Answered step by step

Verified Expert Solution

Question

1 Approved Answer

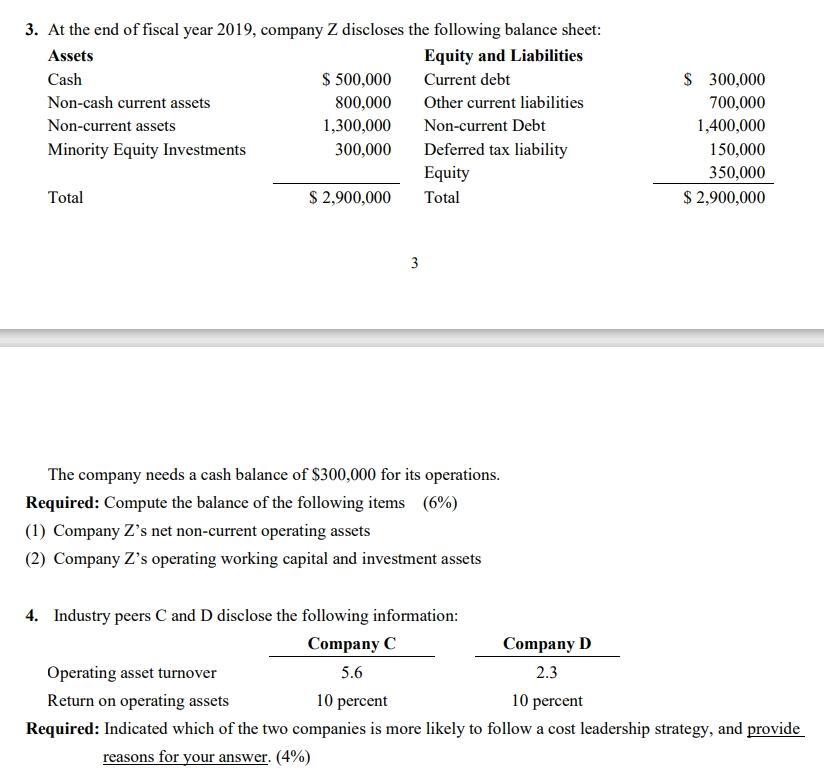

3. At the end of fiscal year 2019, company Z discloses the following balance sheet: Equity and Liabilities Current debt Other current liabilities Non-current

3. At the end of fiscal year 2019, company Z discloses the following balance sheet: Equity and Liabilities Current debt Other current liabilities Non-current Debt Assets Cash $ 500,000 Non-cash current assets Non-current assets 800,000 1,300,000 Minority Equity Investments 300,000 Equity Total $2,900,000 Total Deferred tax liability $ 300,000 700,000 1,400,000 150,000 350,000 $ 2,900,000 3 The company needs a cash balance of $300,000 for its operations. Required: Compute the balance of the following items (6%) (1) Company Z's net non-current operating assets (2) Company Z's operating working capital and investment assets 4. Industry peers C and D disclose the following information: Company C Operating asset turnover Return on operating assets 5.6 10 percent Company D 2.3 10 percent Required: Indicated which of the two companies is more likely to follow a cost leadership strategy, and provide reasons for your answer. (4%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Company Zs net noncurrent operating assets can be calculated as follows Noncurrent assets Noncash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started