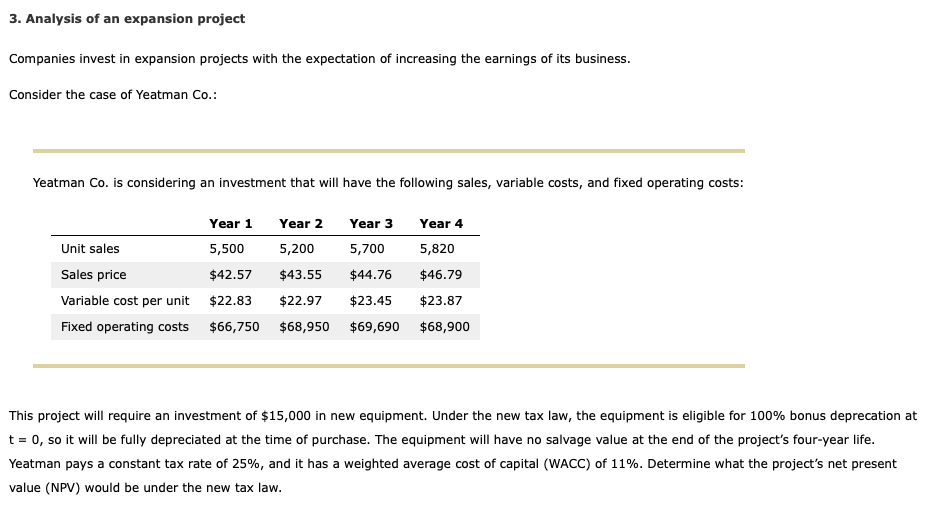

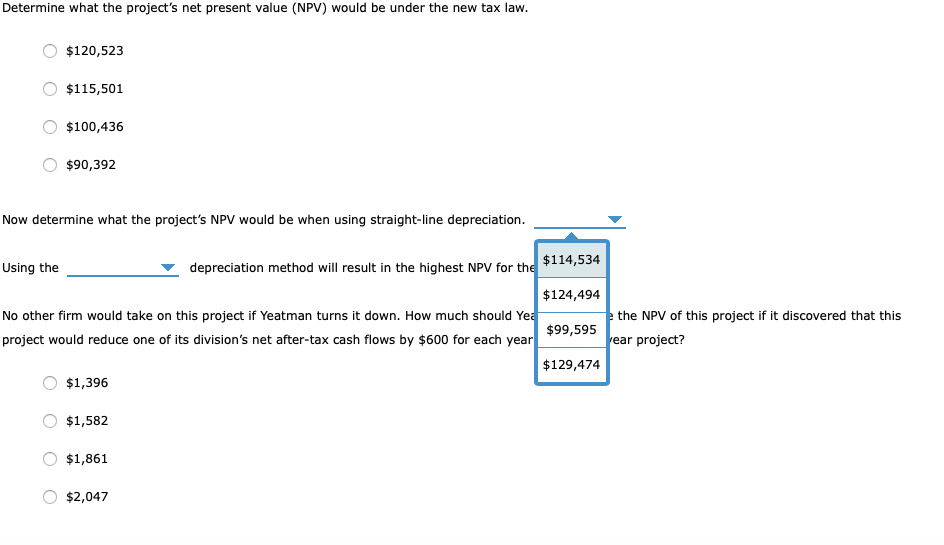

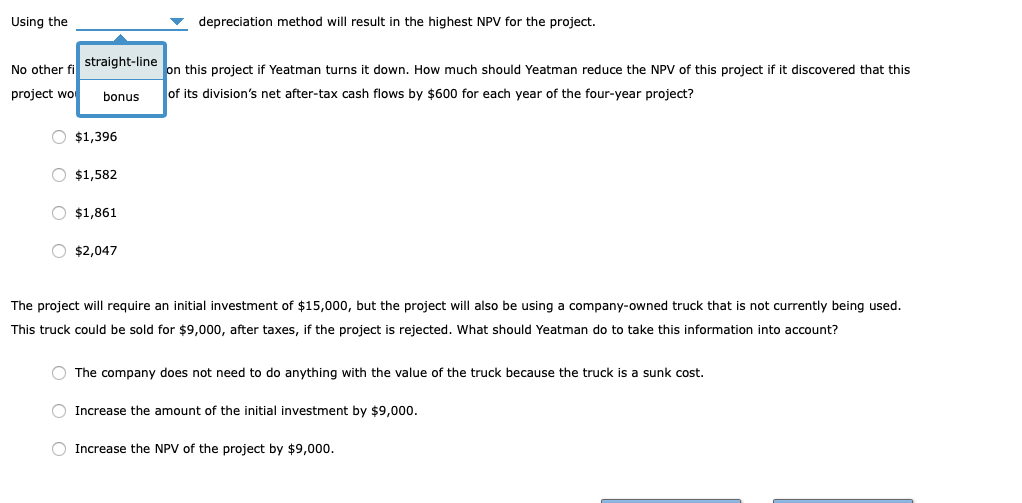

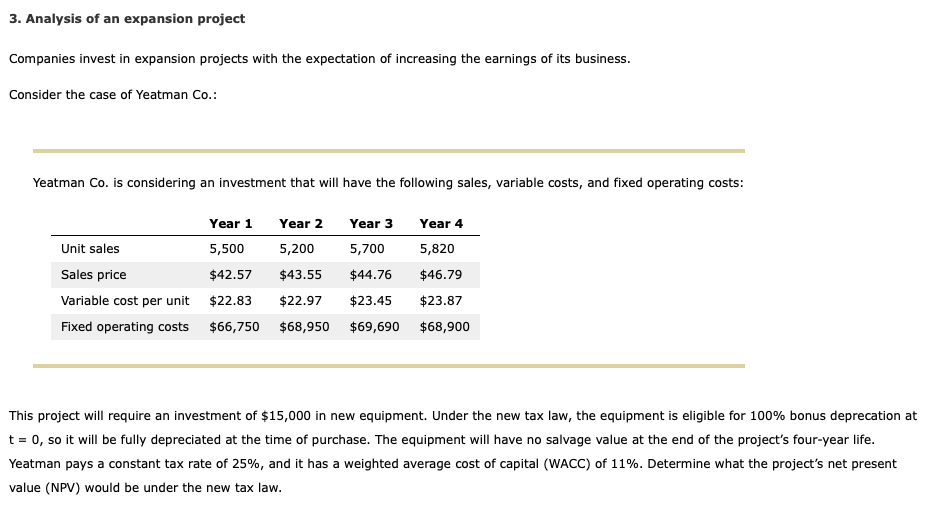

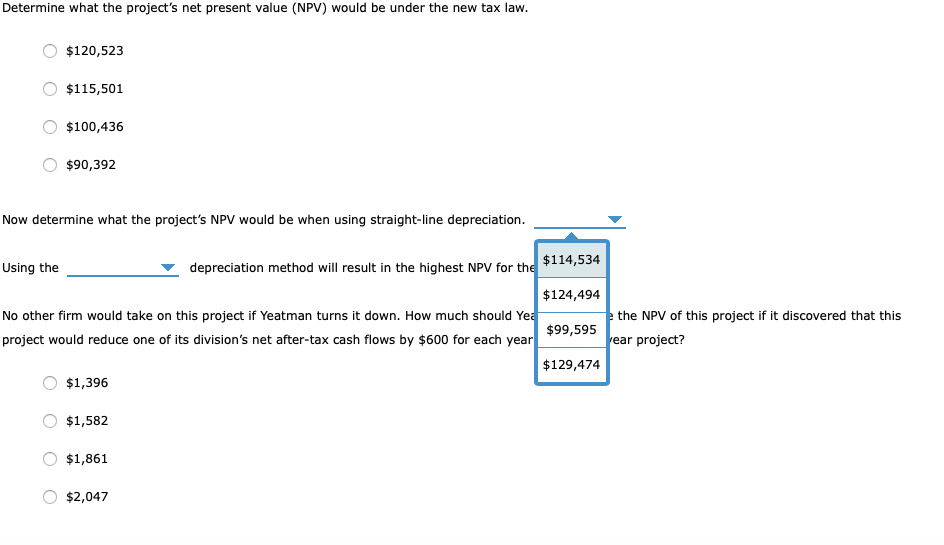

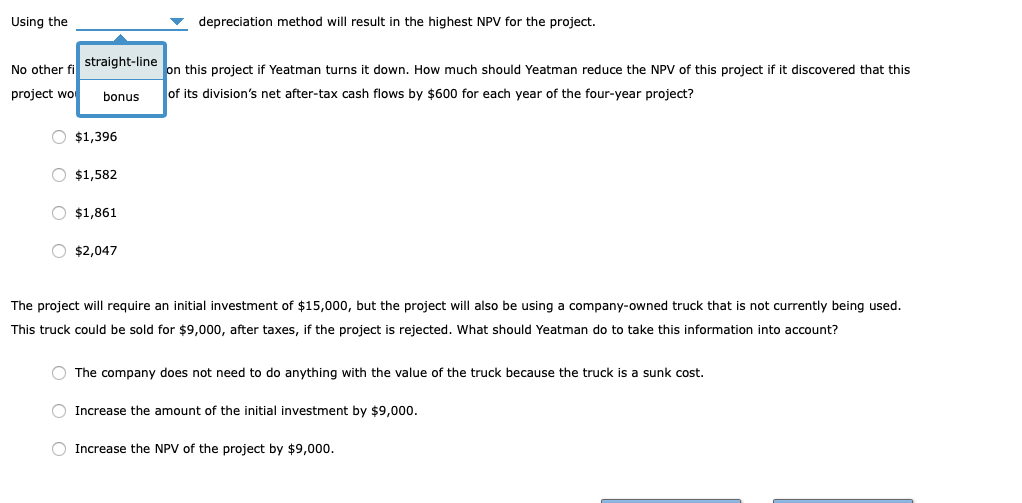

3. Analysis of an expansion project Companies invest in expansion projects with the expectation of increasing the earnings of its business. Consider the case of Yeatman Co.: Yeatman Co. is considering an investment that will have the following sales, variable costs, and fixed operating costs: Unit sales Sales price Variable cost per unit Fixed operating costs Year 1 5,500 $42.57 $22.83 $66,750 Year 2 Year 3 5,2005,700 $43.55 $44.76 $22.97 $23.45 $68,950 $69,690 Year 4 5,820 $46.79 $23.87 $68,900 This project will require an investment of $15,000 in new equipment. Under the new tax law, the equipment is eligible for 100% bonus deprecation at t = 0, so it will be fully depreciated at the time of purchase. The equipment will have no salvage value at the end of the project's four-year life. Yeatman pays a constant tax rate of 25%, and it has a weighted average cost of capital (WACC) of 11%. Determine what the project's net present value (NPV) would be under the new tax law. Determine what the project's net present value (NPV) would be under the new tax law. O $120,523 $115,501 $100,436 $90,392 Now determine what the project's NPV would be when using straight-line depreciation. Using the depreciation method will result in the highest NPV for the $114,534 $124,494 No other firm would take on this project if Yeatman turns it down. How much should Yea $99,595 project would reduce one of its division's net after-tax cash flows by $600 for each year $129,474 $1,396 the NPV of this project if it discovered that this rear project? $1,582 $1,861 $2,047 Using the depreciation method will result in the highest NPV for the project. No other fi project wo straight-line on this project if Yeatman turns it down. How much should Yeatman reduce the NPV of this project if it discovered that this bonus of its division's net after-tax cash flows by $600 for each year of the four-year project? O $1,396 $1,582 $1,861 $2,047 The project will require an initial investment of $15,000, but the project will also be using a company-owned truck that is not currently being used. This truck could be sold for $9,000, after taxes, if the project is rejected. What should Yeatman do to take this information into account? O The company does not need to do anything with the value of the truck because the truck is a sunk cost. O Increase the amount of the initial investment by $9,000. Increase the NPV of the project by $9,000