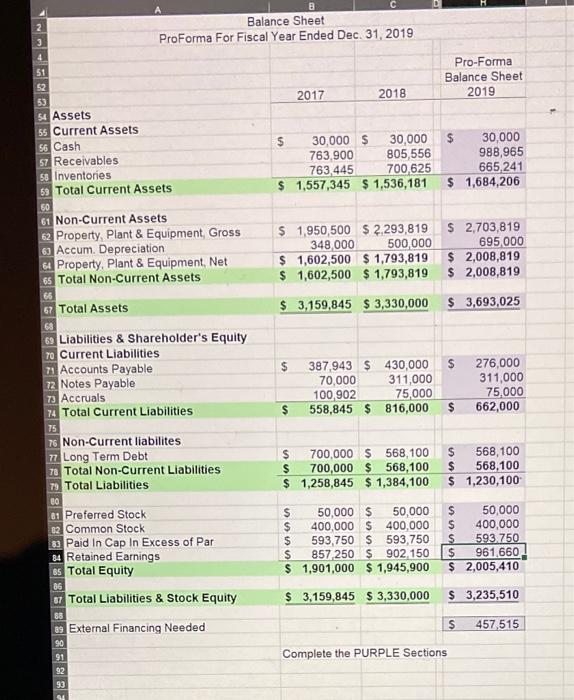

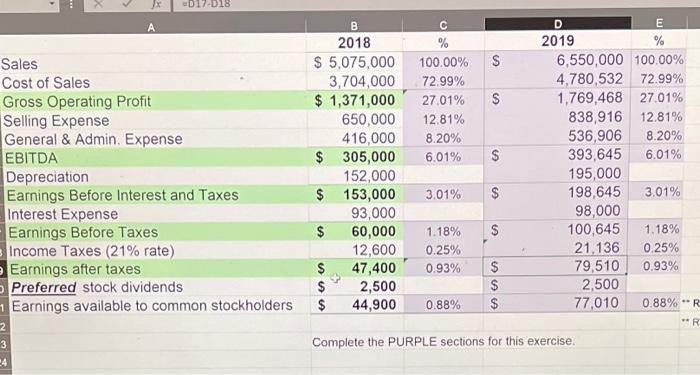

3. Assuming they have the ability to obtain any form of external financing, please explain the options Tyler Toys has to make the balance sheet balance. Will they need to 4. What if they do not want 40 obtain mare financing (or ate unable to), what other options are there? B Balance Sheet ProForma For Fiscal Year Ended Dec 31, 2019 2 3 4 51 52 Pro-Forma Balance Sheet 2019 2017 2018 53 54 Assets 55 Current Assets 56 Cash $ 30,000 $ 30,000 763.900 805,556 763,445 700,625 $ 1,557,345 $ 1,536,181 $ 30,000 988,965 665,241 $ 1,684,206 $ 1,950,500 $ 2,293,819 348 000 500,000 $ 1,602,500 $ 1,793,819 $ 1,602,500 $ 1,793,819 $ 2,703,819 695.000 $ 2,008,819 $ 2,008,819 $ 3,159,845 $ 3,330,000 $3,693,025 57 Receivables 58 Inventories 59 Total Current Assets 50 61 Non-Current Assets 62 Property, Plant & Equipment Gross 6 Accum. Depreciation 64 Property, Plant & Equipment, Net 65 Total Non-Current Assets 66 67 Total Assets 68 69 Liabilities & Shareholder's Equity TO Current Liabilities 71 Accounts Payable 72 Notes Payable 73 Accruals 74 Total Current Liabilities 75 76 Non-Current liabilites 77 Long Term Debt 78 Total Non-Current Liabilities 79 Total Liabilities $ s 387,943 $ 430,000 70,000 311,000 100 902 75,000 558,845 $ 816,000 276,000 311,000 75.000 662,000 $ $ $ 700,000 $ 568,100 $ 700,000 $ 568,100 $ 1,258,845 $ 1,384,100 $ 568,100 $ 568,100 $ 1,230,100 81 Preferred Stock 12 Common Stock 33 Paid In Cap In Excess of Par 84 Retained Earnings 85 Total Equity 66 67 Total Liabilities & Stock Equity uu 50,000 $ 50,000 400,000 $400,000 $ 593,750 S 593,750 $ 857,250 $ 902.150 $ 1,901,000 $ 1,945,900 $ 50,000 S 400,000 $ 593.750 S 961,660 $ 2,005,410 $ 3,159,845 $ 3,330,000 $ 3,235,510 88 89 External Financing Needed $ 457,515 Complete the PURPLE Sections 90 91 92 93 Jx 017-18 s % 100.00% 72.99% 27.01% 12.81% 8.20% 6.01% S $ $ $ $ Sales Cost of Sales Gross Operating Profit Selling Expense General & Admin. Expense EBITDA Depreciation Earnings Before Interest and Taxes Interest Expense Earnings Before Taxes Income Taxes (21% rate) Earnings after taxes Preferred stock dividends Earnings available to common stockholders B 2018 $ 5,075,000 3,704,000 $ 1,371,000 650,000 416,000 $ 305,000 152,000 $ 153,000 93,000 $ 60,000 12,600 $ 47,400 $ 2,500 $ 44,900 E 2019 % 6,550,000 100.00% 4,780,532 72.99% 1,769,468 27.01% 838,916 12.81% 536,906 8.20% 393,645 6.01% 195,000 198,645 3,01% 98,000 100,645 1.18% 21.136 0.25% 79,510 0.93% 2,500 77,010 0.88% **R 3.01% $ $ 1.18% 0.25% 0.93% neno $ $ $ 0.88% **R 2 3 Complete the PURPLE sections for this exercise. 24 3. Assuming they have the ability to obtain any form of external financing, please explain the options Tyler Toys has to make the balance sheet balance. Will they need to 4. What if they do not want 40 obtain mare financing (or ate unable to), what other options are there? B Balance Sheet ProForma For Fiscal Year Ended Dec 31, 2019 2 3 4 51 52 Pro-Forma Balance Sheet 2019 2017 2018 53 54 Assets 55 Current Assets 56 Cash $ 30,000 $ 30,000 763.900 805,556 763,445 700,625 $ 1,557,345 $ 1,536,181 $ 30,000 988,965 665,241 $ 1,684,206 $ 1,950,500 $ 2,293,819 348 000 500,000 $ 1,602,500 $ 1,793,819 $ 1,602,500 $ 1,793,819 $ 2,703,819 695.000 $ 2,008,819 $ 2,008,819 $ 3,159,845 $ 3,330,000 $3,693,025 57 Receivables 58 Inventories 59 Total Current Assets 50 61 Non-Current Assets 62 Property, Plant & Equipment Gross 6 Accum. Depreciation 64 Property, Plant & Equipment, Net 65 Total Non-Current Assets 66 67 Total Assets 68 69 Liabilities & Shareholder's Equity TO Current Liabilities 71 Accounts Payable 72 Notes Payable 73 Accruals 74 Total Current Liabilities 75 76 Non-Current liabilites 77 Long Term Debt 78 Total Non-Current Liabilities 79 Total Liabilities $ s 387,943 $ 430,000 70,000 311,000 100 902 75,000 558,845 $ 816,000 276,000 311,000 75.000 662,000 $ $ $ 700,000 $ 568,100 $ 700,000 $ 568,100 $ 1,258,845 $ 1,384,100 $ 568,100 $ 568,100 $ 1,230,100 81 Preferred Stock 12 Common Stock 33 Paid In Cap In Excess of Par 84 Retained Earnings 85 Total Equity 66 67 Total Liabilities & Stock Equity uu 50,000 $ 50,000 400,000 $400,000 $ 593,750 S 593,750 $ 857,250 $ 902.150 $ 1,901,000 $ 1,945,900 $ 50,000 S 400,000 $ 593.750 S 961,660 $ 2,005,410 $ 3,159,845 $ 3,330,000 $ 3,235,510 88 89 External Financing Needed $ 457,515 Complete the PURPLE Sections 90 91 92 93 Jx 017-18 s % 100.00% 72.99% 27.01% 12.81% 8.20% 6.01% S $ $ $ $ Sales Cost of Sales Gross Operating Profit Selling Expense General & Admin. Expense EBITDA Depreciation Earnings Before Interest and Taxes Interest Expense Earnings Before Taxes Income Taxes (21% rate) Earnings after taxes Preferred stock dividends Earnings available to common stockholders B 2018 $ 5,075,000 3,704,000 $ 1,371,000 650,000 416,000 $ 305,000 152,000 $ 153,000 93,000 $ 60,000 12,600 $ 47,400 $ 2,500 $ 44,900 E 2019 % 6,550,000 100.00% 4,780,532 72.99% 1,769,468 27.01% 838,916 12.81% 536,906 8.20% 393,645 6.01% 195,000 198,645 3,01% 98,000 100,645 1.18% 21.136 0.25% 79,510 0.93% 2,500 77,010 0.88% **R 3.01% $ $ 1.18% 0.25% 0.93% neno $ $ $ 0.88% **R 2 3 Complete the PURPLE sections for this exercise. 24