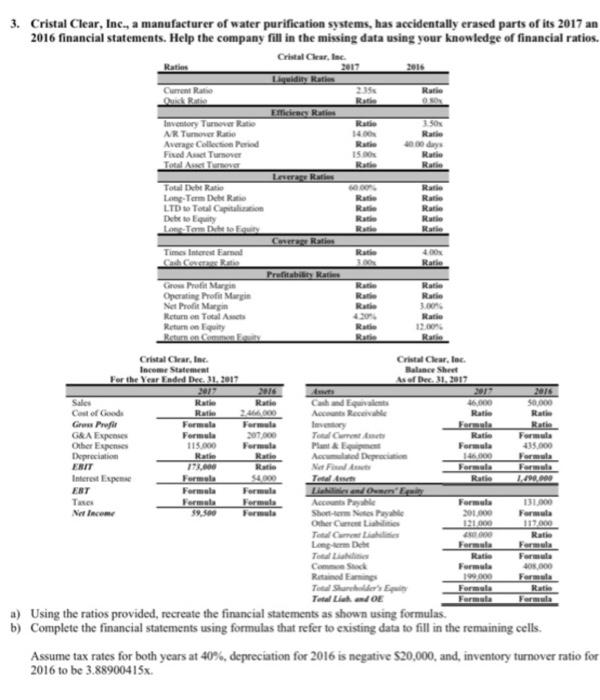

3. Cristal Clear, Inc., a manufacturer of water purification systems, has accidentally erased parts of its 2017 an 2016 financial statements. Help the company fill in the missing data using your knowledge of financial ratios. Creal Clear, Inc. 2015 Liquidity Rates Rati Ratio Current Ratio Rite ER Ratio Inventory Tree Ratio ART Ratio Average Collection Persed Fixed Aunt Turnover Total Auct TS Ratio 15. 250 Ratio 000 Ratio Ratio Letrage Rates Ratio Ratio Toul De Rate Long-Term De Rate LTD Total Capital Dute to Equity Lorem Dates Futy Rati Rate Rat Rati Ratio CR Ratio Times Interest Farnal Ga Cucos 400 Ratio Profitability Ratin Rati Rate Grow Profit Margin Operating Profit Marin Net Profit Margin Return on Total A Remonty Rumen Comment Ratio Ratio 3. Ratio Rati Rate Cristal Clear, Inc. Income Statement For the Year Ended Dec. 11. 2017 Cristal Clear, loc. Balance Sheet As of Dec. 31. 2017 2016 50.000 Chanda A Receive 16.000 Ratlie Forte Rate Formula 435.000 Sales Cast of Goode GP G&A Expenses Other Expenses Depreciation ERIT Interest Expense ERT Times Not Incom Rate Ratio 246000 Formula Formal Formula 307.000 115.00 Formal Rati Ratio Ratio Format 5400 Farmala Formula Format Format 59.500 Format Toalett Plant Ad Der Nur To Forma 1 Formule Ratio Formule 1.790.000 A Pay Shemale Other Cum TC Le-tem Det Formule 301.000 12 Formula Ratio Formule 131.000 Formula 117.000 Rate Formula Formula 40.000 Formula Ratie Formate CeStack Remed Te Shower Formula Total Link and OE a) Using the ratios provided, recreate the financial statements as shown using formulas b) Complete the financial statements using formulas that refer to existing data to fill in the remaining cells. Assume tax rates for both years at 40%, depreciation for 2016 is negative 520,000, and, inventory turnover ratio for 2016 to be 3.88900415x 3. Cristal Clear, Inc., a manufacturer of water purification systems, has accidentally erased parts of its 2017 an 2016 financial statements. Help the company fill in the missing data using your knowledge of financial ratios. Creal Clear, Inc. 2015 Liquidity Rates Rati Ratio Current Ratio Rite ER Ratio Inventory Tree Ratio ART Ratio Average Collection Persed Fixed Aunt Turnover Total Auct TS Ratio 15. 250 Ratio 000 Ratio Ratio Letrage Rates Ratio Ratio Toul De Rate Long-Term De Rate LTD Total Capital Dute to Equity Lorem Dates Futy Rati Rate Rat Rati Ratio CR Ratio Times Interest Farnal Ga Cucos 400 Ratio Profitability Ratin Rati Rate Grow Profit Margin Operating Profit Marin Net Profit Margin Return on Total A Remonty Rumen Comment Ratio Ratio 3. Ratio Rati Rate Cristal Clear, Inc. Income Statement For the Year Ended Dec. 11. 2017 Cristal Clear, loc. Balance Sheet As of Dec. 31. 2017 2016 50.000 Chanda A Receive 16.000 Ratlie Forte Rate Formula 435.000 Sales Cast of Goode GP G&A Expenses Other Expenses Depreciation ERIT Interest Expense ERT Times Not Incom Rate Ratio 246000 Formula Formal Formula 307.000 115.00 Formal Rati Ratio Ratio Format 5400 Farmala Formula Format Format 59.500 Format Toalett Plant Ad Der Nur To Forma 1 Formule Ratio Formule 1.790.000 A Pay Shemale Other Cum TC Le-tem Det Formule 301.000 12 Formula Ratio Formule 131.000 Formula 117.000 Rate Formula Formula 40.000 Formula Ratie Formate CeStack Remed Te Shower Formula Total Link and OE a) Using the ratios provided, recreate the financial statements as shown using formulas b) Complete the financial statements using formulas that refer to existing data to fill in the remaining cells. Assume tax rates for both years at 40%, depreciation for 2016 is negative 520,000, and, inventory turnover ratio for 2016 to be 3.88900415x