Answered step by step

Verified Expert Solution

Question

1 Approved Answer

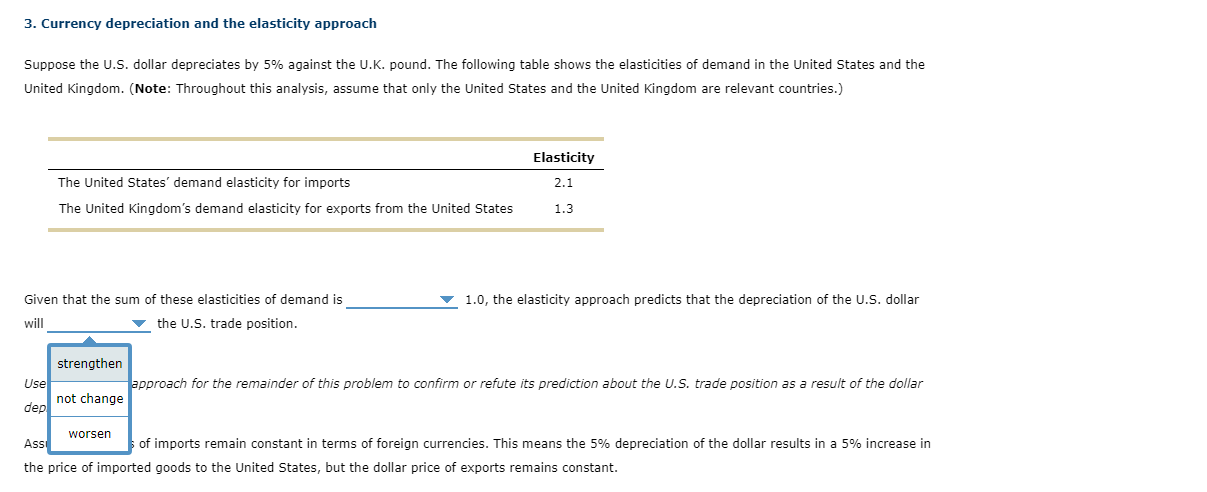

3. Currency depreciation and the elasticity approach Suppose the U.S. dollar depreciates by 5% against the U.K. pound. The following table shows the elasticities

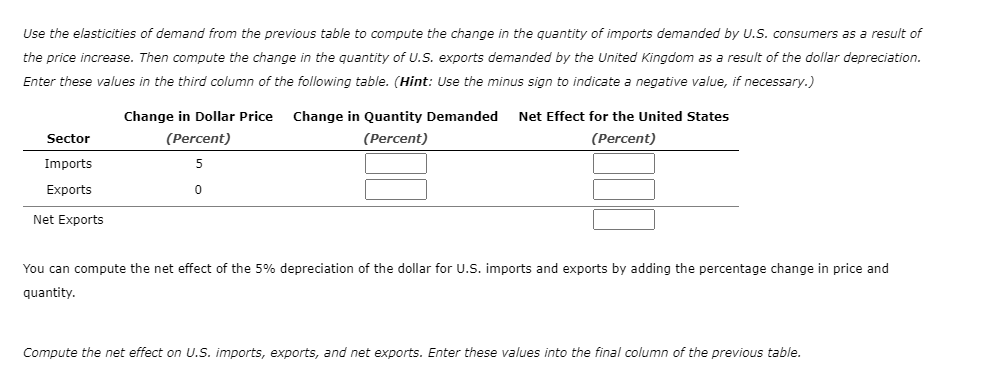

3. Currency depreciation and the elasticity approach Suppose the U.S. dollar depreciates by 5% against the U.K. pound. The following table shows the elasticities of demand in the United States and the United Kingdom. (Note: Throughout this analysis, assume that only the United States and the United Kingdom are relevant countries.) The United States' demand elasticity for imports The United Kingdom's demand elasticity for exports from the United States Elasticity 2.1 1.3 Given that the sum of these elasticities of demand is the U.S. trade position. will Use dep strengthen not change 1.0, the elasticity approach predicts that the depreciation of the U.S. dollar approach for the remainder of this problem to confirm or refute its prediction about the U.S. trade position as a result of the dollar worsen Ass of imports remain constant in terms of foreign currencies. This means the 5% depreciation of the dollar results in a 5% increase in the price of imported goods to the United States, but the dollar price of exports remains constant. Use the elasticities of demand from the previous table to compute the change in the quantity of imports demanded by U.S. consumers as a result of the price increase. Then compute the change in the quantity of U.S. exports demanded by the United Kingdom as a result of the dollar depreciation. Enter these values in the third column of the following table. (Hint: Use the minus sign to indicate a negative value, if necessary.) Change in Dollar Price Change in Quantity Demanded Net Effect for the United States Sector Imports Exports Net Exports (Percent) 5 0 (Percent) (Percent) You can compute the net effect of the 5% depreciation of the dollar for U.S. imports and exports by adding the percentage change in price and quantity. Compute the net effect on U.S. imports, exports, and net exports. Enter these values into the final column of the previous table.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started