Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Accounting for Asset Retirement Obligations Instructions: Use the FASB Accounting Standards Codification Research System to answer the following questions. Document the process used

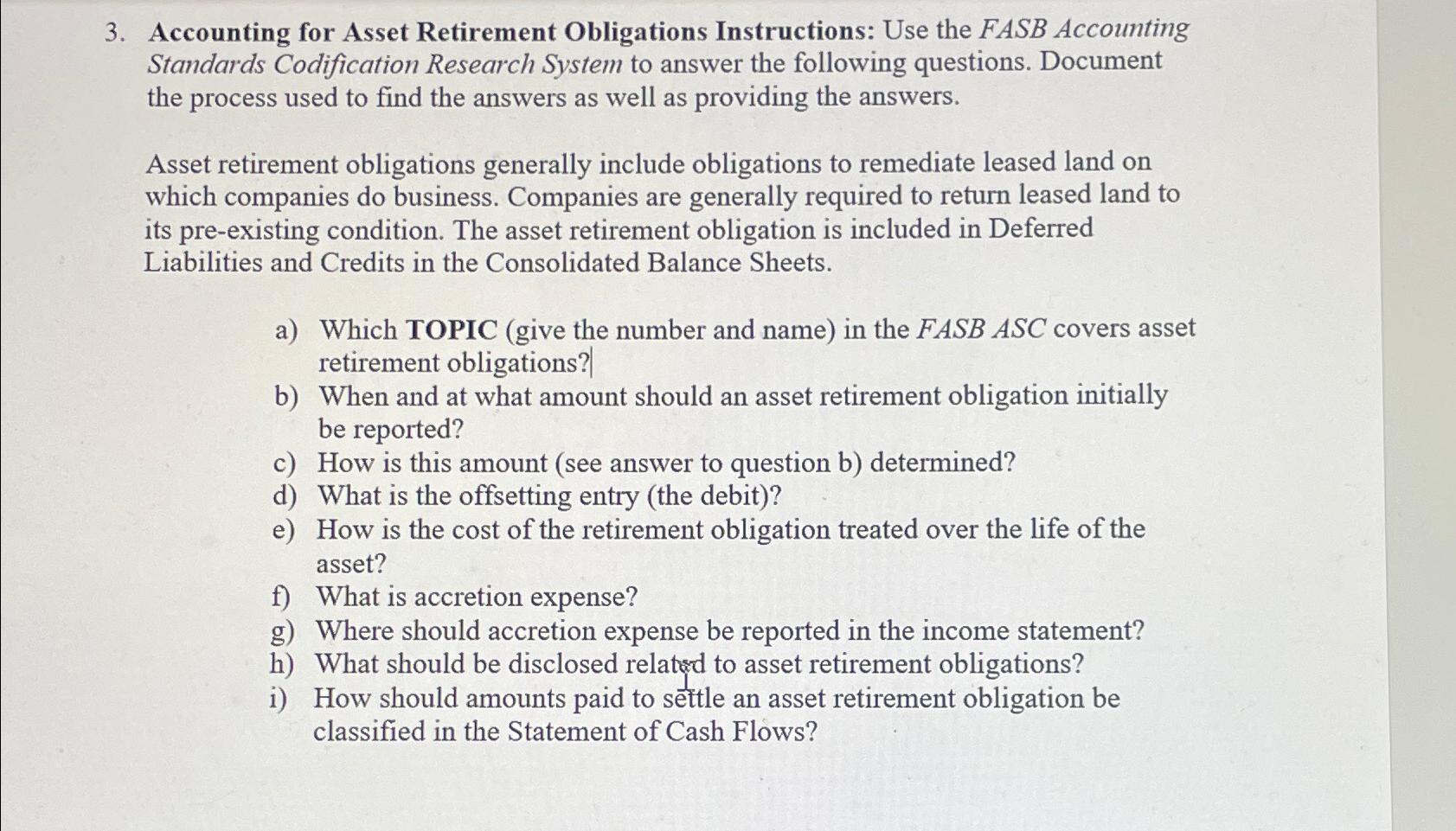

3. Accounting for Asset Retirement Obligations Instructions: Use the FASB Accounting Standards Codification Research System to answer the following questions. Document the process used to find the answers as well as providing the answers. Asset retirement obligations generally include obligations to remediate leased land on which companies do business. Companies are generally required to return leased land to its pre-existing condition. The asset retirement obligation is included in Deferred Liabilities and Credits in the Consolidated Balance Sheets. a) Which TOPIC (give the number and name) in the FASB ASC covers asset retirement obligations? b) When and at what amount should an asset retirement obligation initially be reported? c) How is this amount (see answer to question b) determined? d) What is the offsetting entry (the debit)? e) How is the cost of the retirement obligation treated over the life of the asset? f) What is accretion expense? g) Where should accretion expense be reported in the income statement? h) What should be disclosed related to asset retirement obligations? i) How should amounts paid to settle an asset retirement obligation be classified in the Statement of Cash Flows?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The TOPIC in the FASB ASC that covers asset retirement obligations is 41020 Asset Retirement Obligations b An asset retirement obligation should be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started