Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. A Treasury bill has a face value of $10,000, is selling for $9,800, and matures in 78 days. i. What is its discount

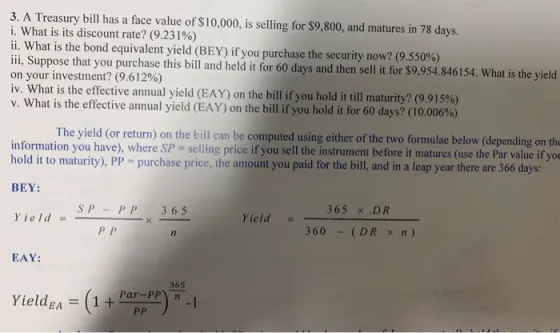

3. A Treasury bill has a face value of $10,000, is selling for $9,800, and matures in 78 days. i. What is its discount rate? (9.231%) ii. What is the bond equivalent yield (BEY) if you purchase the security now? (9.550 %) iii, Suppose that you purchase this bill and held it for 60 days and then sell it for $9,954.846154. What is the yield on your investment? (9.612%) iv. What is the effective annual yield (EAY) on the bill if you hold it till maturity? (9.915%) v. What is the effective annual yield (EAY) on the bill if you hold it for 60 days? (10.006%) The yield (or return) on the bill can be computed using either of the two formulae below (depending on the information you have), where SP-selling price if you sell the instrument before it matures (use the Par value if you hold it to maturity), PP- purchase price, the amount you paid for the bill, and in a leap year there are 366 days: BEY: Yield = EAY: SP - PP PP X 365 11 365 71 Yield EA = (1 + Par-PP) - 1 Yield 360 365 x .DR (DR x n )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Treasury Bill Calculations Given Face value Par value 10000 Selling price SP 9800 Maturity 78 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started