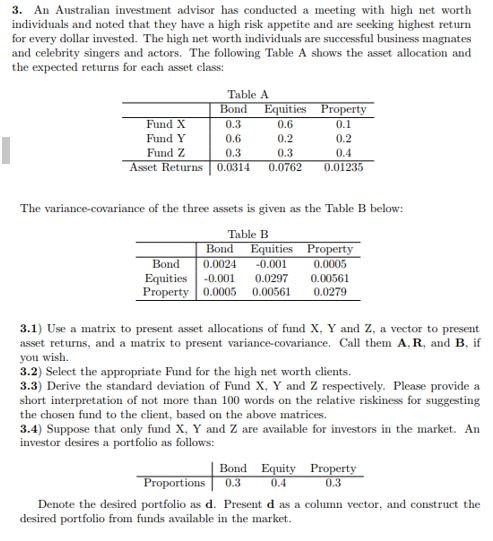

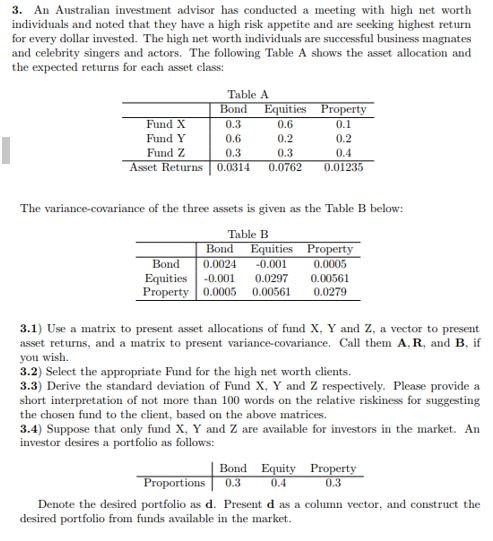

3. An Australian investment advisor has conducted a meeting with high net worth individuals and noted that they have a high risk appetite and are seeking highest return for every dollar invested. The high net worth individuals are successful business magnates and celebrity singers and actors. The following Table A shows the asset allocation and the expected returns for each asset class: Table A Bond Equities Property Fund X 0.3 0.6 0.1 Fund Y 0.6 0.2 0.2 Fund Z 0.3 0.3 0.4 Asset Returns 0.0314 0.0762 0.01235 The variance-covariance of the three assets is given as the Table B below: Table B Equities Property 0.0005 Bond Bond Equities0.001 Property 0.0005 0,0024 -0.001 0.0297 0.00561 0.00561 0.0279 3.1) Use a matrix to present asset allocations of fund X, Y and Z, a vector to present asset returns, and a matrix to present variance-covariance. Call them A. R, and B, if you wish 3.2) Select the appropriate Fund for the high net worth clients 3.3) Derive the standard deviation of Fund X, Y and Z respectively. Please provide short interpretation of not more than 100 words on the relative riskiness for suggesting the chosen fund to the client, based on the above matrices. a 3.4) Suppose that only fund X, Y and Z are available for investors in the market. An investor desires a portfolio as follows: Bond Equity Property 0.4 Proportions 0.3 0.3 Denote the desired portfolio as d. Present d as a column vector, and construct the desired portfolio from funds available in the market. 3. An Australian investment advisor has conducted a meeting with high net worth individuals and noted that they have a high risk appetite and are seeking highest return for every dollar invested. The high net worth individuals are successful business magnates and celebrity singers and actors. The following Table A shows the asset allocation and the expected returns for each asset class: Table A Bond Equities Property Fund X 0.3 0.6 0.1 Fund Y 0.6 0.2 0.2 Fund Z 0.3 0.3 0.4 Asset Returns 0.0314 0.0762 0.01235 The variance-covariance of the three assets is given as the Table B below: Table B Equities Property 0.0005 Bond Bond Equities0.001 Property 0.0005 0,0024 -0.001 0.0297 0.00561 0.00561 0.0279 3.1) Use a matrix to present asset allocations of fund X, Y and Z, a vector to present asset returns, and a matrix to present variance-covariance. Call them A. R, and B, if you wish 3.2) Select the appropriate Fund for the high net worth clients 3.3) Derive the standard deviation of Fund X, Y and Z respectively. Please provide short interpretation of not more than 100 words on the relative riskiness for suggesting the chosen fund to the client, based on the above matrices. a 3.4) Suppose that only fund X, Y and Z are available for investors in the market. An investor desires a portfolio as follows: Bond Equity Property 0.4 Proportions 0.3 0.3 Denote the desired portfolio as d. Present d as a column vector, and construct the desired portfolio from funds available in the market