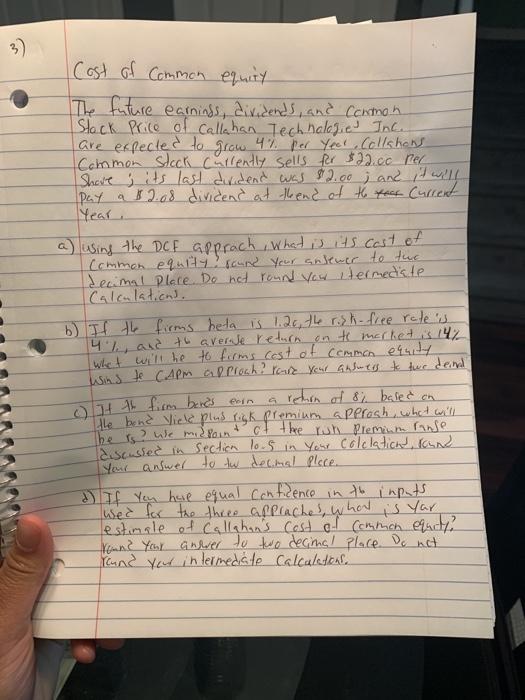

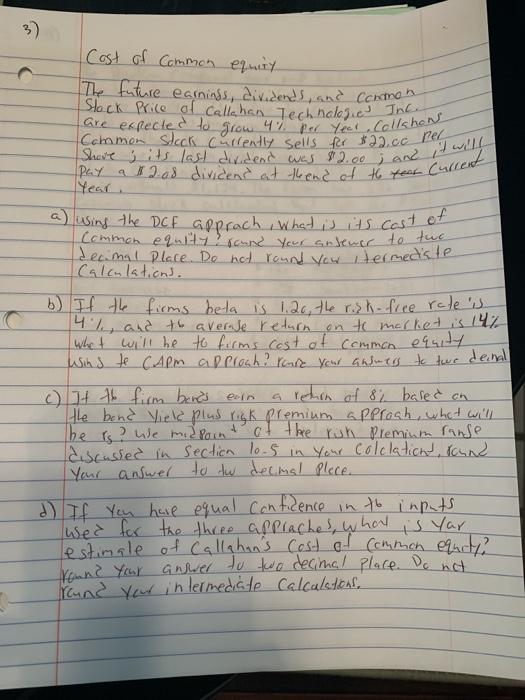

3) Cost of Common equity The future earnings, dividends, and common Stack Price of callahan Technologie Inc. are expected to grow 4% por Yeel Collshons Common stock Cullently sells for $22.cc per Share ; its last dividend was $2.00 ; and it will pay a $2.08 dividend at the end of the fact Current Year. a) using the DCF apprach , what is its cost of Common equity sound your anlever to the decimal plore Do not round you Hermediate Calculations. b) If the firms heta is 1.20, the rish- free rate is 4%, and to averse return on to market is 14% What will he to firms cost of common equity was to CAPM approch? ravie your answers to tur denal a return of 8% based on the bond Viele plus rigk premium approsh, what will The is? We midpoin I of the rush Premium ranse discussed in section 10.5 in your colclation round Your answer to tw decimal place d) If You hare equal Confidence in to inputs wed for the three afflaches, whore is yar estimale of Callahan's cost of common equity? round your answer to two decimal place. Do not round your intermediate Calculations. c) it th firm bands earn Cost of common equiry The future earninds, dividends, and Carmen Istock Price of Callahan Technologie Ince are expected to grow 47 per year Collshon Common Stock Currently sells for $22.cc rer Pay a 112.08 dividens at thend of th tear. Shave j its last dividend was $2.00 j and it will Year a) using the DCE approch. What is its cost of Common equity! round your enlever to the decimal Place. Do not round your termediate Calculations. b) If the firms hela is 1.20, the righ-free rate is 4 h, and to averase return on to market is 14% what will be to firms cost of common equity wins to CAPm approch? rause your answers to two deinal c) It to firm bands earn a redion of 8; based on the bend Vield plus rigk premium approah, what will he is? We midpoint of the run Premium ranse discussed in Section 10.5 in your colclations, round Your answer to tw deemal Place d) If you have equal Confidence in to inputs wed for the three appraches, whorl is yar estimale of Callahan's cost of common equity? round your answer to two decimal place. Do not round your intermediate Calculations