3. Business finance questions

3. Business finance questions

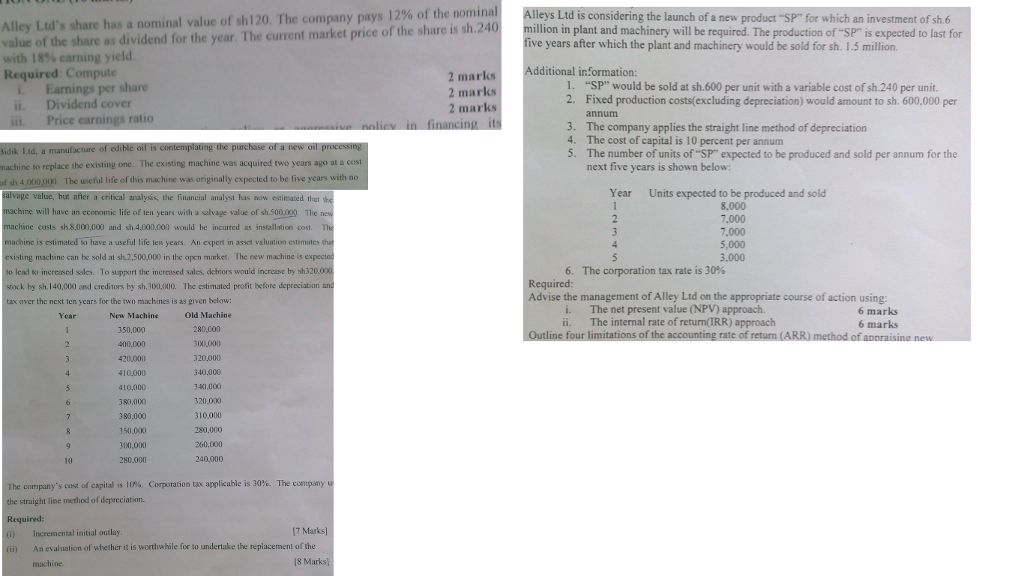

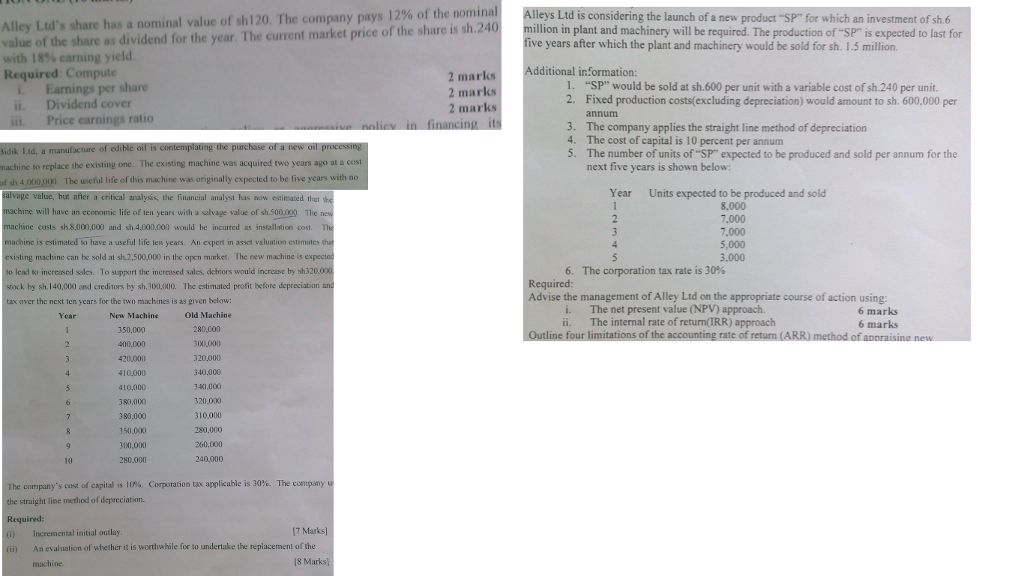

Alley share has a nominal value of sh120. The company pays 12% of the nomina value of the share as dividend for the year. The current market price of the share is 18% earning yield Required Compute 2 marks Earnings per share 2 marks 2 marks iii. Price earnings ratio idik I td. a manufacture of edible oil machine to replace the existing one. The existing machine was acquired two years ago at a cost led to be five years with no 4000000 The useful life orthis mach was originally expect vage value, but after a critical analysis, the financial analyst has now estimated that machine will have an economic life of ten years with a alvage value of sh 500.000 The new machine costs sh8,000,000 and sh 4,000,000 would be incurred as installation cost. Th machine is estimated to have a useful life ten years. An expert in asset valuation estimates tha existing machine can be sold at sh.2,500,000 in the open market, The new machine is expected to lead to increased sales. To support the increased sales, debtors would increase by sh320.000 stock by sh 40,000 and creditors by sh 300.000. The estimated profit before depreciation and as given below: the two machines Old Machine Year New Mach 320,000 0,000 150.000 280.000 The company's cost of capital is 10%. Corporation tax applicable is 30% The company the straight line method of depreciation. 7 Marks is worthwhile for to undertake the replace s considering the launch of a new product SP for which an investment of sh 6 illion in plant and machinery will be required. The production of "SP is expected to last for ive years after which the plant and machinery would be sold for sh. I 5 million. Additional information: 1. "SP" would be sold at sh.600 per unit with a variable cost of sh.240 per unit. 2. Fixed production costs(excluding depreciation) would amount to sh. 600,000 per annumm 3. The company applies the straight line method of depreciation 4. The cost of capital is 10 percent per annum s. The number of units of SP expected to be produced and sold per annum for the next five years is shown below: Year Units expected to be produced and sold 6. The corporation tax rate is 30% Required Advise the management of Alley Ltd on the appropriate course of action using: i. The net present value (NPV) approach. 6 marks ii. The internal rate of return(IRR) approach 6 marks

3. Business finance questions

3. Business finance questions