Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Andrew Co. has $100,000 of pre-tax GAAP book income for the current period that includes a goodwill impairment charge of $23,000 for a

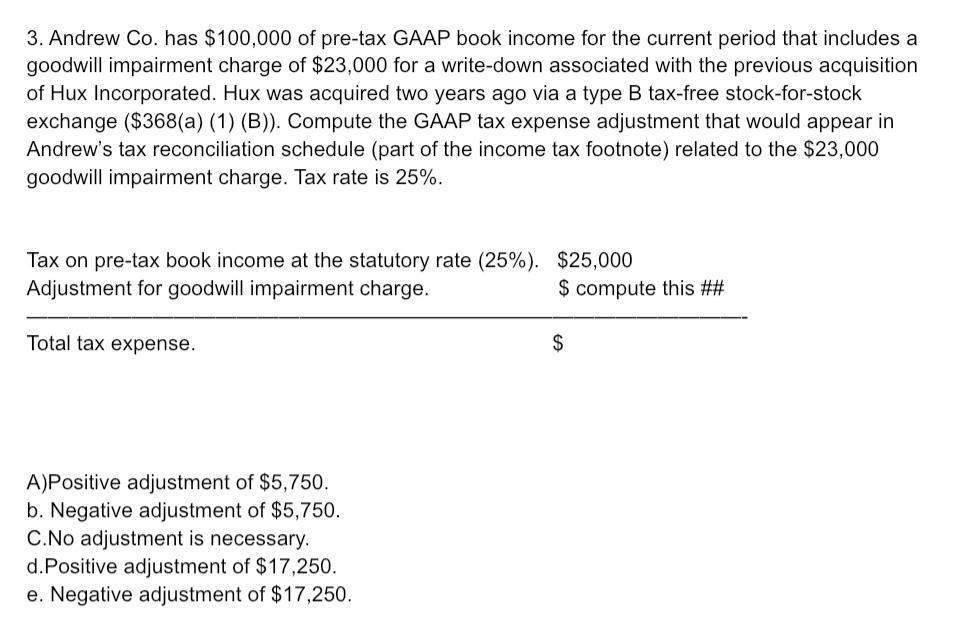

3. Andrew Co. has $100,000 of pre-tax GAAP book income for the current period that includes a goodwill impairment charge of $23,000 for a write-down associated with the previous acquisition of Hux Incorporated. Hux was acquired two years ago via a type B tax-free stock-for-stock exchange ($368(a) (1) (B)). Compute the GAAP tax expense adjustment that would appear in Andrew's tax reconciliation schedule (part of the income tax footnote) related to the $23,000 goodwill impairment charge. Tax rate is 25%. Tax on pre-tax book income at the statutory rate (25%). $25,000 Adjustment for goodwill impairment charge. Total tax expense. A)Positive adjustment of $5,750. b. Negative adjustment of $5,750. C.No adjustment is necessary. d.Positive adjustment of $17,250. e. Negative adjustment of $17,250. $ compute this ## $

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below SO...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started