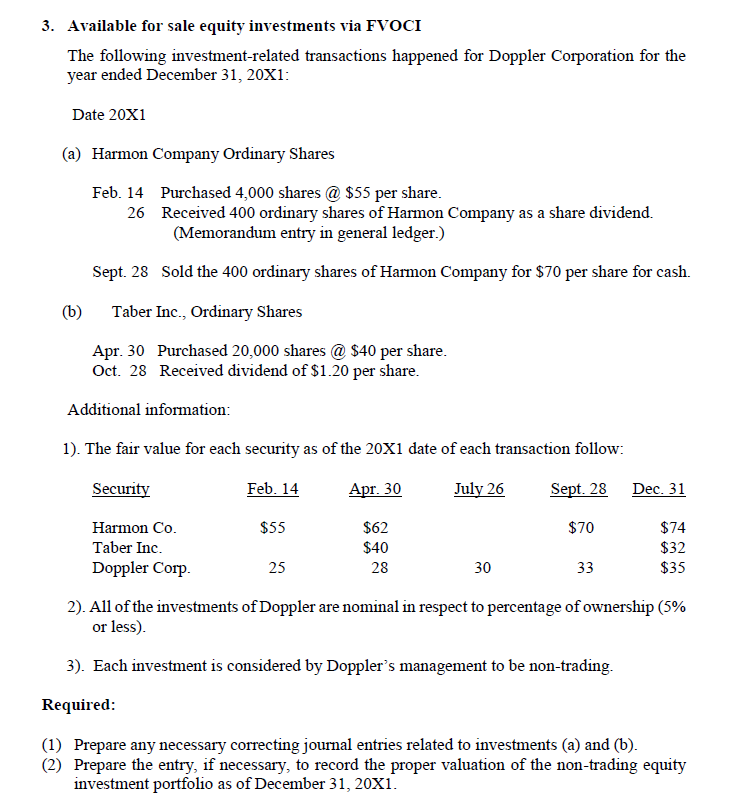

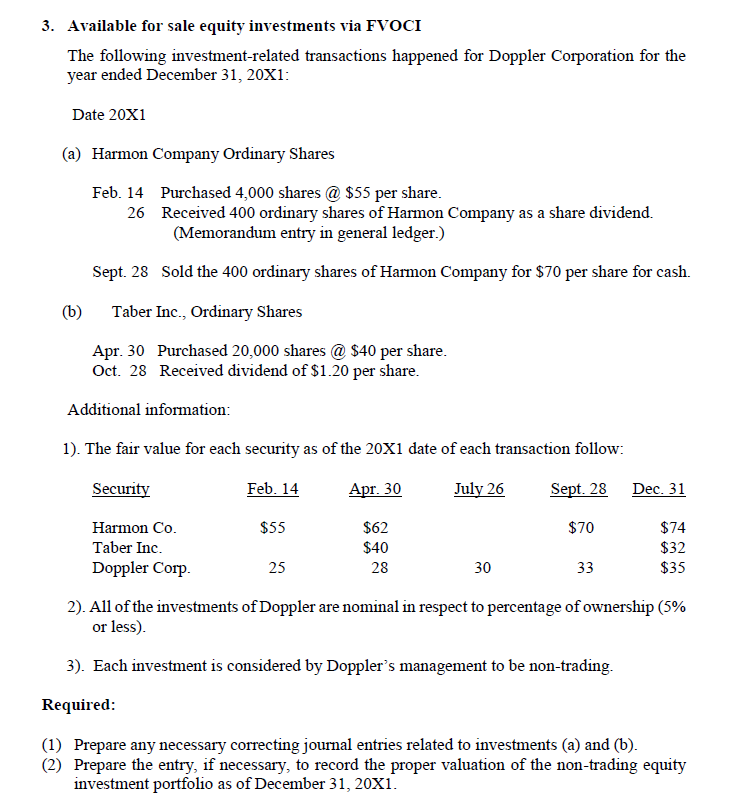

3. Available for sale equity investments via FVOCI The following investment-related transactions happened for Doppler Corporation for the year ended December 31, 20X1: Date 20X1 (a) Harmon Company Ordinary Shares Feb.14 Purchased 4,000 shares@ $55 per share. 26 Received 400 ordinary shares of Harmon Company as a share dividend. (Memorandum entry in general ledger.) Sept. 28 Sold the 400 ordinary shares of Harmon Company for $70 per share for cash. (b) Taber Inc., Ordinary Shares Apr.30 Purchased 20,000 shares@\$40 per share. Oct. 28 Received dividend of $1.20 per share. Additional information: 1). The fair value for each security as of the 20X1 date of each transaction follow: 2). All of the investments of Doppler are nominal in respect to percentage of ownership ( 5% or less). 3). Each investment is considered by Doppler's management to be non-trading. Required: (1) Prepare any necessary correcting journal entries related to investments (a) and (b). (2) Prepare the entry, if necessary, to record the proper valuation of the non-trading equity investment portfolio as of December 31,20X1. 3. Available for sale equity investments via FVOCI The following investment-related transactions happened for Doppler Corporation for the year ended December 31, 20X1: Date 20X1 (a) Harmon Company Ordinary Shares Feb.14 Purchased 4,000 shares@ $55 per share. 26 Received 400 ordinary shares of Harmon Company as a share dividend. (Memorandum entry in general ledger.) Sept. 28 Sold the 400 ordinary shares of Harmon Company for $70 per share for cash. (b) Taber Inc., Ordinary Shares Apr.30 Purchased 20,000 shares@\$40 per share. Oct. 28 Received dividend of $1.20 per share. Additional information: 1). The fair value for each security as of the 20X1 date of each transaction follow: 2). All of the investments of Doppler are nominal in respect to percentage of ownership ( 5% or less). 3). Each investment is considered by Doppler's management to be non-trading. Required: (1) Prepare any necessary correcting journal entries related to investments (a) and (b). (2) Prepare the entry, if necessary, to record the proper valuation of the non-trading equity investment portfolio as of December 31,20X1