3

could you pls answer the below questions with brief explanation

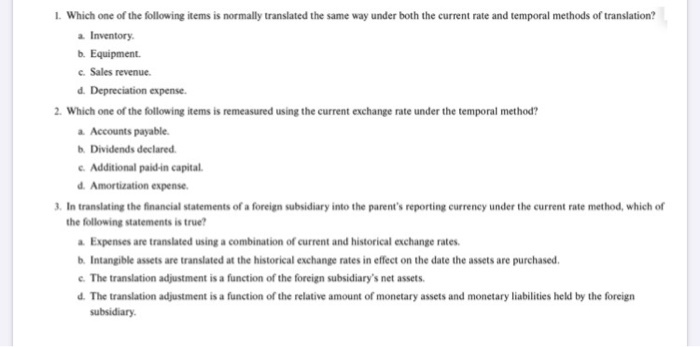

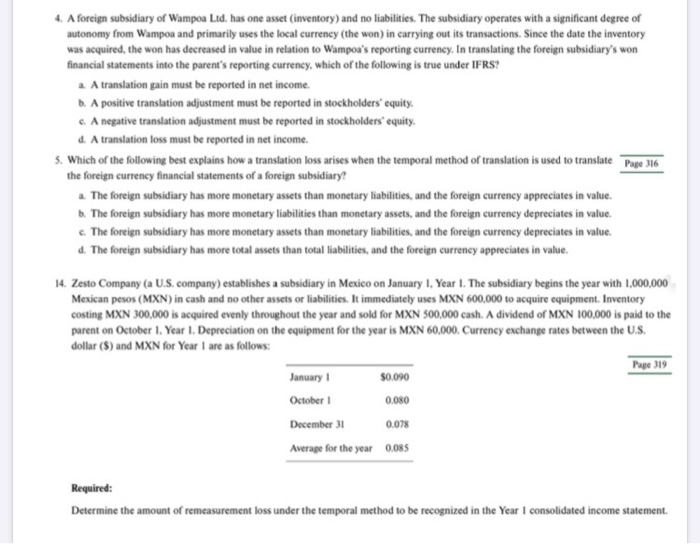

1. Which one of the following items is normally translated the same way under both the current rate and temporal methods of translation? a Inventory b. Equipment c. Sales revenue. d. Depreciation expense. 2. Which one of the following items is remeasured using the current exchange rate under the temporal method? a Accounts payable . Dividends declared c. Additional paid in capital. d. Amortization expense. 3. In translating the financial statements of a foreign subsidiary into the parent's reporting currency under the current rate method, which of the following statements is true! a. Expenses are translated using a combination of current and historical exchange rates b. Intangible assets are translated at the historical exchange rates in effect on the date the assets are purchased c. The translation adjustment is a function of the foreign subsidiary's net assets. d. The translation adjustment is a function of the relative amount of monetary assets and monetary liabilities held by the foreign subsidiary 4. A foreign subsidiary of Wampoa Ltd. has one asset (inventory) and no liabilities. The subsidiary operates with a significant degree of autonomy from Wampoa and primarily uses the local currency (the won) in carrying out its transactions. Since the date the inventory was acquired, the won has decreased in value in relation to Wampoa's reporting currency. In translating the foreign subsidiary's won financial statements into the parent's reporting currency, which of the following is true under IFRS? a. A translation gain must be reported in net income. b. A positive translation adjustment must be reported in stockholders' equity. c. A negative translation adjustment must be reported in stockholders' equity. d. A translation loss must be reported in net income. 5. Which of the following best explains how a translation loss arises when the temporal method of translation is used to translate Page 316 the foreign currency financial statements of a foreign subsidiary! a. The foreign subsidiary has more monetary assets than monetary liabilities, and the foreign currency appreciates in value. b. The foreign subsidiary has more monetary liabilities than monetary assets, and the foreign currency depreciates in value c. The foreign subsidiary has more monetary assets than monetary liabilities, and the foreign currency depreciates in value. d. The foreign subsidiary has more total assets than total liabilities, and the foreign currency appreciates in value. 14. Zesto Company (a U.S. company) establishes a subsidiary in Mexico on January 1 Year 1. The subsidiary begins the year with 1,000,000 Mexican pesos (MXN) in cash and no other assets or liabilities. It immediately uses MXN 600,000 to acquire equipment. Inventory costing MXN 300,000 is acquired evenly throughout the year and sold for MXN 500,000 cash. A dividend of MXN 100,000 is paid to the parent on October 1 Year I. Depreciation on the equipment for the year is MXN 60,000. Currency exchange rates between the U.S. dollar ($) and MXN for Year 1 are as follows: Page 319 January 1 $0.090 October 0.080 December 31 0.078 Average for the year 0.085 Required: Determine the amount of remeasurement loss under the temporal method to be recognized in the Year I consolidated income statement