Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Assume that you just graduated from Mason and are employed at an investment bank making $120,000 (after-tax) per year, and you expect to

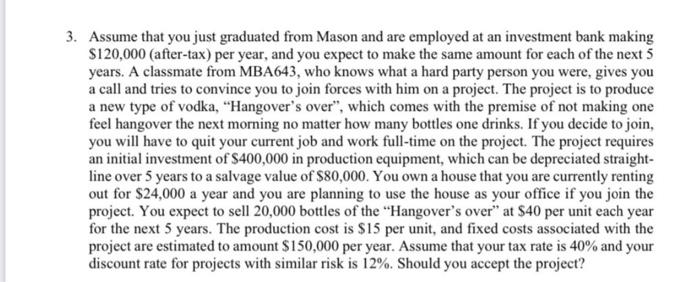

3. Assume that you just graduated from Mason and are employed at an investment bank making $120,000 (after-tax) per year, and you expect to make the same amount for each of the next 5 years. A classmate from MBA643, who knows what a hard party person you were, gives you a call and tries to convince you to join forces with him on a project. The project is to produce a new type of vodka, "Hangover's over", which comes with the premise of not making one feel hangover the next morning no matter how many bottles one drinks. If you decide to join, you will have to quit your current job and work full-time on the project. The project requires an initial investment of $400,000 in production equipment, which can be depreciated straight- line over 5 years to a salvage value of $80,000. You own a house that you are currently renting out for $24,000 a year and you are planning to use the house as your office if you join the project. You expect to sell 20,000 bottles of the "Hangover's over" at $40 per unit each year for the next 5 years. The production cost is $15 per unit, and fixed costs associated with the project are estimated to amount $150,000 per year. Assume that your tax rate is 40% and your discount rate for projects with similar risk is 12%. Should you accept the project?

Step by Step Solution

★★★★★

3.56 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether you should accept the project we need to calculate the net present value NPV of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started