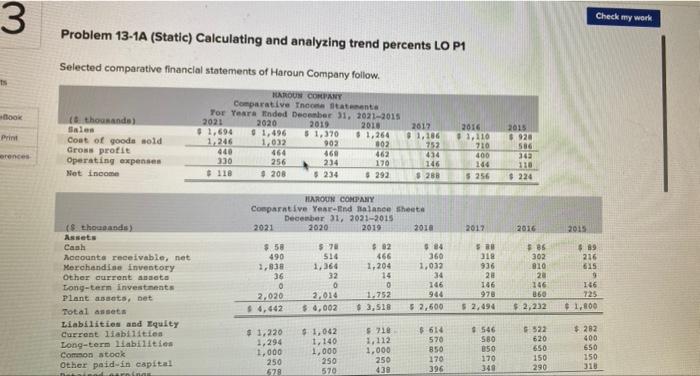

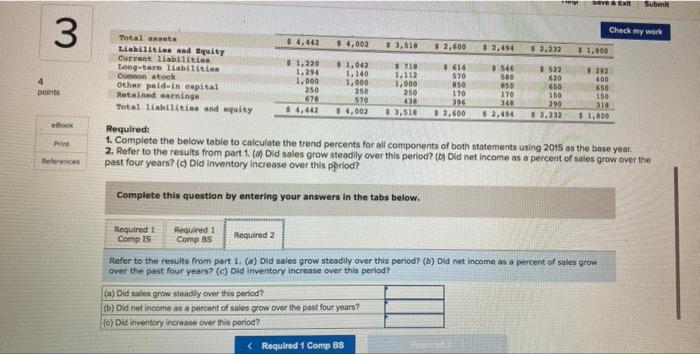

3 Check my work Problem 13-1A (Static) Calculating and analyzing trend percents LO P1 Book Selected comparative financial statements of Haroun Company follow. MAROUN COMPANY Comparative Tooltanta Tor Years Inded December 31, 2021-2015 ( thousando 2021 2020 2019 2018 Salon 1.694 1,496 31,370 $1,264 Coat of goods sold 1.246 1.032 902 802 Gross profit 440 464 460 462 Operating expenses 330 256 234 170 Net income $110 $ 208 $ 234 $ 292 Print 2012 $ 1,186 752 414 2015 $920 586 rences 2016 $1,110 710 400 144 5 256 110 $ 224 3.288 2021 2017 2016 2015 HAROUN COMPANY Comparative Year-End Balance Sheet December 31, 2021-2015 2020 2019 2018 5.58 5.70 $ 82 684 490 514 466 360 1,838 1,364 1,204 1,032 36 32 14 34 0 0 0 146 2.020 2,014 1.252 964 $4,442 $ 0.002 $ 3,518 5 2,600 530 318 $89 216 615 (S. thoands) Assets Caah Accounts receivable, net Merchandise Inventory Other current anata Long-term investments Plant assets, bet Total assets Liabilities and Equity Current liabilities Long-term liabilities Come on stock Other paid-in capital hatarimas 936 28 166 978 $ 2,494 3.8 302 010 20 146 360 $ 2,232 146 725 + 1,800 $1,220 1,294 1.000 250 2579 $1,042 1,140 1.000 250 570 $ 210 1.112 1,000 250 430 $ 614 570 850 170 396 1546 580 850 170 340 $ 522 620 650 150 290 $282 400 650 150 318 VSE Submit 3 1.000 $70 points Check my work Total asset 64,442 $ 4,002 3,510 # 2,600 $ 2,494 Liabilities and Equity 3,232 $ 1.500 Current liabilities 1,220 $1,042 Long-term liabilities 1710 614 546 1.294 #522 $ 22 1,140 1,112 Common stock 500 620 400 Other paid in capital 1,000 1.000 050 850 1650 650 250 250 250 170 170 150 Retained earning 150 670 438 396 340 290 310 Total 11bilities and equity 54,442 04.002 3,510 # 2,600 2.494 2.232 # 1,400 Required: 1. Complete the below table to calculate the trend percents for all components of both statements using 2015 as the base year. 2. Refer to the results from part 1. (o) Did sales grow steadily over this period? (Did net income as a percent of sales grow over the past four years? (Did Inventory increase over this phriodi Complete this question by entering your answers in the tabs below. Required 1 Comp 15 Required 1 Comp BS Required 2 Refer to the results from part 1. () Did sales grow steadily over this period? (b) Did net income as a percent of sales grow over the past four years? (c) Did Inventory increase over this period? (a) Did sales grow steadily over this period? (b) Did net income as a percent of sales grow over the past four years? (o) Did inventory increase over this period? Required 1 Comp BS