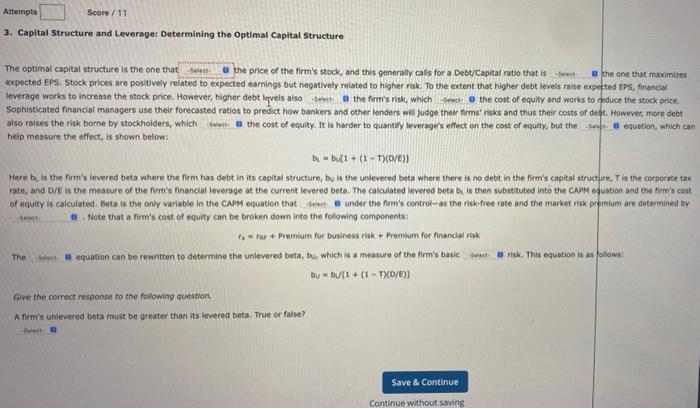

Question: 3. Capital Structure and Leverage: Determining the Optimal Capital Structure The optimal capital structure is the one that the price of the firm's stock, and

3. Capital Structure and Leverage: Determining the Optimal Capital Structure The optimal capital structure is the one that the price of the firm's stock, and this generally cals for a Debticapilal rotio that is expected EPS, Stock prices are positively related to expected earnings but negatively related to higher risk. To the extent that higher debt levels rase experted EPS, finanolal leverage works to increase the stock price. However, higher debt ligvels also the firm's risk, which Selist. the cost of equity and works to raduce the stock price. Sophisticated financial managers use their forecasted ratios to predict how bankers and other lenders will fudge their firms' risks and thus their costs of dest. Hawivec, more debt also raises the risk borne by stockholders, which the cost of equity. It is harder to quantify leverage's effect on the cost of equity, but the -les. a equation, which can help measure the effect, is shown below: b2=bu[1+(2T)(D/c)] Here ba is the firm's levered beta where the firm has debt in its capital structure, bu is the unlevered beta where there is no debt in the firm's capital structure, T is the corporate tax. rate, and D/E is the measure of the firn's financial leverage at the current levered beta. The calculated livered beta br. is then substituted into the CirM equation and the firm's cost of equity is calculated. Beta is the only variable in the CaPM equation that - whit. B under the firm's control-as the risk-free rate and the market risk oremium are determined by aresi Note that a firm's cost of equity can be broken down into the folowing components: r1=ru+Premiumforbusinesseisk+Premiumforfinandialrisk The equation can be reminten to determine the unlevered beta, bu. which is a measure of the firm's basic riak. This equation is as follows: Du=bU/1+(1T)(D/E)] Give the correct respanse to the following question, A firm's unievered beta must be greater than its levered beta. True or false? Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts