Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Consider the monthly returns of McDonald's stock from August 1966 to December 2014. The data are available from CRSP and in the file

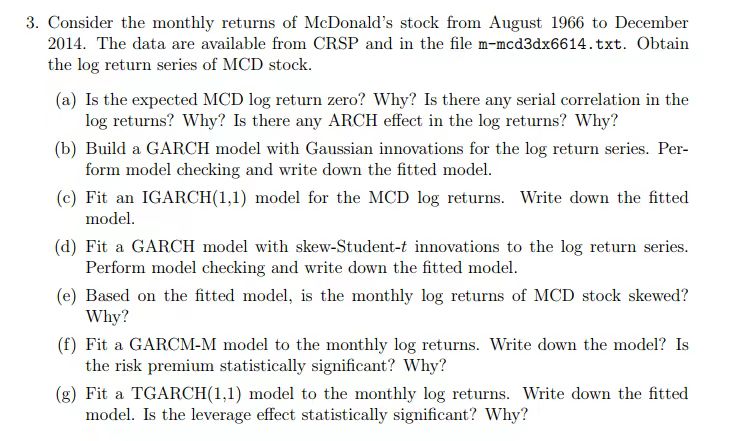

3. Consider the monthly returns of McDonald's stock from August 1966 to December 2014. The data are available from CRSP and in the file m-mcd3dx6614.txt. Obtain the log return series of MCD stock. (a) Is the expected MCD log return zero? Why? Is there any serial correlation in the log returns? Why? Is there any ARCH effect in the log returns? Why? (b) Build a GARCH model with Gaussian innovations for the log return series. Per- form model checking and write down the fitted model. (c) Fit an IGARCH(1,1) model for the MCD log returns. Write down the fitted model. (d) Fit a GARCH model with skew-Student-t innovations to the log return series. Perform model checking and write down the fitted model. (e) Based on the fitted model, is the monthly log returns of MCD stock skewed? Why? (f) Fit a GARCM-M model to the monthly log returns. Write down the model? Is the risk premium statistically significant? Why? (g) Fit a TGARCH(1,1) model to the monthly log returns. Write down the fitted model. Is the leverage effect statistically significant? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

This set of questions requires several steps to analyze the monthly returns of McDonalds stock including data analysis statistical testing and fitting various types of GARCH models Lets break down eac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started