Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 . CIA Susan Prescott is a foreign exchange trader for a bank in New York. She has $ 1 million ( or its Swiss

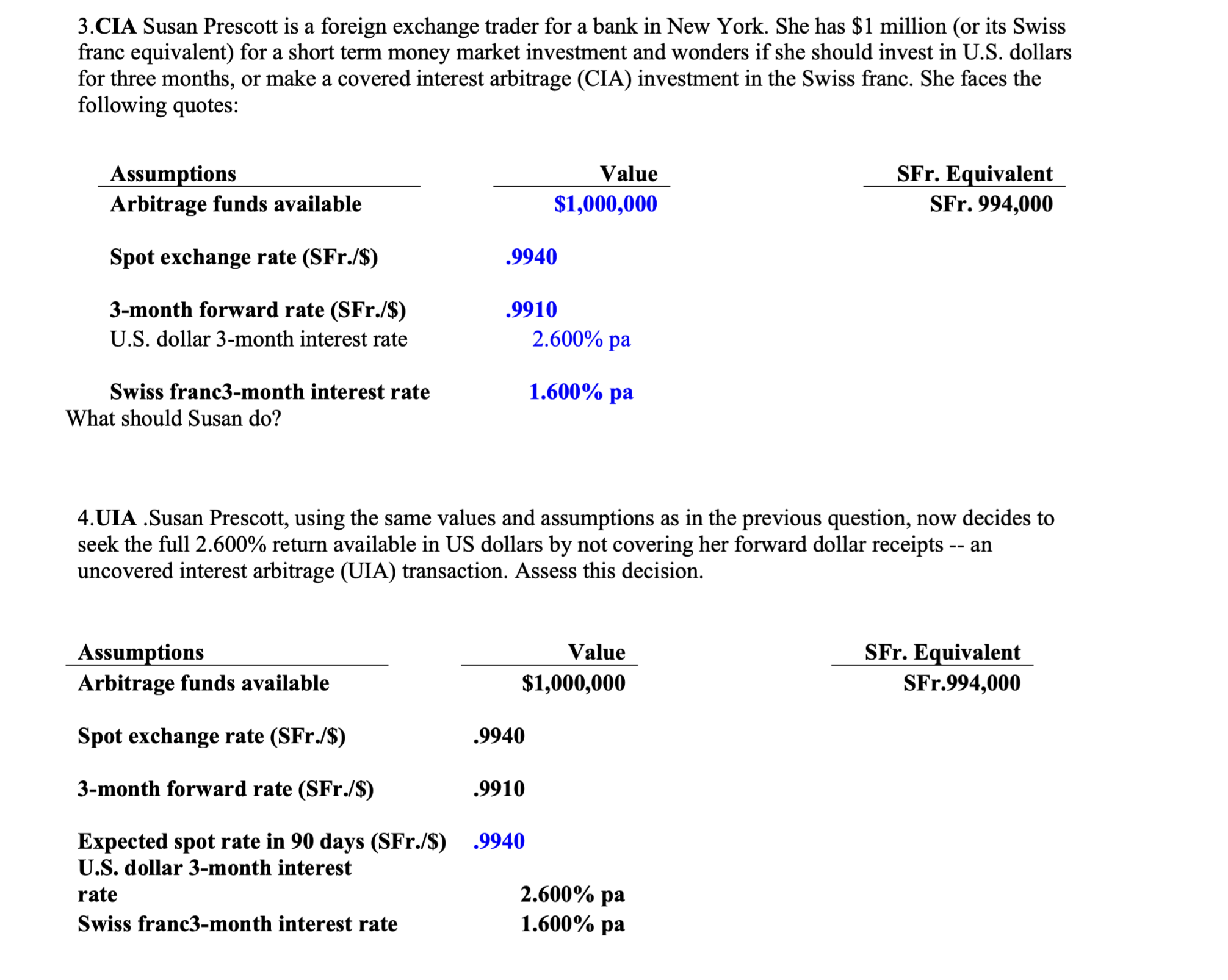

CIA Susan Prescott is a foreign exchange trader for a bank in New York. She has $ million or its Swiss franc equivalent for a short term money market investment and wonders if she should invest in US dollars for three months, or make a covered interest arbitrage CIA investment in the Swiss franc. She faces the following quotes: What should Susan do UIA Susan Prescott, using the same values and assumptions as in the previous question, now decides to seek the full return available in US dollars by not covering her forward dollar receipts an uncovered interest arbitrage UIA transaction. Assess this decision

CIA Susan Prescott is a foreign exchange trader for a bank in New York. She has $ million or its Swiss

franc equivalent for a short term money market investment and wonders if she should invest in US dollars

for three months, or make a covered interest arbitrage CIA investment in the Swiss franc. She faces the

following quotes:

What should Susan do

UIA Susan Prescott, using the same values and assumptions as in the previous question, now decides to

seek the full return available in US dollars by not covering her forward dollar receipts an

uncovered interest arbitrage UIA transaction. Assess this decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started