Answered step by step

Verified Expert Solution

Question

1 Approved Answer

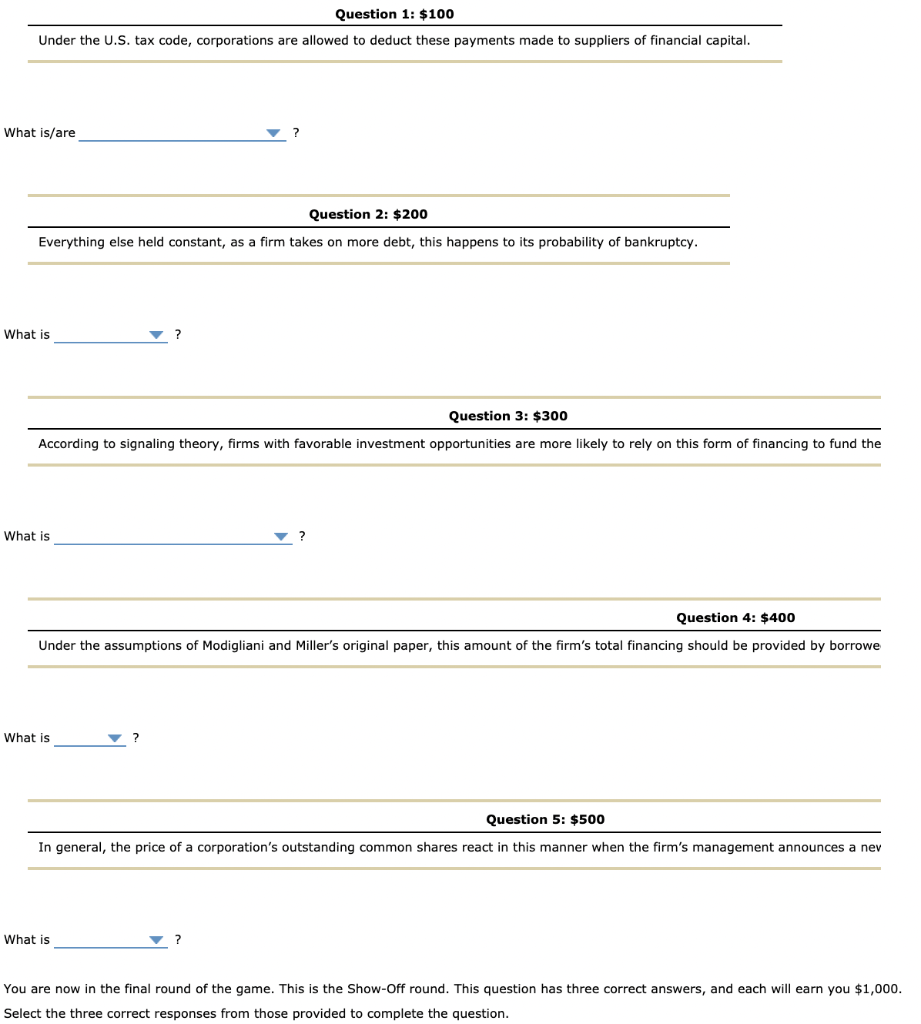

#3 according to signaling theory, firms with favorable investment opportunities are more likely to rely on this form of financing to fund their new projects.

#3 according to signaling theory, firms with favorable investment opportunities are more likely to rely on this form of financing to fund their new projects.

#4Under the assumptions of Modigliani and Millers original paper, this amount of the firms total financing should be provided by borrowed fundsif managements objective is to maximize the price of the firms common stock.

#5

| In general, the price of a corporations outstanding common shares react in this manner when the firms management announces a new offering of common stock. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started