Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Consider a buyer willing to buy a good x that a seller owns. The buyer values the item at 100 GBP where the

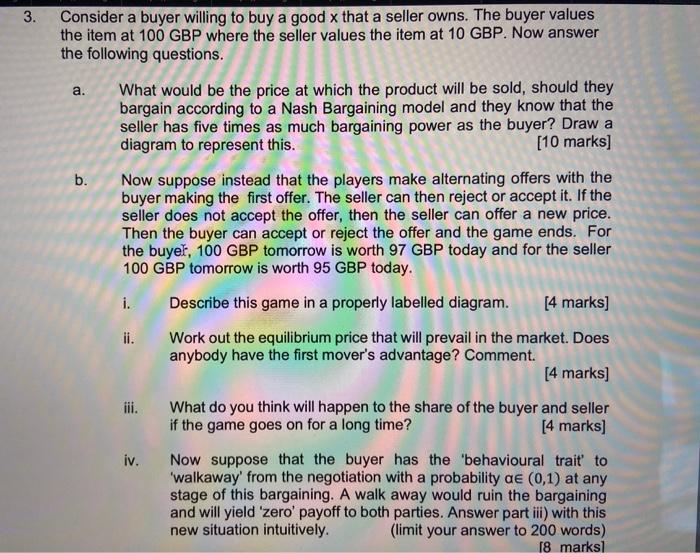

3. Consider a buyer willing to buy a good x that a seller owns. The buyer values the item at 100 GBP where the seller values the item at 10 GBP. Now answer the following questions. a. b. What would be the price at which the product will be sold, should they bargain according to a Nash Bargaining model and they know that the seller has five times as much bargaining power as the buyer? Draw a diagram to represent this. [10 marks] Now suppose instead that the players make alternating offers with the buyer making the first offer. The seller can then reject or accept it. If the seller does not accept the offer, then the seller can offer a new price. Then the buyer can accept or reject the offer and the game ends. For the buyer, 100 GBP tomorrow is worth 97 GBP today and for the seller 100 GBP tomorrow is worth 95 GBP today. i. Describe this game in a properly labelled diagram. [4 marks] ii. Work out the equilibrium price that will prevail in the market. Does anybody have the first mover's advantage? Comment. [4 marks] iii. What do you think will happen to the share of the buyer and seller if the game goes on for a long time? [4 marks] iv. Now suppose that the buyer has the 'behavioural trait' to 'walkaway' from the negotiation with a probability a (0,1) at any stage of this bargaining. A walk away would ruin the bargaining and will yield 'zero' payoff to both parties. Answer part iii) with this new situation intuitively. (limit your answer to 200 words) [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started