Answered step by step

Verified Expert Solution

Question

1 Approved Answer

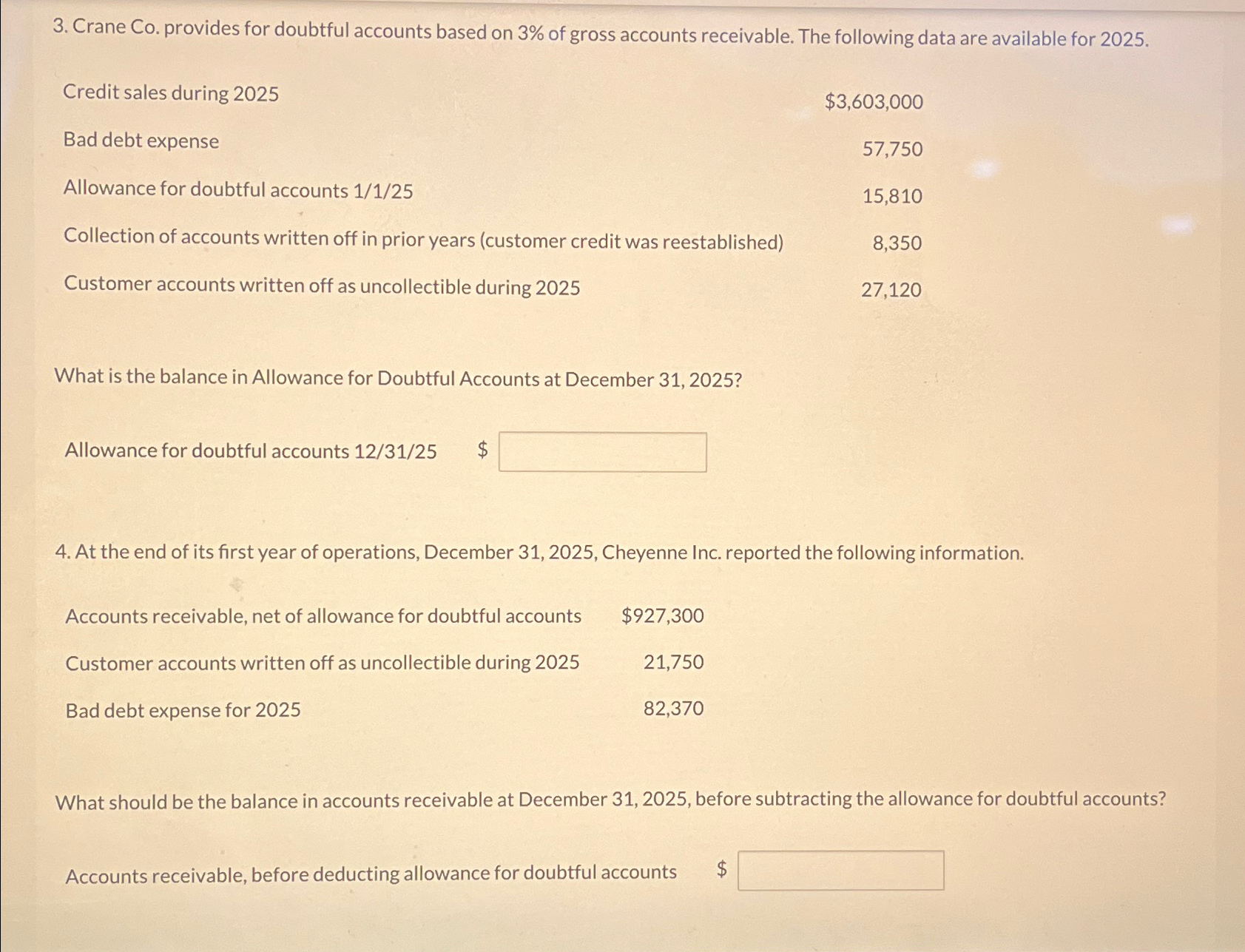

3. Crane Co. provides for doubtful accounts based on 3% of gross accounts receivable. The following data are available for 2025. Credit sales during

3. Crane Co. provides for doubtful accounts based on 3% of gross accounts receivable. The following data are available for 2025. Credit sales during 2025 Bad debt expense $3,603,000 57,750 Allowance for doubtful accounts 1/1/25 15,810 Collection of accounts written off in prior years (customer credit was reestablished) Customer accounts written off as uncollectible during 2025 8,350 27,120 What is the balance in Allowance for Doubtful Accounts at December 31, 2025? Allowance for doubtful accounts 12/31/25 $ 4. At the end of its first year of operations, December 31, 2025, Cheyenne Inc. reported the following information. Accounts receivable, net of allowance for doubtful accounts $927,300 Customer accounts written off as uncollectible during 2025 21,750 Bad debt expense for 2025 82,370 What should be the balance in accounts receivable at December 31, 2025, before subtracting the allowance for doubtful accounts? Accounts receivable, before deducting allowance for doubtful accounts

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To solve these problems we need to use the information provided to calculate the balance in the Allo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642ba4cba6e7_975282.pdf

180 KBs PDF File

6642ba4cba6e7_975282.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started