Question

3. Consider a stock which is currently selling at $4.5. The stock price will either go up to $5 +a with probability 0.5 or

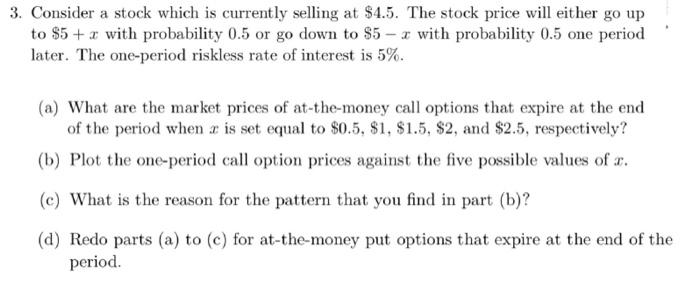

3. Consider a stock which is currently selling at $4.5. The stock price will either go up to $5 +a with probability 0.5 or go down to $5 - z with probability 0.5 one period later. The one-period riskless rate of interest is 5%. (a) What are the market prices of at-the-money call options that expire at the end of the period when a is set equal to $0.5, $1, $1.5, $2, and $2.5, respectively? (b) Plot the one-period call option prices against the five possible values of r. (c) What is the reason for the pattern that you find in part (b)? (d) Redo parts (a) to (c) for at-the-money put options that expire at the end of the period.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Risn neutral probability of an up state p S0 x 1 r Sd Su Sd 45 x 1 5 5 x 5 x 5 x x 0275 2x Strike price for at the money call option K current price S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting principles and analysis

Authors: Terry d. Warfield, jerry j. weygandt, Donald e. kieso

2nd Edition

471737933, 978-0471737933

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App