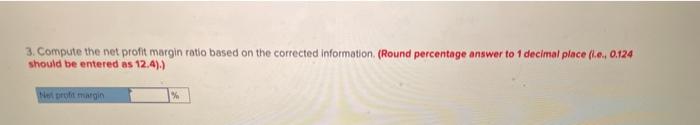

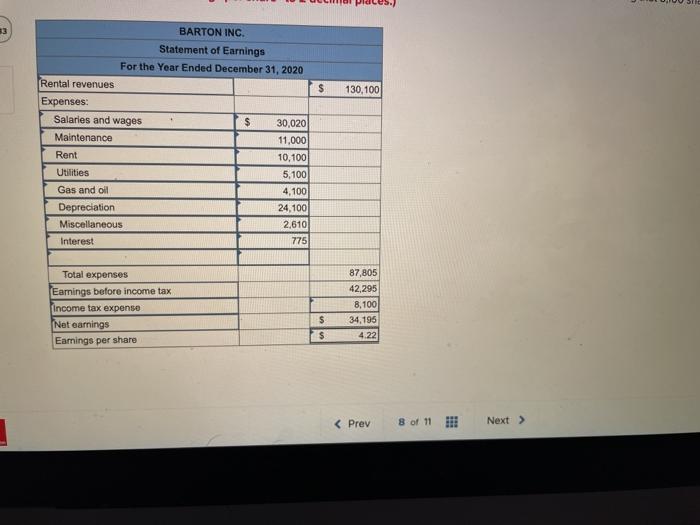

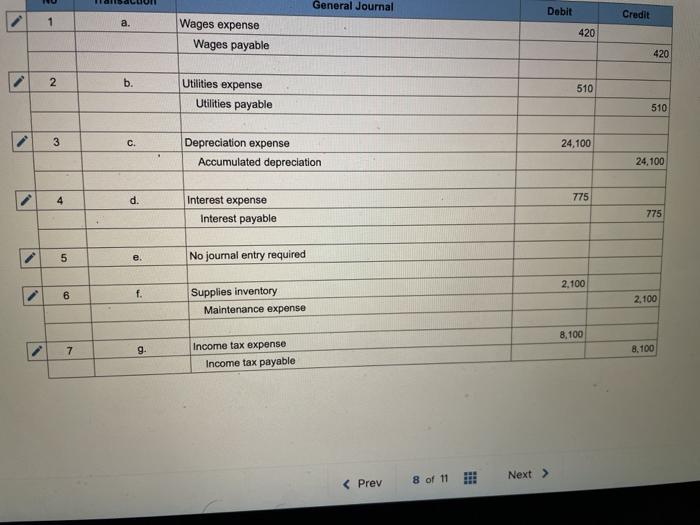

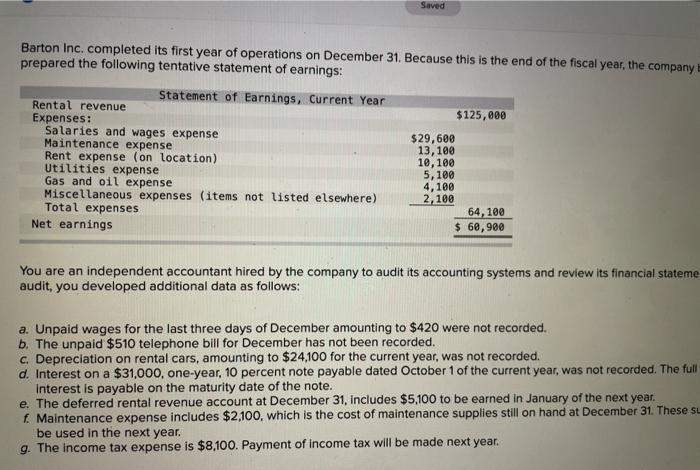

3. Compute the net profit margin ratio based on the corrected Information (Round percentage answer to 1 decimal place (n. 0.124 should be entered as 12.4).) Neprofit margin % 53 $ 130,100 BARTON INC. Statement of Earnings For the Year Ended December 31, 2020 Rental revenues Expenses: Salaries and wages $ 30,020 Maintenance 11,000 Rent 10,100 Utilities 5,100 Gas and oil 4,100 Depreciation 24,100 Miscellaneous 2,610 Interest 775 Total expenses Earings before income tax Income tax expenso Net earnings Earnings per share 87,805 42.295 8,100 34,195 4.22 s $ General Journal Debit Credit 1 a. Wages expense Wages payable 420 420 N b. Utilities expense Utilities payable 510 510 3 C. 24,100 Depreciation expense Accumulated depreciation 24.100 4 d. 775 Interest expense Interest payable 775 5 e. No journal entry required 2,100 6 f. Supplies inventory Maintenance expense 2,100 8,100 7 9. 8.100 Income tax expense Income tax payable Saved Barton Inc. completed its first year of operations on December 31. Because this is the end of the fiscal year, the company prepared the following tentative statement of earnings: Statement of Earnings, Current Year Rental revenue $125,000 Expenses: Salaries and wages expense $29,600 Maintenance expense 13, 100 Rent expense (on location) 10,100 Utilities expense Gas and oil expense 4,100 Miscellaneous expenses (items not listed elsewhere) 2,100 Total expenses 64,100 Net earnings $ 60,900 5, 100 You are an independent accountant hired by the company to audit its accounting systems and review its financial stateme audit, you developed additional data as follows: a. Unpaid wages for the last three days of December amounting to $420 were not recorded. b. The unpaid $510 telephone bill for December has not been recorded. c. Depreciation on rental cars, amounting to $24,100 for the current year, was not recorded. d. Interest on a $31,000, one-year, 10 percent note payable dated October 1 of the current year, was not recorded. The full Interest is payable on the maturity date of the note. e. The deferred rental revenue account at December 31, includes $5,100 to be earned in January of the next year. f. Maintenance expense includes $2,100, which is the cost of maintenance supplies still on hand at December 31. These SL be used in the next year. 9. The income tax expense is $8,100. Payment of income tax will be made next year