Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Binomial tree: random interest rates II A stock that pays no dividends has current price 100. In one year's time the stock price

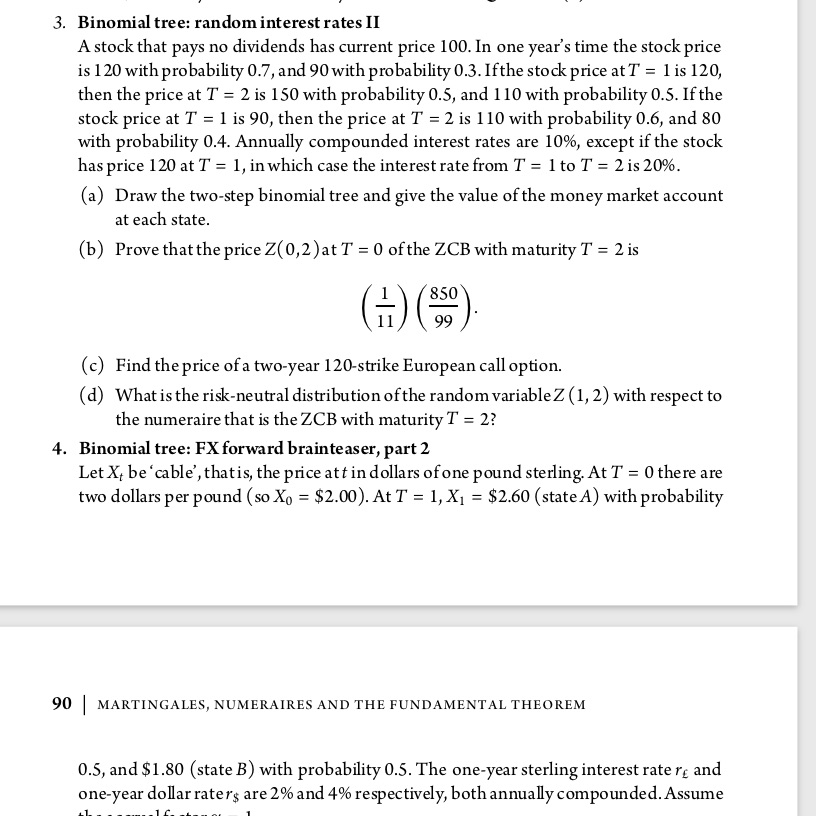

3. Binomial tree: random interest rates II A stock that pays no dividends has current price 100. In one year's time the stock price is 120 with probability 0.7, and 90 with probability 0.3. Ifthe stock price at T = 1 is 120, then the price at T = 2 is 150 with probability 0.5, and 110 with probability 0.5. If the stock price at T = 1 is 90, then the price at T = 2 is 110 with probability 0.6, and 80 with probability 0.4. Annually compounded interest rates are 10%, except if the stock has price 120 at T = 1, in which case the interest rate from T = 1 to T = 2 is 20%. (a) Draw the two-step binomial tree and give the value of the money market account at each state. (b) Prove that the price Z(0,2) at T = 0 of the ZCB with maturity T = 2 is 850 99 (c) Find the price of a two-year 120-strike European call option. (d) What is the risk-neutral distribution of the random variable Z (1, 2) with respect to the numeraire that is the ZCB with maturity T = 2? 4. Binomial tree: FX forward brainteaser, part 2 Let X be 'cable', that is, the price att in dollars of one pound sterling. At T = 0 there are two dollars per pound (so Xo = $2.00). At T = 1, X = $2.60 (state A) with probability 90 | MARTINGALES, NUMERAIRES AND THE FUNDAMENTAL THEOREM 0.5, and $1.80 (state B) with probability 0.5. The one-year sterling interest rate re and one-year dollar raters are 2% and 4% respectively, both annually compounded. Assume

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started