Answered step by step

Verified Expert Solution

Question

1 Approved Answer

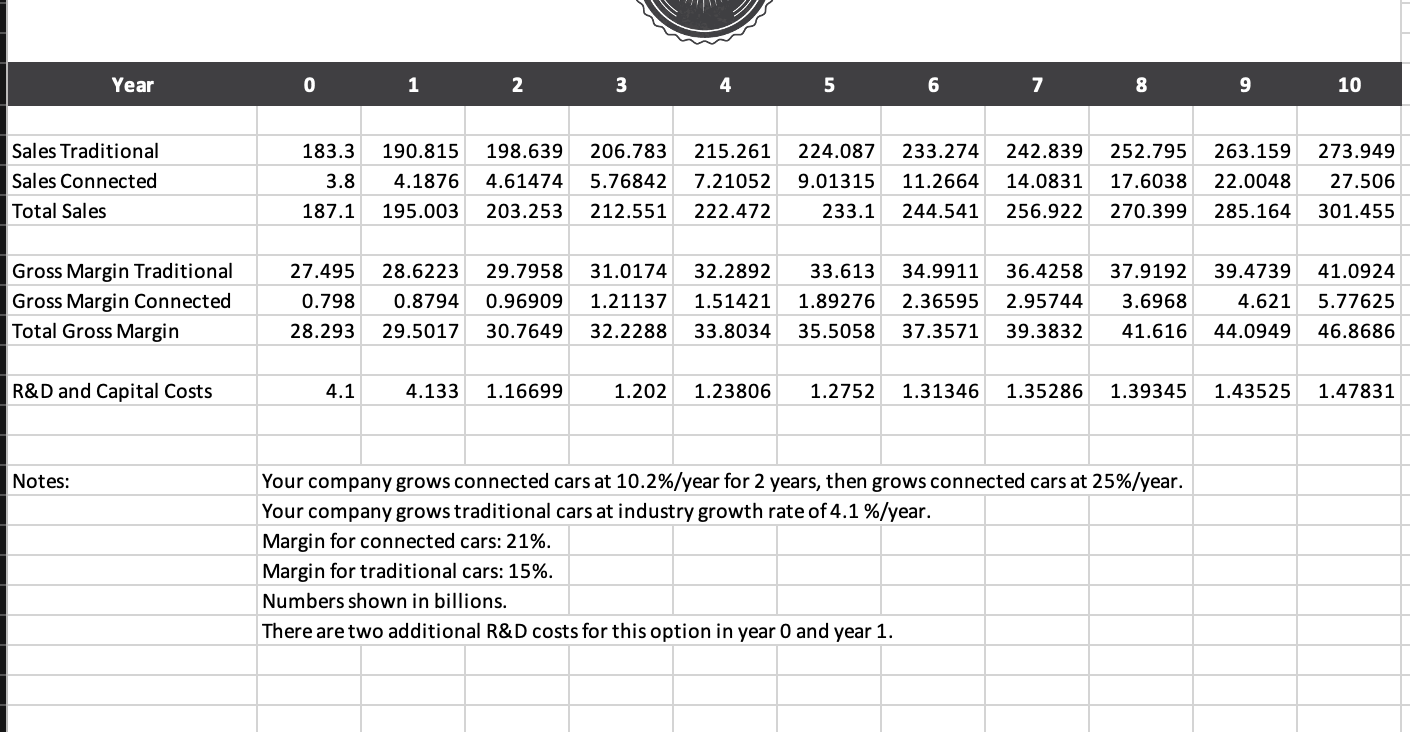

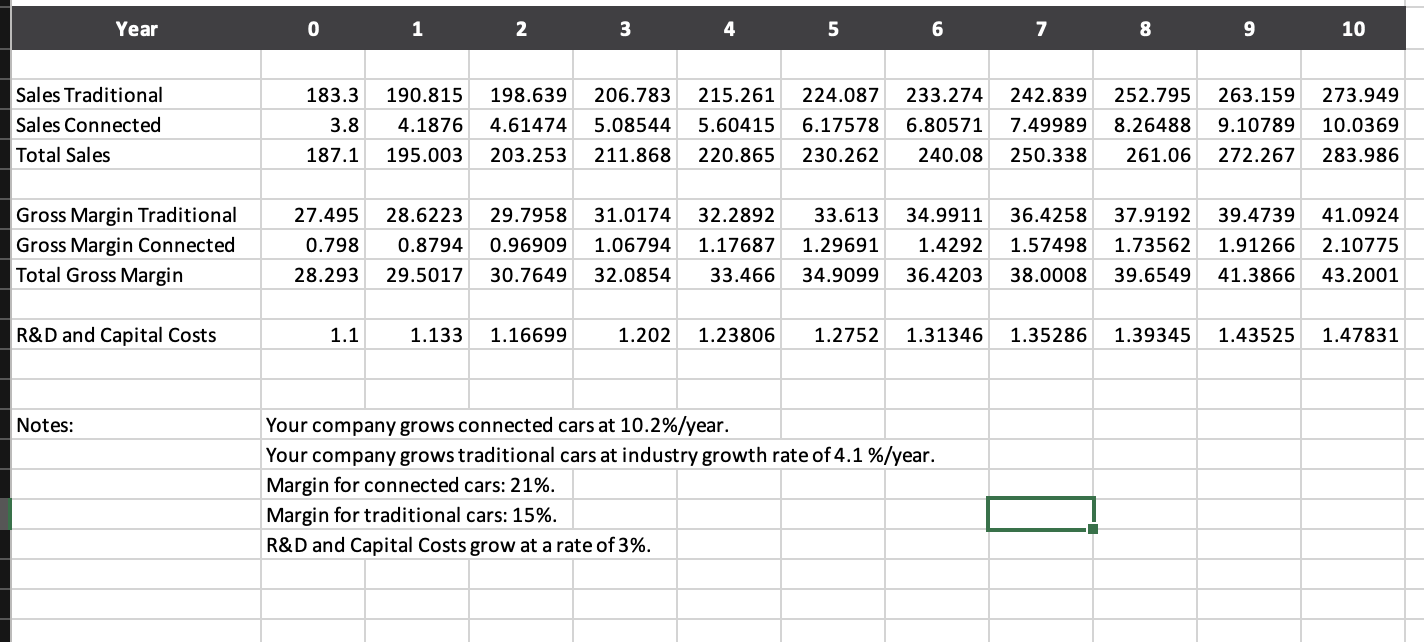

3. Create a chart for gross margin less R&D and capital costs calculations. a. Calculate gross margin less R&D and capital costs for options

3. Create a chart for gross margin less R&D and capital costs calculations. a. Calculate gross margin less R&D and capital costs for options A and B. b. Graph total gross margin less R&D and capital costs forecasts to compare options A and B on a line chart. Both options should appear on the same chart. Year 0 1 2 3 4 5 6 7 8 9 10 Sales Traditional 183.3 Sales Connected Total Sales 190.815 198.639 206.783 215.261 224.087 233.274 3.8 4.1876 4.61474 5.76842 7.21052 9.01315 187.1 195.003 203.253 212.551 222.472 233.1 242.839 252.795 263.159 273.949 11.2664 14.0831 17.6038 22.0048 27.506 244.541 256.922 270.399 285.164 301.455 Gross Margin Traditional Gross Margin Connected Total Gross Margin 27.495 28.6223 29.7958 31.0174 32.2892 33.613 34.9911 36.4258 37.9192 0.798 0.8794 0.96909 1.21137 1.51421 1.89276 2.36595 2.95744 3.6968 28.293 29.5017 30.7649 32.2288 33.8034 35.5058 37.3571 39.3832 39.4739 41.0924 4.621 5.77625 41.616 44.0949 46.8686 R&D and Capital Costs 4.1 4.133 1.16699 1.202 1.23806 1.2752 1.31346 1.35286 1.39345 1.43525 1.47831 Notes: Your company grows connected cars at 10.2% / year for 2 years, then grows connected cars at 25%/year. Your company grows traditional cars at industry growth rate of 4.1 %/year. Margin for connected cars: 21%. Margin for traditional cars: 15%. Numbers shown in billions. There are two additional R&D costs for this option in year 0 and year 1. Year 0 1 2 3 4 5 6 7 8 9 10 Sales Traditional Sales Connected 183.3 190.815 198.639 206.783 215.261 224.087 233.274 242.839 252.795 263.159 273.949 3.8 4.1876 4.61474 5.08544 5.60415 6.17578 6.80571 7.49989 8.26488 9.10789 10.0369 187.1 195.003 203.253 211.868 220.865 230.262 240.08 250.338 261.06 272.267 283.986 Total Sales Gross Margin Traditional Gross Margin Connected Total Gross Margin 27.495 28.6223 29.7958 31.0174 32.2892 33.613 34.9911 36.4258 37.9192 39.4739 41.0924 0.798 0.8794 0.96909 1.06794 1.17687 1.29691 1.4292 1.57498 1.73562 1.91266 2.10775 28.293 29.5017 30.7649 32.0854 33.466 34.9099 36.4203 38.0008 39.6549 41.3866 43.2001 R&D and Capital Costs 1.1 1.133 1.16699 1.202 1.23806 1.2752 1.31346 1.35286 1.39345 1.43525 1.47831 Notes: Your company grows connected cars at 10.2%/year. Your company grows traditional cars at industry growth rate of 4.1 %/year. Margin for connected cars: 21%. Margin for traditional cars: 15%. R&D and Capital Costs grow at a rate of 3%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started