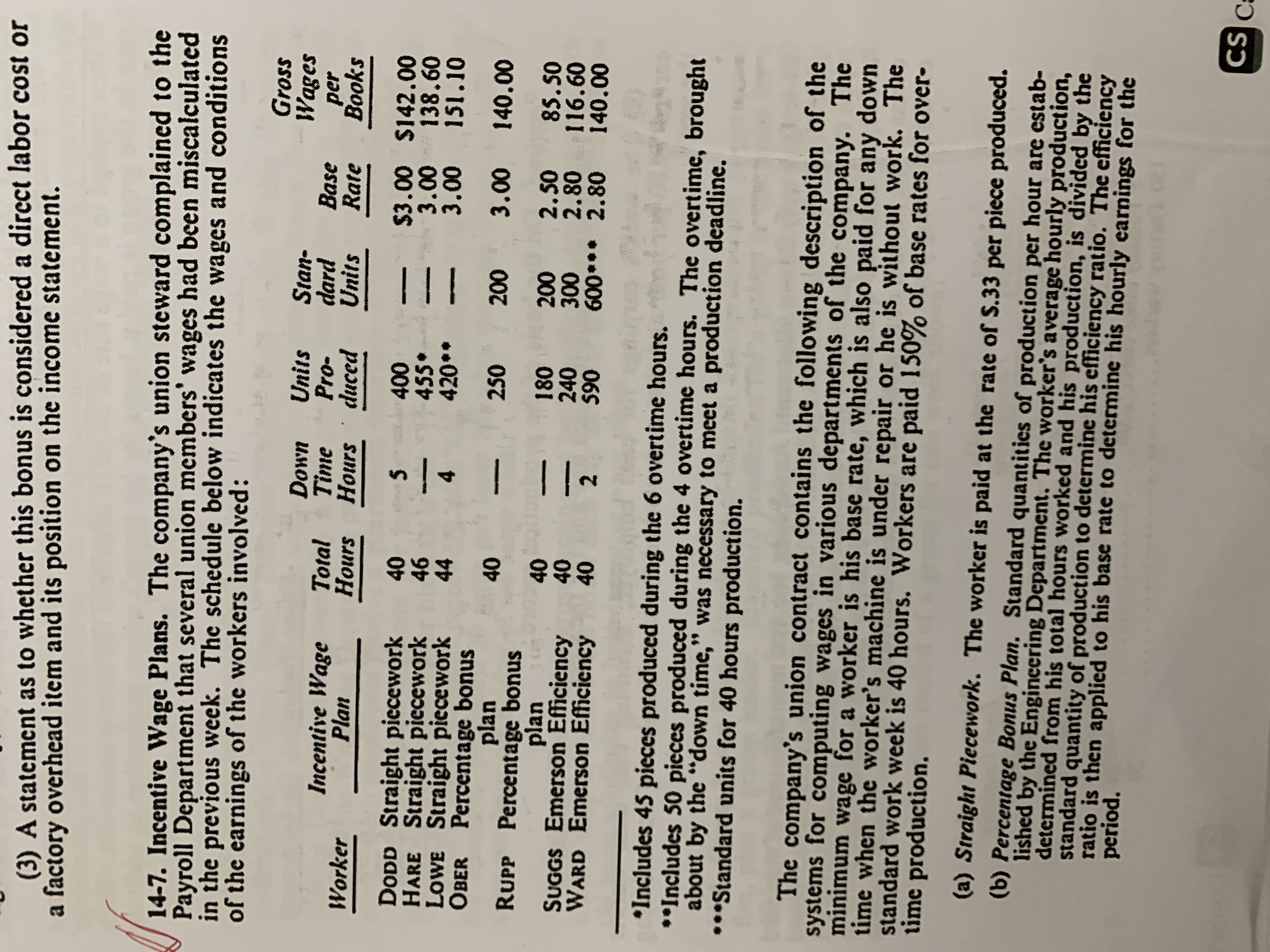

(3) A statement as to whether this bonus is considered a direct labor cost or a factory overhead item and its position on the

(3) A statement as to whether this bonus is considered a direct labor cost or a factory overhead item and its position on the income statement. 14-7. Incentive Wage Plans. The company's union steward complained to the Payroll Department that several union members' wages had been miscalculated in the previous week. The schedule below indicates the wages and conditions of the earnings of the workers involved: Worker Incentive Wage Plan Down Units Stan- Total Time Pro- dard Base per Hours Hours duced Units Rate Books Gross Wages DODD Straight piecework HARE Straight piecework Lowe Straight piecework OBER 40 46 44 Percentage bonus plan RUPP Percentage bonus plan SUGGS Emerson Efficiency WARD Emerson Efficiency 40 *** *** S 4 40 40 40 2 | | ||~ 400 455* 420** 250 180 240 590 | | | $3.00 $142.00 138.60 3.00 3.00 151.10 200 3.00 140.00 200 2.50 85.50 300 2.80 116.60 600*** 2.80 140.00 *Includes 45 pieces produced during the 6 overtime hours. **Includes 50 pieces produced during the 4 overtime hours. The overtime, brought about by the "down time," was necessary to meet a production deadline. Standard units for 40 hours production. The company's union contract contains the following description of the systems for computing wages in various departments of the company. The minimum wage for a worker is his base rate, which is also paid for any down time when the worker's machine is under repair or he is without work. The time production. standard work week is 40 hours. Workers are paid 150% of base rates for over- (a) Straight Piecework. The worker is paid at the rate of S.33 per piece produced. (b) Percentage Bonus Plan. Standard quantities of production per hour are estab- lished by the Engineering Department. The worker's average hourly production, determined from his total hours worked and his production, is divided by the period. standard quantity of production to determine his efficiency ratio. The efficiency ratio is then applied to his base rate to determine his hourly earnings for the CS Ca

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started