Question

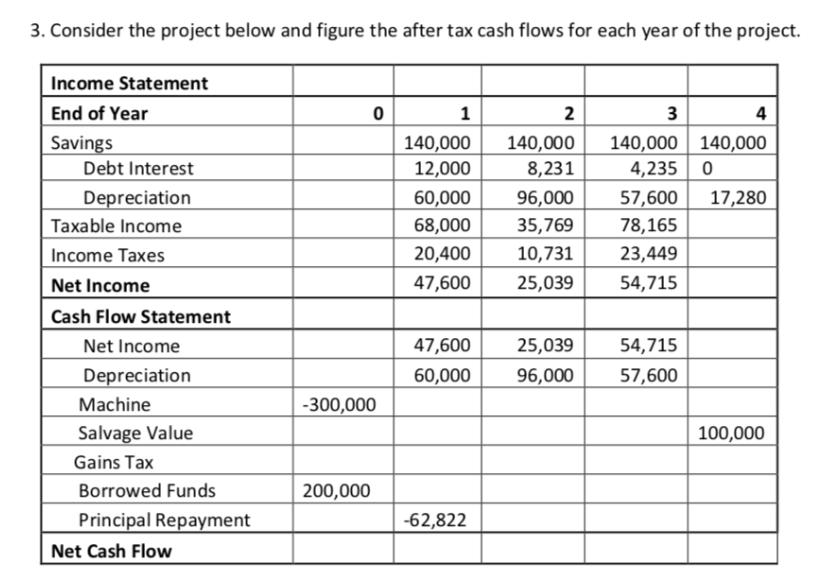

3. Consider the project below and figure the after tax cash flows for each year of the project. Income Statement End of Year Savings

3. Consider the project below and figure the after tax cash flows for each year of the project. Income Statement End of Year Savings Debt Interest Depreciation Taxable Income Income Taxes Net Income Cash Flow Statement Net Income Depreciation Machine Salvage Value Gains Tax Borrowed Funds Principal Repayment Net Cash Flow 0 -300,000 200,000 1 140,000 12,000 60,000 68,000 20,400 47,600 2 140,000 8,231 -62,822 3 4 140,000 140,000 4,235 0 96,000 57,600 17,280 35,769 78,165 10,731 23,449 25,039 54,715 47,600 25,039 54,715 60,000 96,000 57,600 100,000

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Here are the aftertax cash flows for each year of the project Year Cash Flow 0 300000 Machine Cost 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App