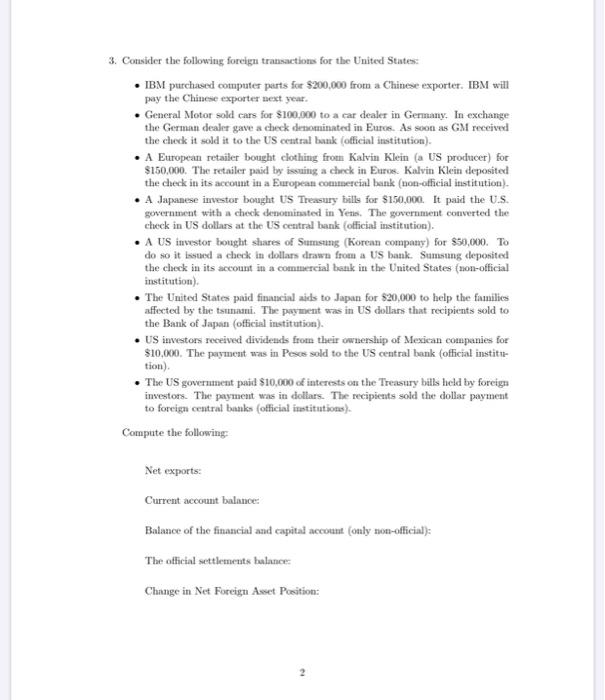

3. Consider the following foreign transactions for the United States IBM purchased computer parts for $200.000 from a Chinese exporter. IBM will pay the Chinese exporter next year. General Motor sold cars for $100.000 to a car dealer in Germany. In exchange the German dealer gave a check denominated in Euros. As soon as GM received the check it sold it to the US central bank (official institution) A European retailer bought clothing from Kalvin Klein (a US producer) for $150,000. The retailer paid by issuing a check in Euros. Kalvin Klein deposited the check in its account in a European commercial bank (non-official institution). A Japanese investor bought US Treasury bills for $150,000. It paid the U.S. government with a check denominated in Yers. The government converted the check in US dollars at the US central bank (official institution). A US investor bought shares of Sumsung (Korean company) for $50,000. To do so it issued a check in dollars drawn from a US bank. Sumsung deposited the check in its account in a commercial bank in the United States (non-official institution). The United States paid financial aids to Japan for $20,000 to help the families affected by the tsunami. The payment was in US dollars that recipients sold to the Bank of Japan (official institution). US investors received dividends from their ownership of Mexican companies for $10,000. The payment was in Pesos sold to the US central bank (official institu tion) The US government paid $10,000 of interests on the Treasury bills held by foreign investors. The payment was in dollars. The recipients sold the dollar payment to foreign central banks (official institutions). Compute the following: Net exports: Current account balances Balance of the financial and capital account only non-official) The official settlements balance Change in Net Foreign Asset Position: 3. Consider the following foreign transactions for the United States IBM purchased computer parts for $200.000 from a Chinese exporter. IBM will pay the Chinese exporter next year. General Motor sold cars for $100.000 to a car dealer in Germany. In exchange the German dealer gave a check denominated in Euros. As soon as GM received the check it sold it to the US central bank (official institution) A European retailer bought clothing from Kalvin Klein (a US producer) for $150,000. The retailer paid by issuing a check in Euros. Kalvin Klein deposited the check in its account in a European commercial bank (non-official institution). A Japanese investor bought US Treasury bills for $150,000. It paid the U.S. government with a check denominated in Yers. The government converted the check in US dollars at the US central bank (official institution). A US investor bought shares of Sumsung (Korean company) for $50,000. To do so it issued a check in dollars drawn from a US bank. Sumsung deposited the check in its account in a commercial bank in the United States (non-official institution). The United States paid financial aids to Japan for $20,000 to help the families affected by the tsunami. The payment was in US dollars that recipients sold to the Bank of Japan (official institution). US investors received dividends from their ownership of Mexican companies for $10,000. The payment was in Pesos sold to the US central bank (official institu tion) The US government paid $10,000 of interests on the Treasury bills held by foreign investors. The payment was in dollars. The recipients sold the dollar payment to foreign central banks (official institutions). Compute the following: Net exports: Current account balances Balance of the financial and capital account only non-official) The official settlements balance Change in Net Foreign Asset Position