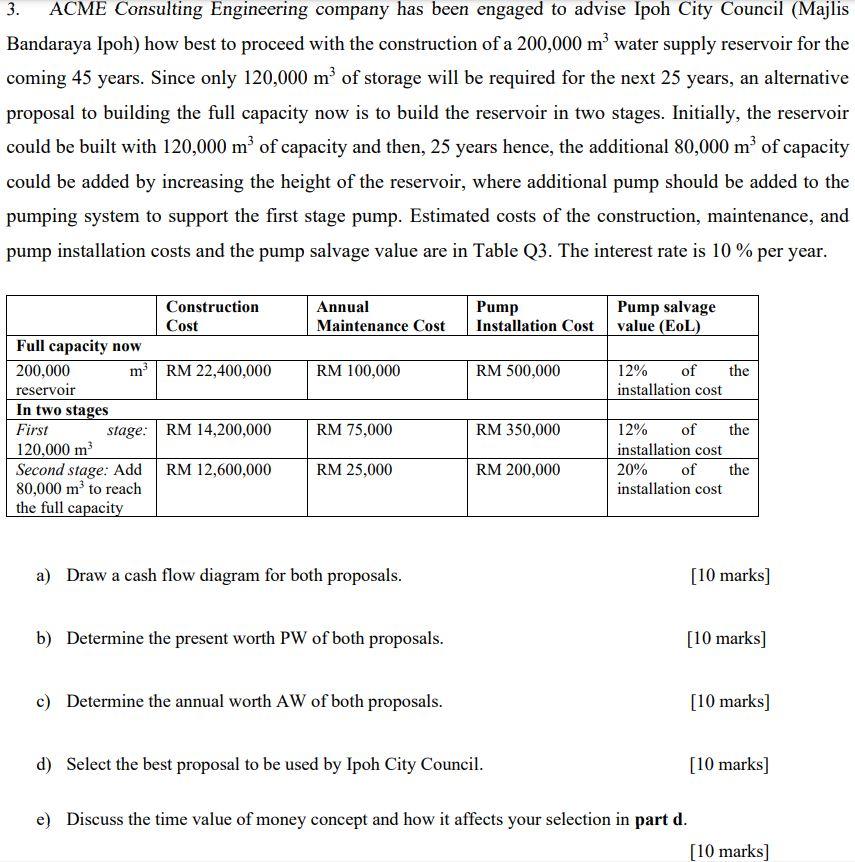

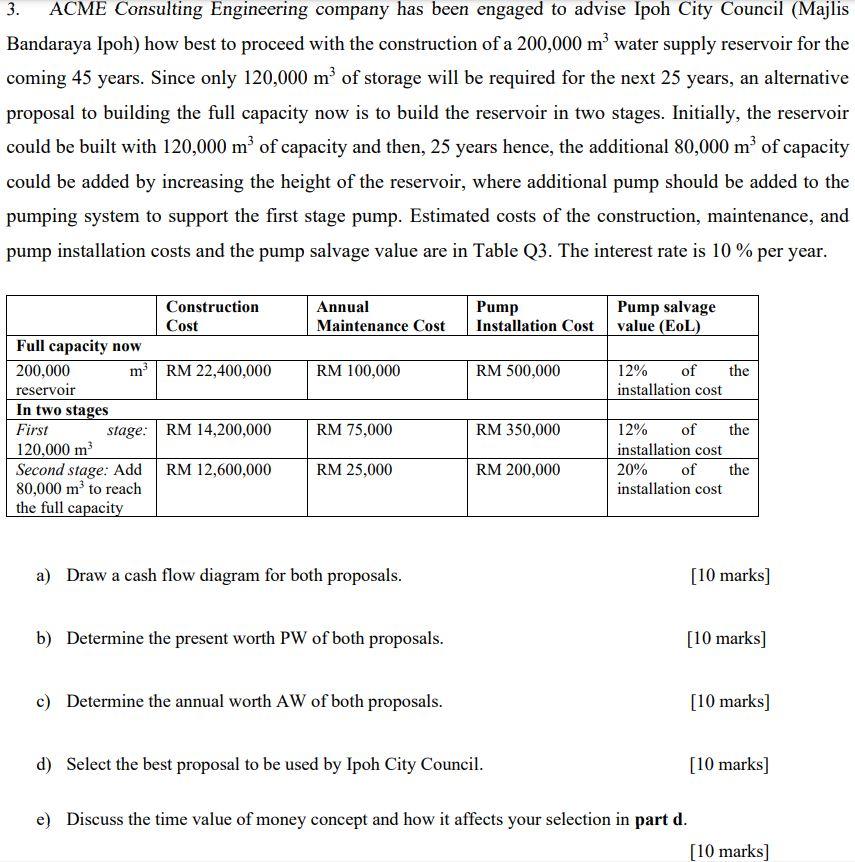

3. ACME Consulting Engineering company has been engaged to advise Ipoh City Council (Majlis Bandaraya Ipoh) how best to proceed with the construction of a 200,000 m water supply reservoir for the coming 45 years. Since only 120,000 m of storage will be required for the next 25 years, an alternative proposal to building the full capacity now is to build the reservoir in two stages. Initially, the reservoir could be built with 120,000 m of capacity and then, 25 years hence, the additional 80,000 m of capacity could be added by increasing the height of the reservoir, where additional pump should be added to the pumping system to support the first stage pump. Estimated costs of the construction, maintenance, and pump installation costs and the pump salvage value are in Table Q3. The interest rate is 10% per year. Annual Construction Cost Pump Installation Cost Maintenance Cost Pump salvage value (EOL) RM 100,000 RM 500,000 12% of the installation cost Full capacity now 200,000 m RM 22,400,000 reservoir In two stages First stage: RM 14,200,000 120,000 m Second stage: Add RM 12,600,000 80,000 m to reach the full capacity RM 75,000 RM 350,000 12% of the installation cost 20% of installation cost RM 25,000 RM 200,000 the a) Draw a cash flow diagram for both proposals. [10 marks] b) Determine the present worth PW of both proposals. [10 marks] c) Determine the annual worth AW of both proposals. [10 marks] d) Select the best proposal to be used by Ipoh City Council. [10 marks) e) Discuss the time value of money concept and how it affects your selection in part d. [10 marks] 3. ACME Consulting Engineering company has been engaged to advise Ipoh City Council (Majlis Bandaraya Ipoh) how best to proceed with the construction of a 200,000 m water supply reservoir for the coming 45 years. Since only 120,000 m of storage will be required for the next 25 years, an alternative proposal to building the full capacity now is to build the reservoir in two stages. Initially, the reservoir could be built with 120,000 m of capacity and then, 25 years hence, the additional 80,000 m of capacity could be added by increasing the height of the reservoir, where additional pump should be added to the pumping system to support the first stage pump. Estimated costs of the construction, maintenance, and pump installation costs and the pump salvage value are in Table Q3. The interest rate is 10% per year. Annual Construction Cost Pump Installation Cost Maintenance Cost Pump salvage value (EOL) RM 100,000 RM 500,000 12% of the installation cost Full capacity now 200,000 m RM 22,400,000 reservoir In two stages First stage: RM 14,200,000 120,000 m Second stage: Add RM 12,600,000 80,000 m to reach the full capacity RM 75,000 RM 350,000 12% of the installation cost 20% of installation cost RM 25,000 RM 200,000 the a) Draw a cash flow diagram for both proposals. [10 marks] b) Determine the present worth PW of both proposals. [10 marks] c) Determine the annual worth AW of both proposals. [10 marks] d) Select the best proposal to be used by Ipoh City Council. [10 marks) e) Discuss the time value of money concept and how it affects your selection in part d. [10 marks]