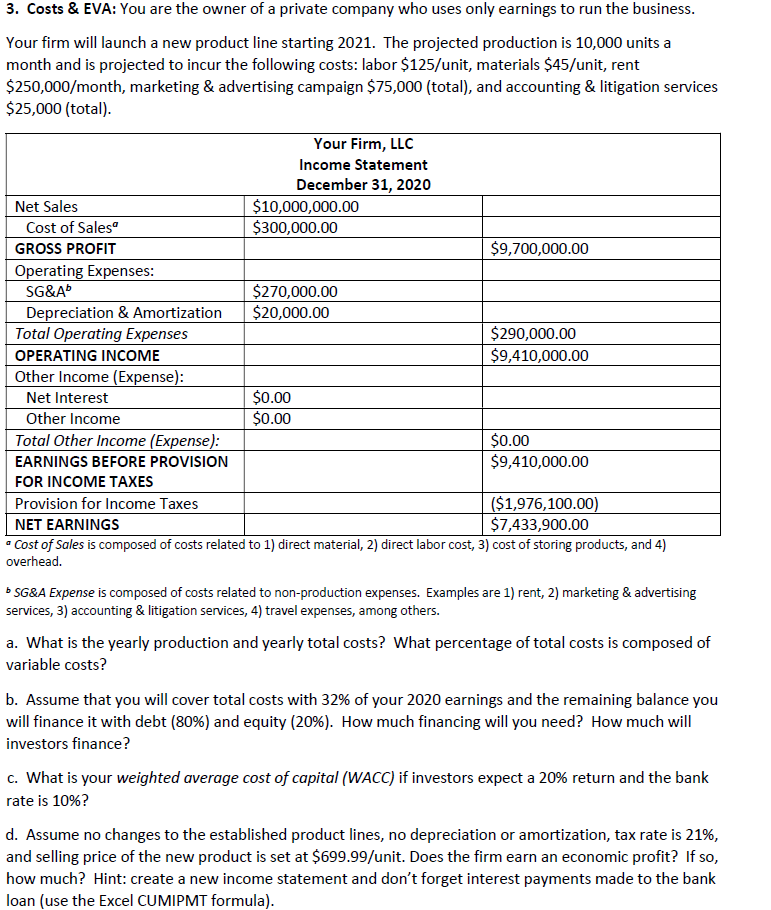

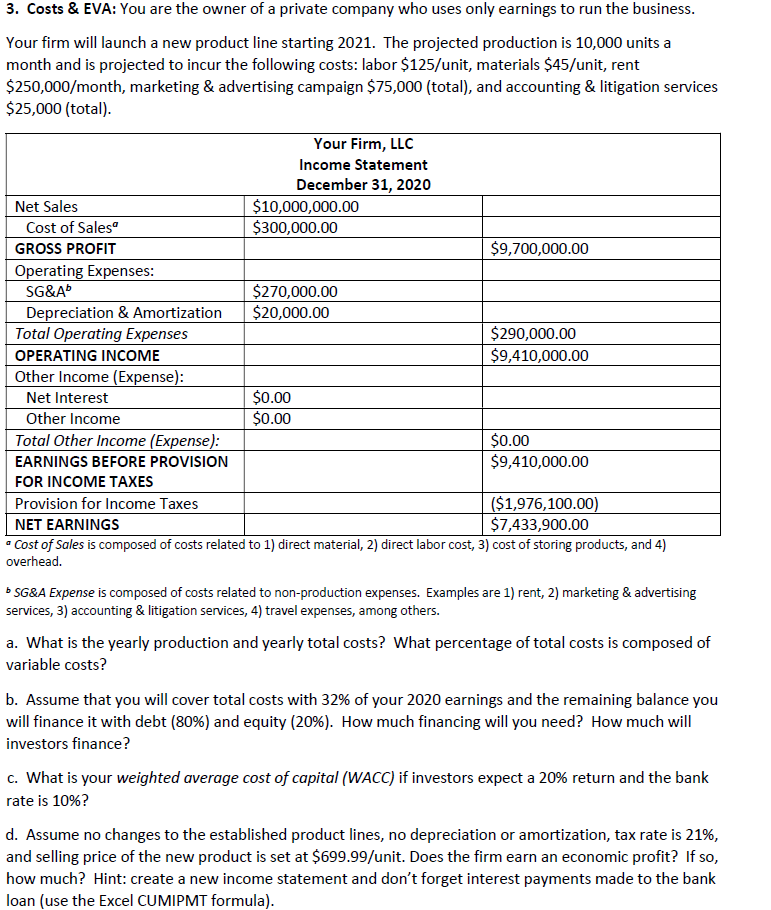

3. Costs & EVA: You are the owner of a private company who uses only earnings to run the business. Your firm will launch a new product line starting 2021. The projected production is 10,000 units a month and is projected to incur the following costs: labor $125/unit, materials $45/unit, rent $250,000/month, marketing & advertising campaign $75,000 (total), and accounting & litigation services $25,000 (total). Your Firm, LLC Income Statement December 31, 2020 Net Sales $10,000,000.00 Cost of Salesa $300,000.00 GROSS PROFIT $9,700,000.00 Operating Expenses: SG&A $270,000.00 Depreciation & Amortization $20,000.00 Total Operating Expenses $290,000.00 OPERATING INCOME $9,410,000.00 Other Income (Expense): Net Interest $0.00 Other Income $0.00 Total Other Income (Expense): $0.00 EARNINGS BEFORE PROVISION $9,410,000.00 FOR INCOME TAXES Provision for Income Taxes ($1,976,100.00) NET EARNINGS $7,433,900.00 . Cost of Sales is composed of costs related to 1) direct material, 2) direct labor cost, 3) cost of storing products, and 4) overhead. bSG&A Expense is composed of costs related to non-production expenses. Examples are 1) rent, 2) marketing & advertising services, 3) accounting & litigation services, 4) travel expenses, among others. a. What is the yearly production and yearly total costs? What percentage of total costs is composed of variable costs? b. Assume that you will cover total costs with 32% of your 2020 earnings and the remaining balance you will finance it with debt (80%) and equity (20%). How much financing will you need? How much will investors finance? c. What is your weighted average cost of capital (WACC) if investors expect a 20% return and the bank rate is 10%? d. Assume no changes to the established product lines, no depreciation or amortization, tax rate is 21%, and selling price of the new product is set at $699.99/unit. Does the firm earn an economic profit? If so, how much? Hint: create a new income statement and don't forget interest payments made to the bank loan (use the Excel CUMIPMT formula)