Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. Note: Round your average cost

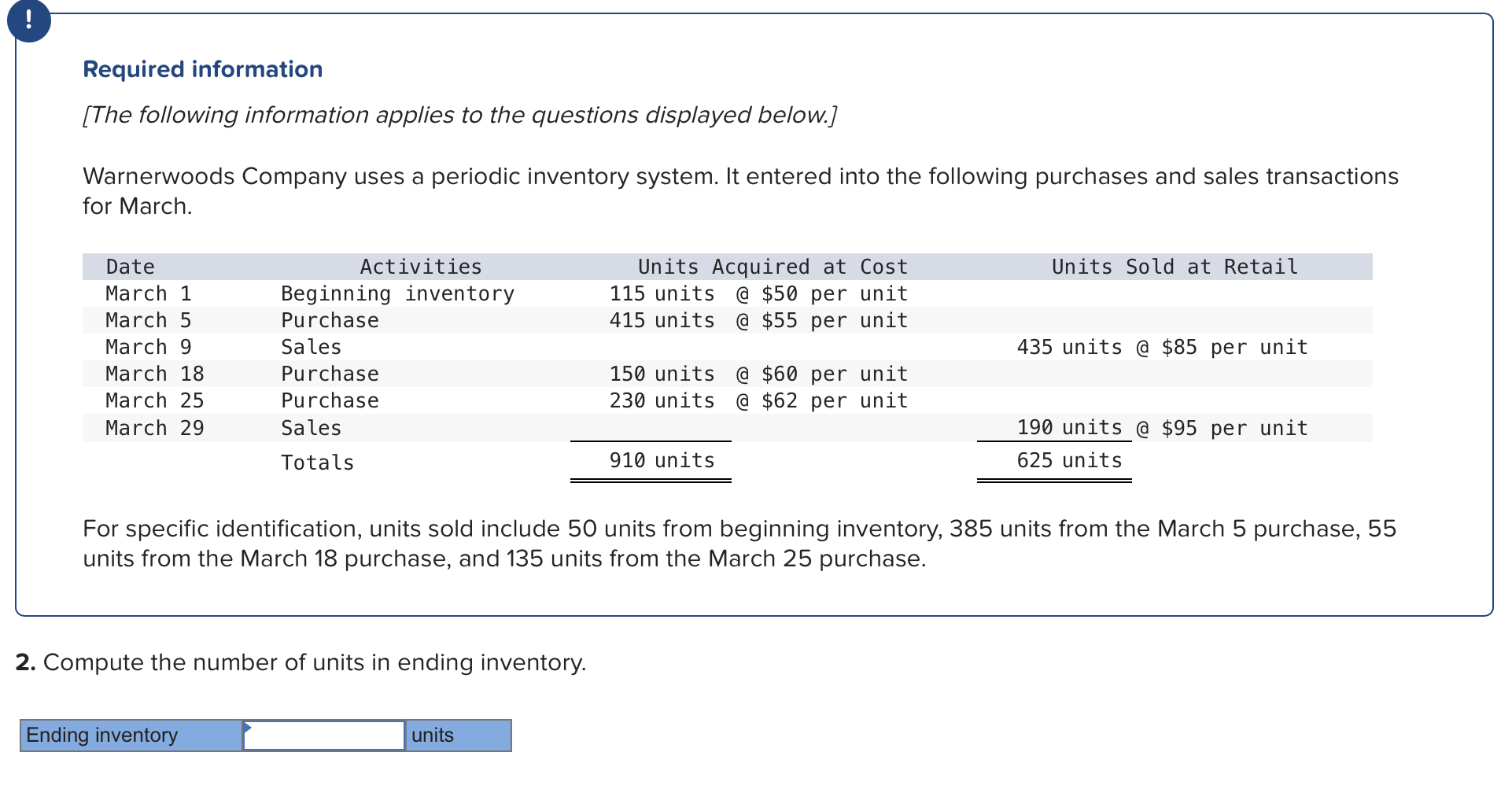

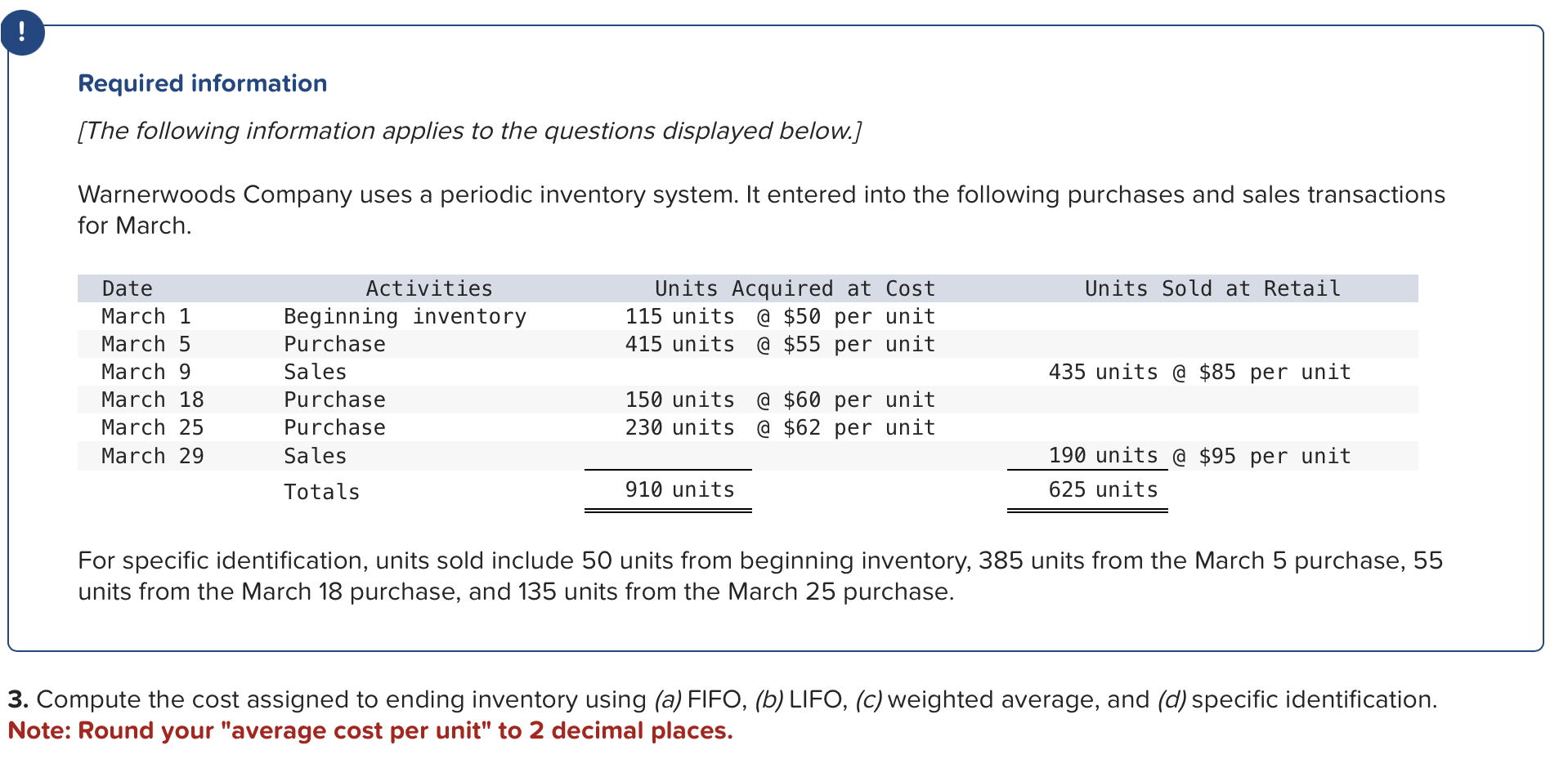

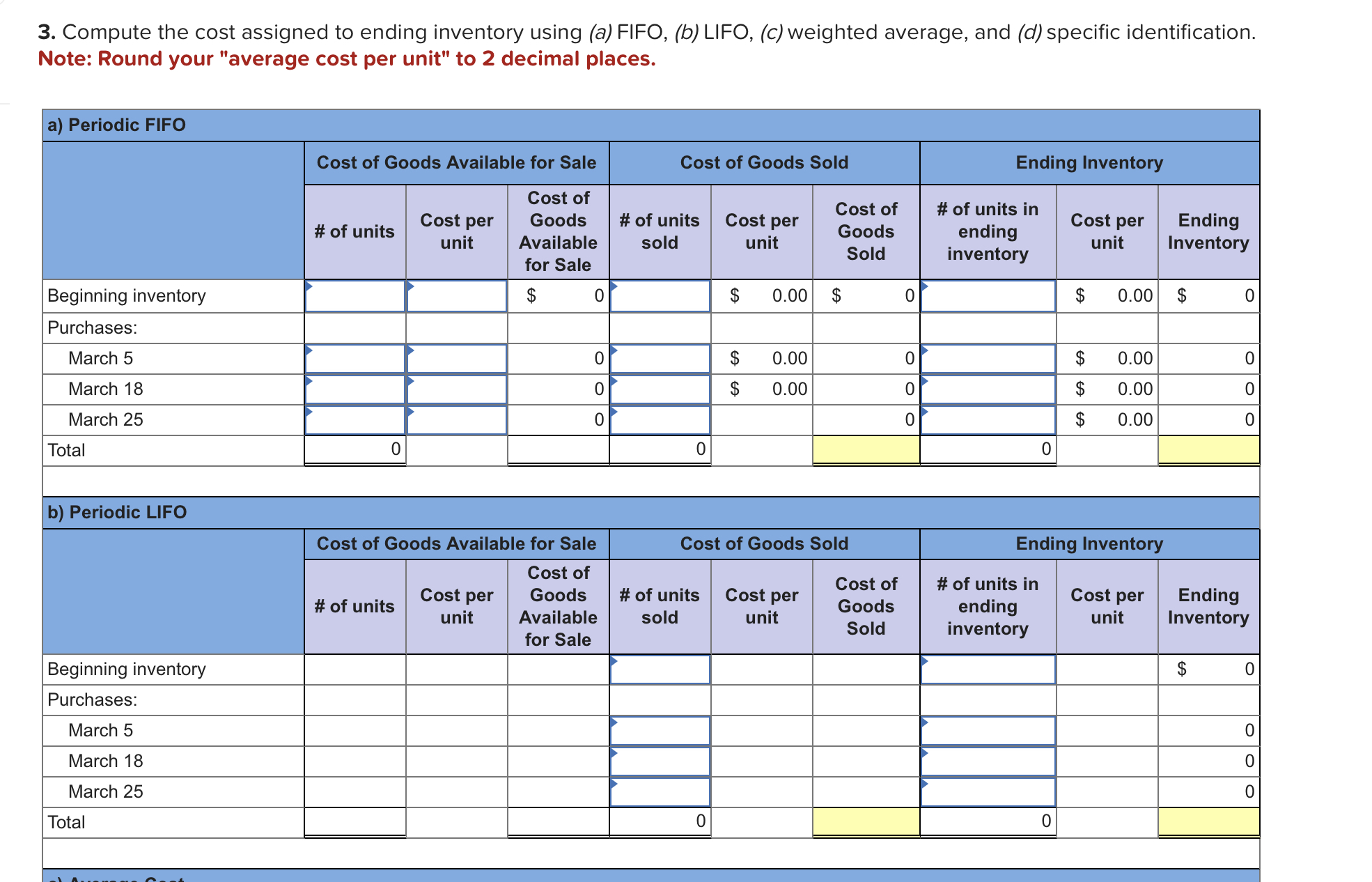

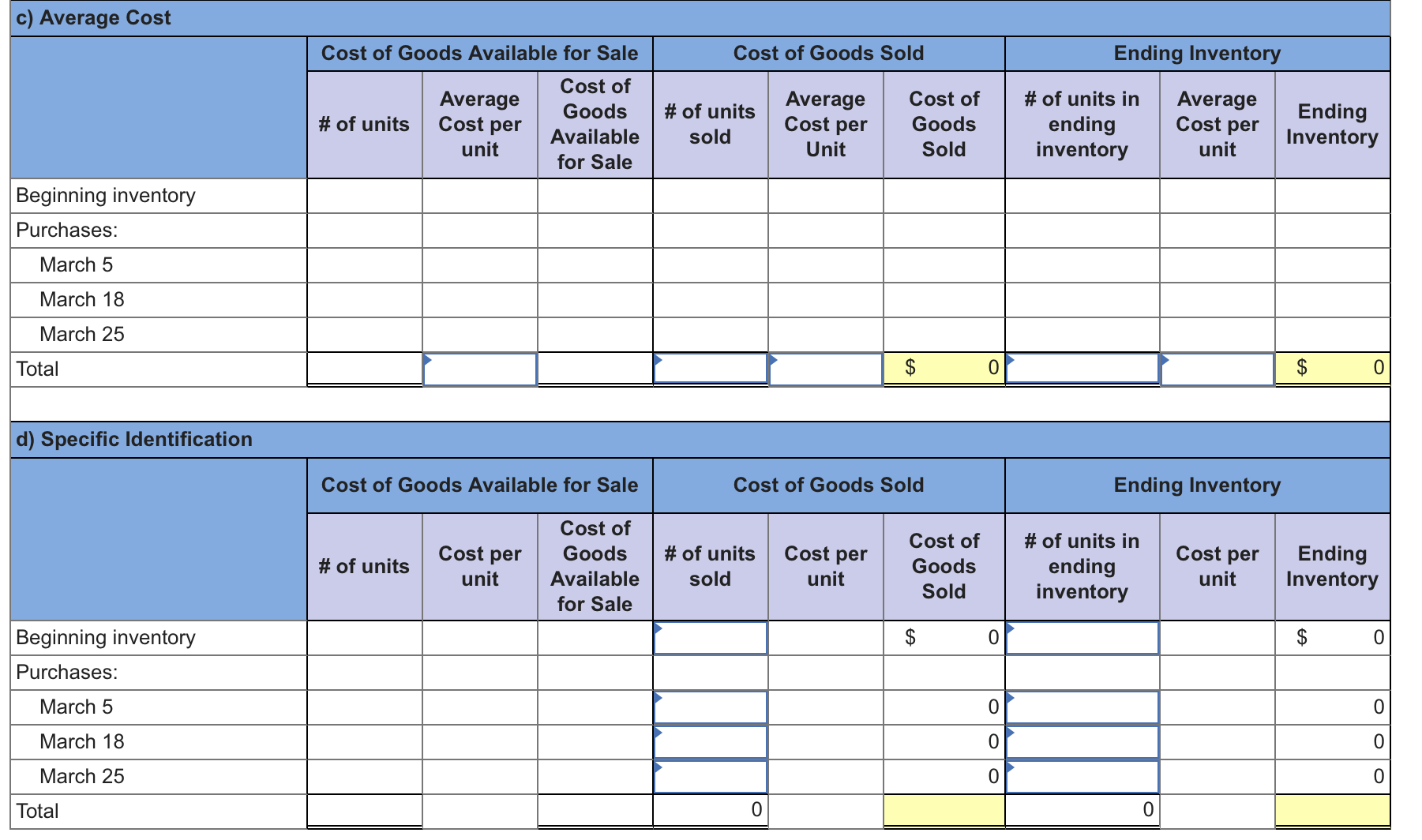

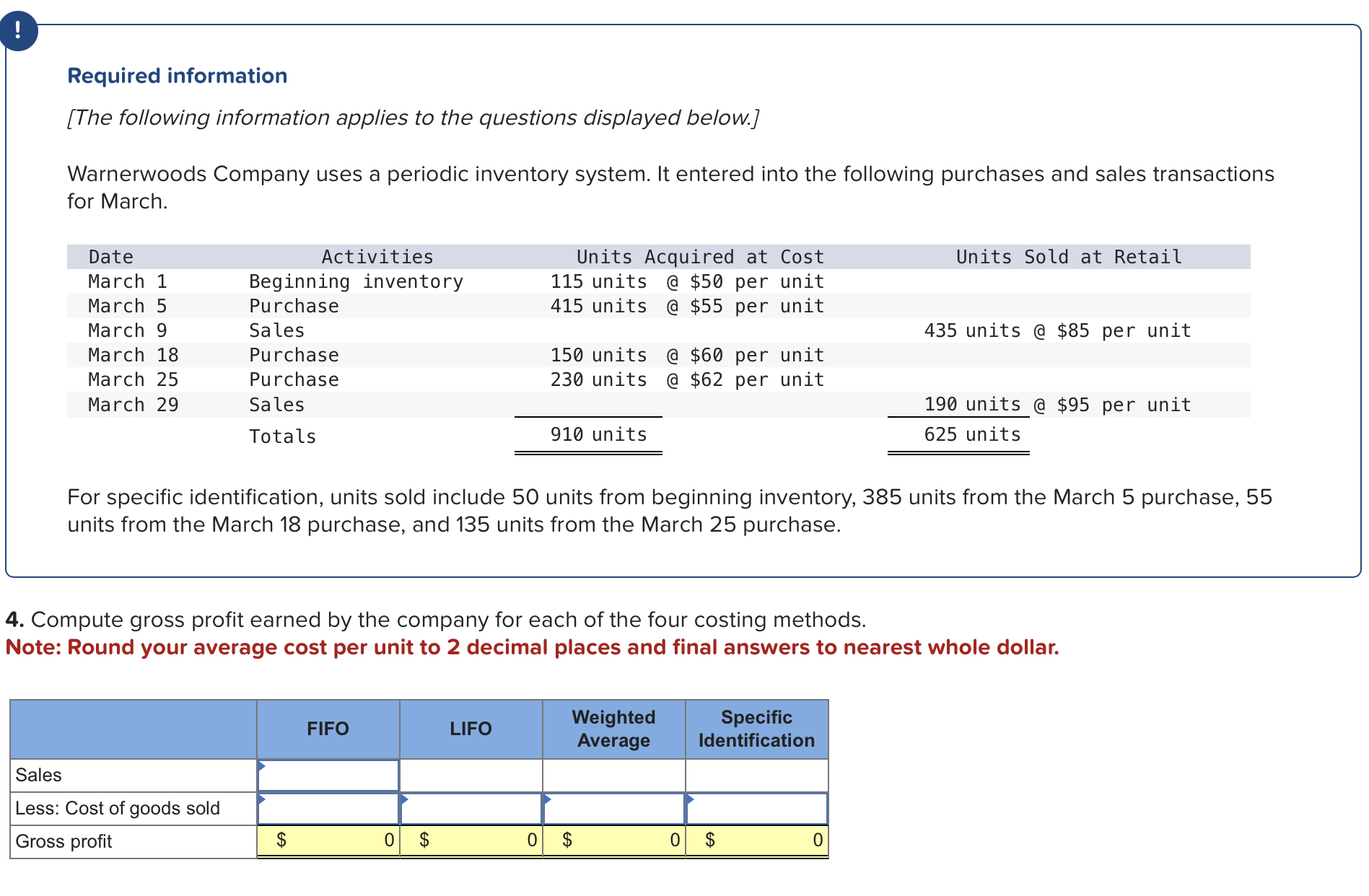

3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. Note: Round your "average cost per unit" to 2 decimal places. c) Average Cost \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & \multicolumn{3}{|c|}{ Cost of Goods Available for Sale } & \multicolumn{3}{|c|}{ Cost of Goods Sold } & \multicolumn{3}{|c|}{ Ending Inventory } \\ \hline & # of units & \begin{tabular}{c} Average \\ Cost per \\ unit \end{tabular} & \begin{tabular}{c} Cost of \\ Goods \\ Available \\ for Sale \end{tabular} & \begin{tabular}{c} # of units \\ sold \end{tabular} & \begin{tabular}{c} Average \\ Cost per \\ Unit \end{tabular} & \begin{tabular}{l} Cost of \\ Goods \\ Sold \end{tabular} & \begin{tabular}{c} \# of units in \\ ending \\ inventory \end{tabular} & \begin{tabular}{c} Average \\ Cost per \\ unit \end{tabular} & \begin{tabular}{c} Ending \\ Inventory \end{tabular} \\ \hline \multicolumn{10}{|l|}{ Beginning inventory } \\ \hline \multicolumn{10}{|l|}{ Purchases: } \\ \hline \multicolumn{10}{|l|}{ March 5} \\ \hline \multicolumn{10}{|l|}{ March 18} \\ \hline \multicolumn{10}{|l|}{ March 25} \\ \hline Total & & & & & & $ & & & $ \\ \hline \multicolumn{10}{|c|}{ d) Specific Identification } \\ \hline & \multicolumn{3}{|c|}{ Cost of Goods Available for Sale } & \multicolumn{3}{|c|}{ Cost of Goods Sold } & \multicolumn{3}{|c|}{ Ending Inventory } \\ \hline & # of units & \begin{tabular}{c} Cost per \\ unit \end{tabular} & \begin{tabular}{c} Cost of \\ Goods \\ Available \\ for Sale \end{tabular} & \begin{tabular}{l} # of units \\ sold \end{tabular} & \begin{tabular}{c} Cost per \\ unit \end{tabular} & \begin{tabular}{l} Cost of \\ Goods \\ Sold \end{tabular} & \begin{tabular}{c} \# of units in \\ ending \\ inventory \end{tabular} & \begin{tabular}{c} Cost per \\ unit \end{tabular} & \begin{tabular}{l} Ending \\ Inventory \end{tabular} \\ \hline Beginning inventory & & & & & & $ & & & $ \\ \hline \multicolumn{10}{|l|}{ Purchases: } \\ \hline March 5 & & & & & & 0 & & & 0 \\ \hline March 18 & & & & & & 0 & & & 0 \\ \hline March 25 & & & & & & 0 & & & 0 \\ \hline Total & & & & 0 & & & 0 & & \\ \hline \end{tabular} Required information [The following information applies to the questions displayed below.] Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. For specific identification, units sold include 50 units from beginning inventory, 385 units from the March 5 purchase, 55 units from the March 18 purchase, and 135 units from the March 25 purchase. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. ote: Round your "average cost per unit" to 2 decimal places. Required information [The following information applies to the questions displayed below.] Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. For specific identification, units sold include 50 units from beginning inventory, 385 units from the March 5 purchase, 55 units from the March 18 purchase, and 135 units from the March 25 purchase. 4. Compute gross profit earned by the company for each of the four costing methods. Note: Round your average cost per unit to 2 decimal places and final answers to nearest whole dollar. Required information [The following information applies to the questions displayed below.] Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. For specific identification, units sold include 50 units from beginning inventory, 385 units from the March 5 purchase, 55 units from the March 18 purchase, and 135 units from the March 25 purchase. 2. Compute the number of units in ending inventory

3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. Note: Round your "average cost per unit" to 2 decimal places. c) Average Cost \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & \multicolumn{3}{|c|}{ Cost of Goods Available for Sale } & \multicolumn{3}{|c|}{ Cost of Goods Sold } & \multicolumn{3}{|c|}{ Ending Inventory } \\ \hline & # of units & \begin{tabular}{c} Average \\ Cost per \\ unit \end{tabular} & \begin{tabular}{c} Cost of \\ Goods \\ Available \\ for Sale \end{tabular} & \begin{tabular}{c} # of units \\ sold \end{tabular} & \begin{tabular}{c} Average \\ Cost per \\ Unit \end{tabular} & \begin{tabular}{l} Cost of \\ Goods \\ Sold \end{tabular} & \begin{tabular}{c} \# of units in \\ ending \\ inventory \end{tabular} & \begin{tabular}{c} Average \\ Cost per \\ unit \end{tabular} & \begin{tabular}{c} Ending \\ Inventory \end{tabular} \\ \hline \multicolumn{10}{|l|}{ Beginning inventory } \\ \hline \multicolumn{10}{|l|}{ Purchases: } \\ \hline \multicolumn{10}{|l|}{ March 5} \\ \hline \multicolumn{10}{|l|}{ March 18} \\ \hline \multicolumn{10}{|l|}{ March 25} \\ \hline Total & & & & & & $ & & & $ \\ \hline \multicolumn{10}{|c|}{ d) Specific Identification } \\ \hline & \multicolumn{3}{|c|}{ Cost of Goods Available for Sale } & \multicolumn{3}{|c|}{ Cost of Goods Sold } & \multicolumn{3}{|c|}{ Ending Inventory } \\ \hline & # of units & \begin{tabular}{c} Cost per \\ unit \end{tabular} & \begin{tabular}{c} Cost of \\ Goods \\ Available \\ for Sale \end{tabular} & \begin{tabular}{l} # of units \\ sold \end{tabular} & \begin{tabular}{c} Cost per \\ unit \end{tabular} & \begin{tabular}{l} Cost of \\ Goods \\ Sold \end{tabular} & \begin{tabular}{c} \# of units in \\ ending \\ inventory \end{tabular} & \begin{tabular}{c} Cost per \\ unit \end{tabular} & \begin{tabular}{l} Ending \\ Inventory \end{tabular} \\ \hline Beginning inventory & & & & & & $ & & & $ \\ \hline \multicolumn{10}{|l|}{ Purchases: } \\ \hline March 5 & & & & & & 0 & & & 0 \\ \hline March 18 & & & & & & 0 & & & 0 \\ \hline March 25 & & & & & & 0 & & & 0 \\ \hline Total & & & & 0 & & & 0 & & \\ \hline \end{tabular} Required information [The following information applies to the questions displayed below.] Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. For specific identification, units sold include 50 units from beginning inventory, 385 units from the March 5 purchase, 55 units from the March 18 purchase, and 135 units from the March 25 purchase. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. ote: Round your "average cost per unit" to 2 decimal places. Required information [The following information applies to the questions displayed below.] Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. For specific identification, units sold include 50 units from beginning inventory, 385 units from the March 5 purchase, 55 units from the March 18 purchase, and 135 units from the March 25 purchase. 4. Compute gross profit earned by the company for each of the four costing methods. Note: Round your average cost per unit to 2 decimal places and final answers to nearest whole dollar. Required information [The following information applies to the questions displayed below.] Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. For specific identification, units sold include 50 units from beginning inventory, 385 units from the March 5 purchase, 55 units from the March 18 purchase, and 135 units from the March 25 purchase. 2. Compute the number of units in ending inventory Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started