Question

3. (a) The price of a European put on XYZ stock that matures in six months and has a strike price of 60 is

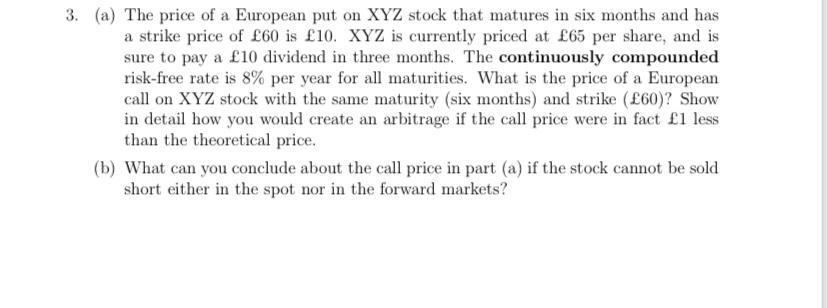

3. (a) The price of a European put on XYZ stock that matures in six months and has a strike price of 60 is 10. XYZ is currently priced at 65 per share, and is sure to pay a 10 dividend in three months. The continuously compounded risk-free rate is 8% per year for all maturities. What is the price of a European call on XYZ stock with the same maturity (six months) and strike (60)? Show in detail how you would create an arbitrage if the call price were in fact 1 less than the theoretical price. (b) What can you conclude about the call price in part (a) if the stock cannot be sold short either in the spot nor in the forward markets?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Pricing the European Call Option 1 PutCall Parity Since we are given the price of a put option and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Futures and Options Markets

Authors: John C. Hull

8th edition

978-1292155036, 1292155035, 132993341, 978-0132993340

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App