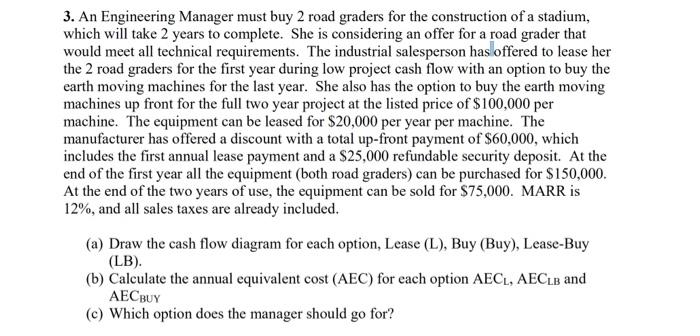

3. An Engineering Manager must buy 2 road graders for the construction of a stadium, which will take 2 years to complete. She is considering an offer for a road grader that would meet all technical requirements. The industrial salesperson has offered to lease her the 2 road graders for the first year during low project cash flow with an option to buy the earth moving machines for the last year. She also has the option to buy the earth moving machines up front for the full two year project at the listed price of $100,000 per machine. The equipment can be leased for $20,000 per year per machine. The manufacturer has offered a discount with a total up-front payment of $60,000, which includes the first annual lease payment and a $25,000 refundable security deposit. At the end of the first year all the equipment (both road graders) can be purchased for $150,000. At the end of the two years of use, the equipment can be sold for $75,000. MARR is 12%, and all sales taxes are already included. (a) Draw the cash flow diagram for each option, Lease (L), Buy (Buy), Lease-Buy (LB). (b) Calculate the annual equivalent cost (AEC) for each option AECL, AECLB and AECBUY (c) Which option does the manager should go for? 3. An Engineering Manager must buy 2 road graders for the construction of a stadium, which will take 2 years to complete. She is considering an offer for a road grader that would meet all technical requirements. The industrial salesperson has offered to lease her the 2 road graders for the first year during low project cash flow with an option to buy the earth moving machines for the last year. She also has the option to buy the earth moving machines up front for the full two year project at the listed price of $100,000 per machine. The equipment can be leased for $20,000 per year per machine. The manufacturer has offered a discount with a total up-front payment of $60,000, which includes the first annual lease payment and a $25,000 refundable security deposit. At the end of the first year all the equipment (both road graders) can be purchased for $150,000. At the end of the two years of use, the equipment can be sold for $75,000. MARR is 12%, and all sales taxes are already included. (a) Draw the cash flow diagram for each option, Lease (L), Buy (Buy), Lease-Buy (LB). (b) Calculate the annual equivalent cost (AEC) for each option AECL, AECLB and AECBUY (c) Which option does the manager should go for