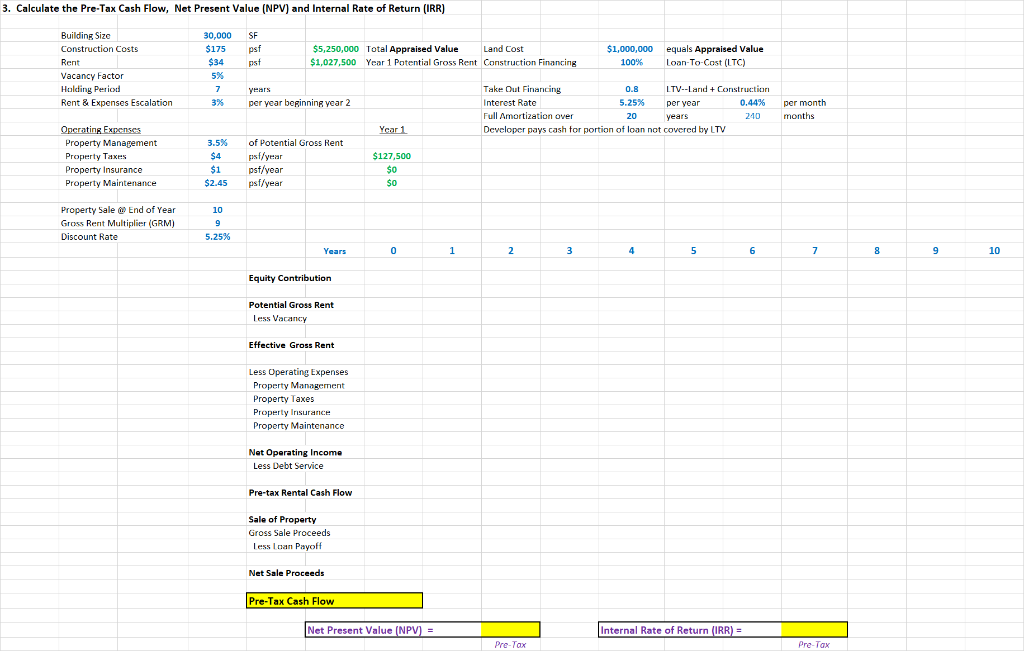

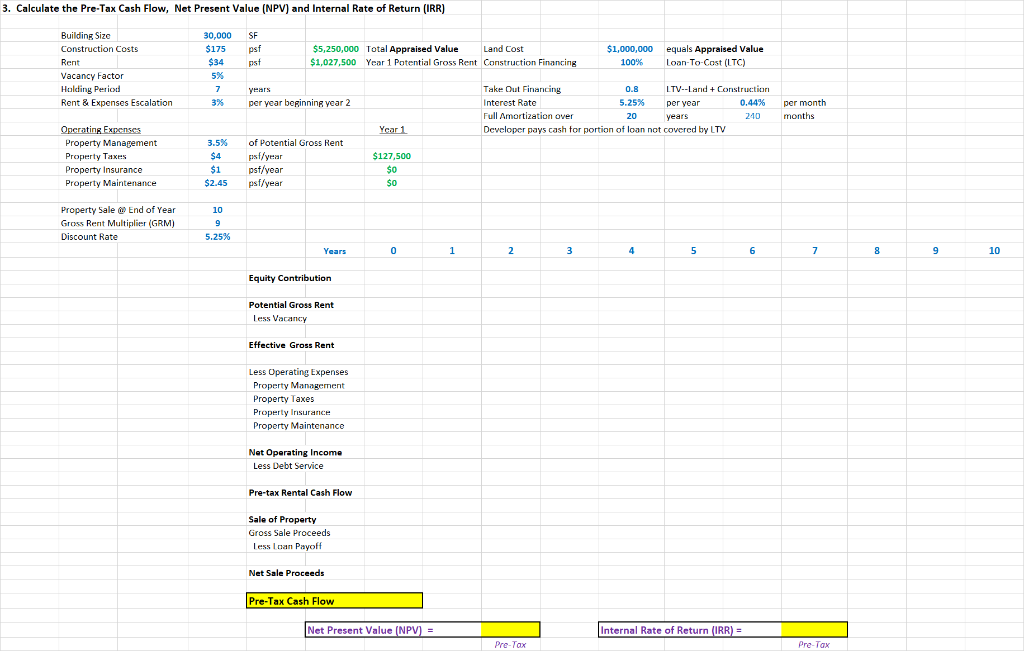

3. Calculate the Pre-Tax Cash Flow, Net Present Value (NPV) and Internal Rate of Return (IRR) Building Size 30,000 SE $5,250,000 Total Appraised Value Construction Costs $175 psf Land Cost $1,000,000 equals Appraised Value $34 Loan-To-Cast (LTC) Rent st $1,027,500 Year 1 Potential Gross Rent Construction Financing 100% 5% Vacancy Factor Holding Period Take Qut Financing LTV-LandConstruction 0.8 ers 0.44 % Rent & Expenses Escalation per year beginning year 2 3% Interest Rate 5.25% per month ear Full Amortization over months 20 240 years Year 1 Operating Expenses Developer payvs cash for portion of loan not covered by LTV of Potential Gross Rent 3.5 % Property Management Propmrty Taxs $4 psf/year psf/year $127,500 $1 $0 Property Insurance Property Maintenance $2.45 psf/year $0 Property Sale End of Year 10 Gross Rent Multiplier (GRM) 9 Discount Rate 5.25 % 0 1 2 3 5 6 7 8 10 Years Equity Contribution Potential Gross Rent Less Vacancy Effective Gross Rent Less Operating Expenses Property Management Property Taxs Property Insurance Property Maintenance Nat Operating Income Less Debt Service Pre-tax Rental Cash Flow Sale of Property Gross Sale Proceeds Less Inan Payoff Net Sale Proceeds Pre-Tax Cash Flow Net Present Value (NPV) Internal Rate of Return (IRR)- Pre-Tax Pre-Tax 3. Calculate the Pre-Tax Cash Flow, Net Present Value (NPV) and Internal Rate of Return (IRR) Building Size 30,000 SE $5,250,000 Total Appraised Value Construction Costs $175 psf Land Cost $1,000,000 equals Appraised Value $34 Loan-To-Cast (LTC) Rent st $1,027,500 Year 1 Potential Gross Rent Construction Financing 100% 5% Vacancy Factor Holding Period Take Qut Financing LTV-LandConstruction 0.8 ers 0.44 % Rent & Expenses Escalation per year beginning year 2 3% Interest Rate 5.25% per month ear Full Amortization over months 20 240 years Year 1 Operating Expenses Developer payvs cash for portion of loan not covered by LTV of Potential Gross Rent 3.5 % Property Management Propmrty Taxs $4 psf/year psf/year $127,500 $1 $0 Property Insurance Property Maintenance $2.45 psf/year $0 Property Sale End of Year 10 Gross Rent Multiplier (GRM) 9 Discount Rate 5.25 % 0 1 2 3 5 6 7 8 10 Years Equity Contribution Potential Gross Rent Less Vacancy Effective Gross Rent Less Operating Expenses Property Management Property Taxs Property Insurance Property Maintenance Nat Operating Income Less Debt Service Pre-tax Rental Cash Flow Sale of Property Gross Sale Proceeds Less Inan Payoff Net Sale Proceeds Pre-Tax Cash Flow Net Present Value (NPV) Internal Rate of Return (IRR)- Pre-Tax Pre-Tax