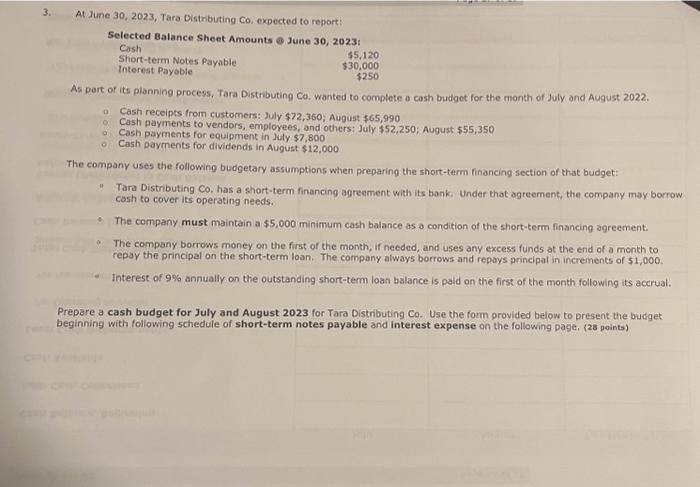

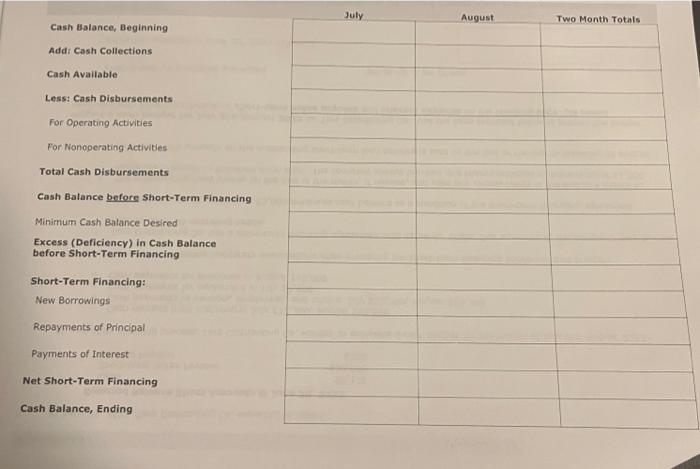

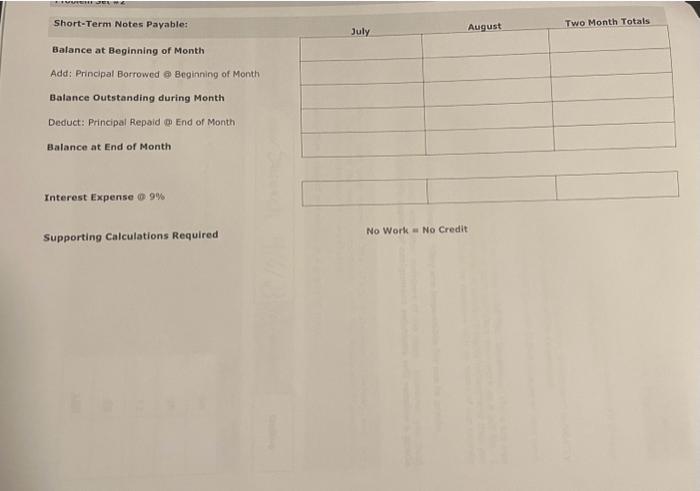

3. At June 30, 2023, Tara Distnbuting Co, expected to report: As part of its planning process, Tara Distributing Co. Wanted to complete a cash budget for the month of July and August 2022. a Cash receipts from customers: July $72,360; August $65,990 Cash payments to vendors, employees, and others: July $52,250; August $55,350 Cash payments for equipment in July $7,800 Cash payments for dividends in August $12,000 The company uses the following budgetary assumptions when preparing the short-term financing section of that budget: " Tara Distributing Co. has a short-term financing agreement with its bank. Under that agreement, the company may borrow cash to cover its operating needs. 4. The company must maintain a $5,000 minimum cash balance as a condition of the short-term financing agreement. - The company borrows money on the first of the month, if needed, and uses any excess funds at the end of a month to repay the principal on the short-term loan. The company always borrows and repays principal in increments of $1,000. - Interest of 9% annually on the outstanding short-term loan balance is paid on the first of the month following its accrual. Prepare a cash budget for July and August 2023 for Tara Distributing Co. Use the form provided below to present the budget beginning with following schedule of short-term notes payable and interest expense on the following page, (2s points) July August Two Month Totats Cash Balance, Beginning Addr Cash Collections Cash Available Less: Cash Disbursements For Operating Activities For Nonoperating Activities Total Cash Disbursements Cash Balance before Short-Term Financing Minimum Cash Balance Desired Excess (Deficiency) in Cash Balance before Short-Term Financing Short-Term Financing: New Borrowings Repayments of Principal Payments of Interest Net Short-Term Financing Cash Balance, Ending Short-Term Notes Payable: July August Two Month Totals Eatance at Beginning of Month Add: Principal Borrowed Be Beginning of Month Balance Outstanding during Month Deduct: Principal Repaid (x) End of Month Balance at End of Month Interest Expense : 9% Supporting Calculations Required No Work a No Credit 3. At June 30, 2023, Tara Distnbuting Co, expected to report: As part of its planning process, Tara Distributing Co. Wanted to complete a cash budget for the month of July and August 2022. a Cash receipts from customers: July $72,360; August $65,990 Cash payments to vendors, employees, and others: July $52,250; August $55,350 Cash payments for equipment in July $7,800 Cash payments for dividends in August $12,000 The company uses the following budgetary assumptions when preparing the short-term financing section of that budget: " Tara Distributing Co. has a short-term financing agreement with its bank. Under that agreement, the company may borrow cash to cover its operating needs. 4. The company must maintain a $5,000 minimum cash balance as a condition of the short-term financing agreement. - The company borrows money on the first of the month, if needed, and uses any excess funds at the end of a month to repay the principal on the short-term loan. The company always borrows and repays principal in increments of $1,000. - Interest of 9% annually on the outstanding short-term loan balance is paid on the first of the month following its accrual. Prepare a cash budget for July and August 2023 for Tara Distributing Co. Use the form provided below to present the budget beginning with following schedule of short-term notes payable and interest expense on the following page, (2s points) July August Two Month Totats Cash Balance, Beginning Addr Cash Collections Cash Available Less: Cash Disbursements For Operating Activities For Nonoperating Activities Total Cash Disbursements Cash Balance before Short-Term Financing Minimum Cash Balance Desired Excess (Deficiency) in Cash Balance before Short-Term Financing Short-Term Financing: New Borrowings Repayments of Principal Payments of Interest Net Short-Term Financing Cash Balance, Ending Short-Term Notes Payable: July August Two Month Totals Eatance at Beginning of Month Add: Principal Borrowed Be Beginning of Month Balance Outstanding during Month Deduct: Principal Repaid (x) End of Month Balance at End of Month Interest Expense : 9% Supporting Calculations Required No Work a No Credit