Answered step by step

Verified Expert Solution

Question

1 Approved Answer

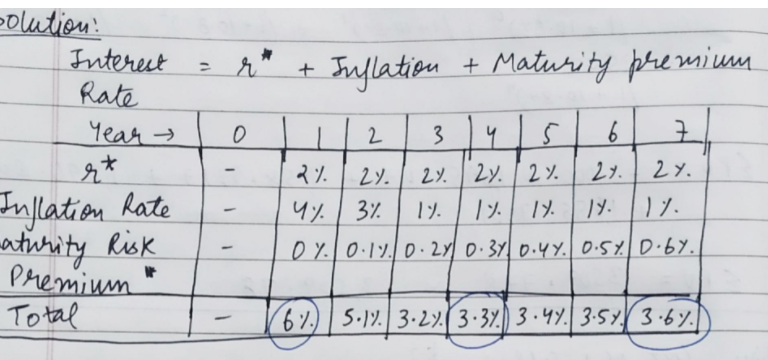

3) Calculate the rate of interest (r) on the following term bonds: a) 1-year bond= 6% b) 4-year bond= 3.3% c) 7-year bond= 3.6% What

3) Calculate the rate of interest (r) on the following term bonds:

a) 1-year bond= 6%

b) 4-year bond= 3.3%

c) 7-year bond= 3.6%

What impact would a change in inflation have on the rate of interest above? Assume inflation is 2% next year, then increases to 3% for each following year. Calculate the rate of interest (r) with these changes to inflation.

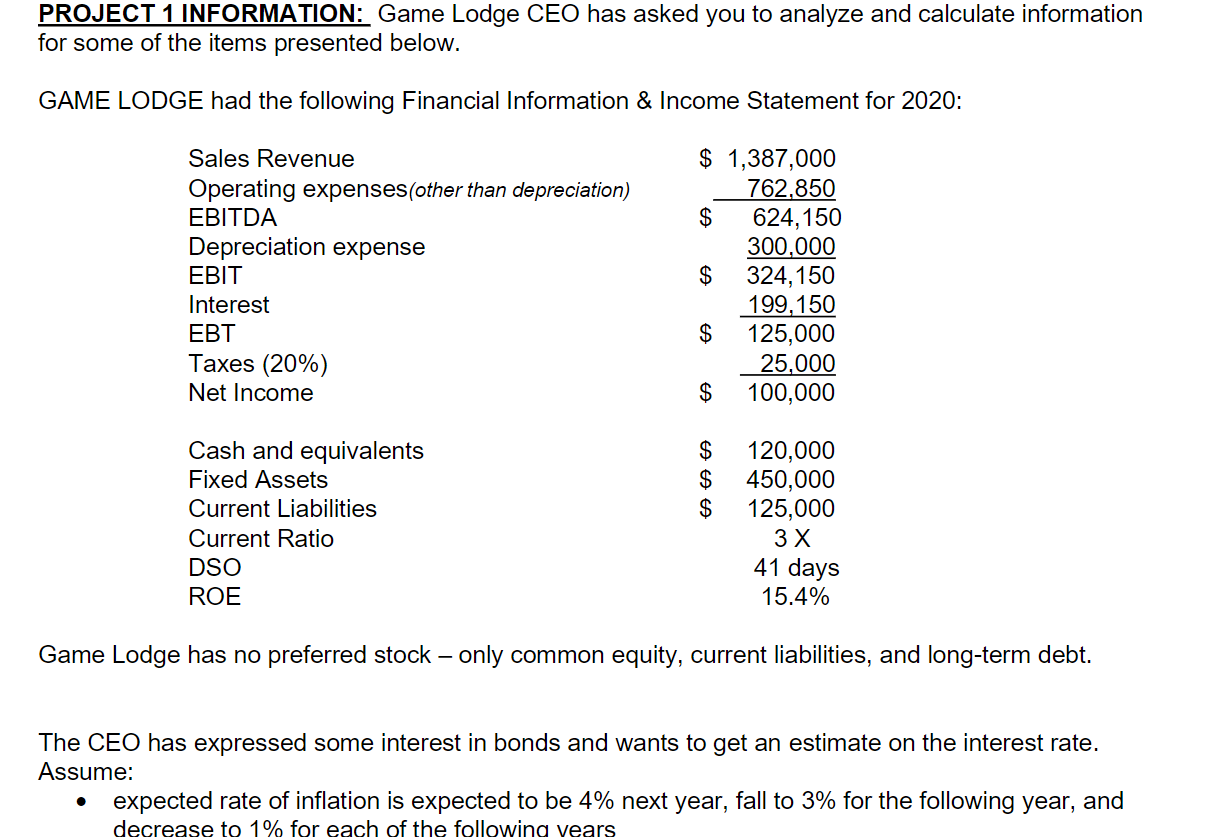

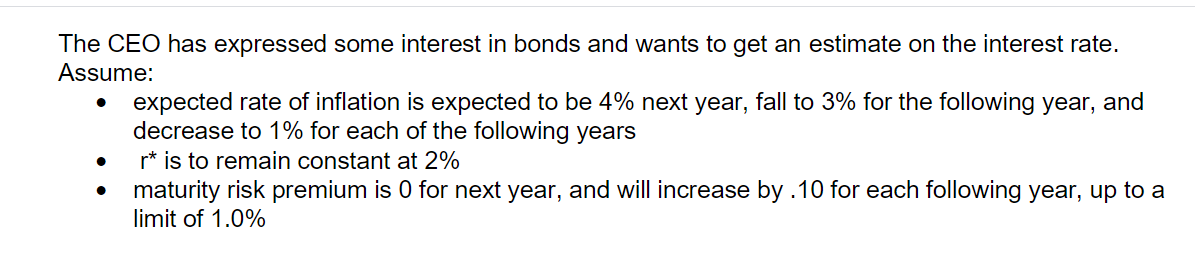

PROJECT 1 INFORMATION: Game Lodge CEO has asked you to analyze and calculate information for some of the items presented below. GAME LODGE had the following Financial Information & Income Statement for 2020: Sales Revenue Operating expenses (other than depreciation) EBITDA Depreciation expense EBIT Interest EBT Taxes (20%) Net Income $ 1,387,000 762,850 $ 624,150 300,000 $ 324,150 199,150 $ 125,000 25,000 $ 100,000 $ $ $ Cash and equivalents Fixed Assets Current Liabilities Current Ratio DSO ROE 120,000 450,000 125,000 3 X 41 days 15.4% Game Lodge has no preferred stock - only common equity, current liabilities, and long-term debt. The CEO has expressed some interest in bonds and wants to get an estimate on the interest rate. Assume: expected rate of inflation is expected to be 4% next year, fall to 3% for the following year, and decrease to 1% for each of the following vears The CEO has expressed some interest in bonds and wants to get an estimate on the interest rate. Assume: expected rate of inflation is expected to be 4% next year, fall to 3% for the following year, and decrease to 1% for each of the following years r* is to remain constant at 2% maturity risk premium is 0 for next year, and will increase by 10 for each following year, up to a limit of 1.0% . . rt Inflation + Maturity premium yts o 2 3 6 7 solution: Interest Rate Year rt Inflation Rate aturity Risk Premium Total 27. 27. 29.27.2%. 24. 2y. 4% | 3% 1%. 1% 1%. Y. 0% 0.1% 0.24 0.310.44 0.54 0.6y. .( (67) 5.19.3.2%3-37.) 3:47. 3.54 3.6%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started