Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Colton Conveyance, Inc., is a large U.S. natural gas pipelme company that wants to raise $120 million to finance expansion. Deming wants a capital

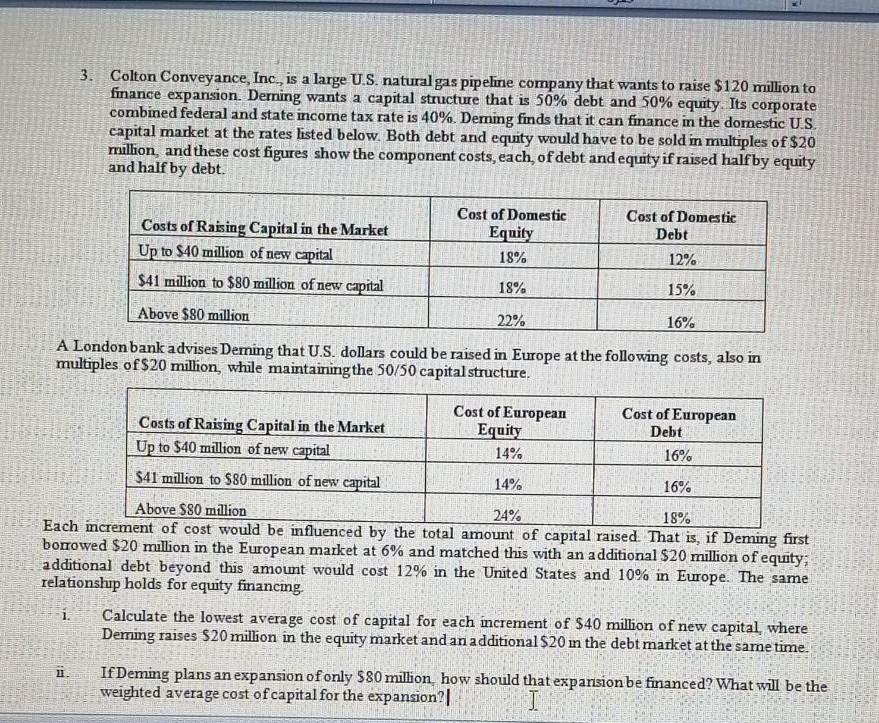

3. Colton Conveyance, Inc., is a large U.S. natural gas pipelme company that wants to raise $120 million to finance expansion. Deming wants a capital structure that is 50% debt and 50% equity Its corporate combined federal and state income tax rate is 40%. Derning finds that it can finance in the domestic U.S. capital market at the rates listed below. Both debt and equity would have to be sold in multiples of $20 million, and these cost figures show the component costs, each of debt and equity if raised halfby equity and half by debt. Costs of Raising Capital in the Market Up to $40 million of new capital $41 million to $80 raillion of new capital Cost of Domestic Equity 18% Cost of Domestic Debt 12% 18% 15% Above $80 million 22% 16% A Londonbank advises Deming that U.S. dollars could be raised in Europe at the following costs, also in multiples of $20 million, while maintaining the 50/50 capital structure. Cost of European Cost of European Costs of Raising Capital in the Market Equity Debt Up to $40 million of new capital 14% 16% $41 million to $80 million of new capital 14% 16% Above S80 million 24% 18% Each increment of cost would be influenced by the total amount of capital raised That is, if Deming first borrowed $20 mullion in the European market at 6% and matched this with an additional $20 million of equity; additional debt beyond this amount would cost 12% in the United States and 10% in Europe. The same relationshup holds for equity financing. Calculate the lowest average cost of capital for each increment of $40 million of new capital, where Deming raises $20 million in the equity market and an additional $20 in the debt market at the same time. 1. 11. If Deming plans an expansion of only $80 million, how should that expansion be financed? What will be the weighted average cost of capital for the expansion?| I 3. Colton Conveyance, Inc., is a large U.S. natural gas pipelme company that wants to raise $120 million to finance expansion. Deming wants a capital structure that is 50% debt and 50% equity Its corporate combined federal and state income tax rate is 40%. Derning finds that it can finance in the domestic U.S. capital market at the rates listed below. Both debt and equity would have to be sold in multiples of $20 million, and these cost figures show the component costs, each of debt and equity if raised halfby equity and half by debt. Costs of Raising Capital in the Market Up to $40 million of new capital $41 million to $80 raillion of new capital Cost of Domestic Equity 18% Cost of Domestic Debt 12% 18% 15% Above $80 million 22% 16% A Londonbank advises Deming that U.S. dollars could be raised in Europe at the following costs, also in multiples of $20 million, while maintaining the 50/50 capital structure. Cost of European Cost of European Costs of Raising Capital in the Market Equity Debt Up to $40 million of new capital 14% 16% $41 million to $80 million of new capital 14% 16% Above S80 million 24% 18% Each increment of cost would be influenced by the total amount of capital raised That is, if Deming first borrowed $20 mullion in the European market at 6% and matched this with an additional $20 million of equity; additional debt beyond this amount would cost 12% in the United States and 10% in Europe. The same relationshup holds for equity financing. Calculate the lowest average cost of capital for each increment of $40 million of new capital, where Deming raises $20 million in the equity market and an additional $20 in the debt market at the same time. 1. 11. If Deming plans an expansion of only $80 million, how should that expansion be financed? What will be the weighted average cost of capital for the expansion?|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started