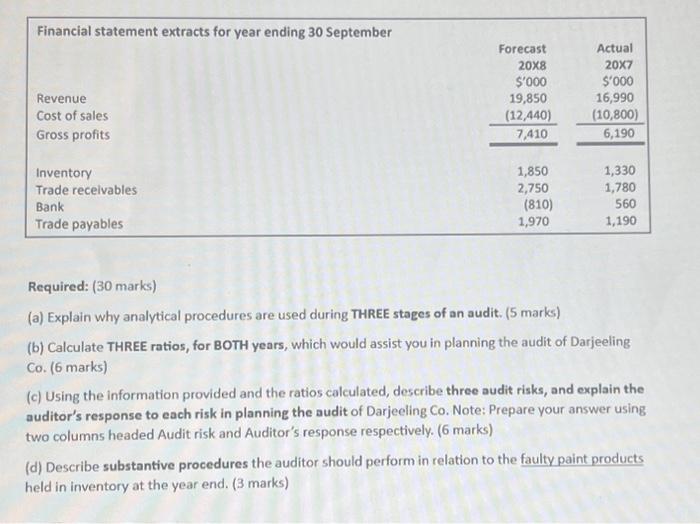

3 DARUEELING CO You are an audit supervisor of Earl \& Co and are planning the audit of Darjeeling Co for the year ending 30 September 20x8. The company develops and manufactures specialist paint products and has been a client of your firm for several years. The audit manager has attended a planning meeting with the finance director and has provided you with the following notes of the meeting and financial statement extracts. You have been asked by the audit manager to undertake preliminary analytical procedures using the financial statement extracts. Planning meeting notes During the year Darjeeling Co has spent $0.9m, which is included within intangible assets, on the development of new product lines, some of which are in the early stages of their development cycle. Additionally, as the company is looking to expand production, during the year it purchased and installed a new manufacturing line. All costs incurred in the purchase and installation of that asset have been included within property, plant, and equipment. These capitalized costs include the purchase price of $2.2m, fnstallation costs of $0.4m and a five-year servicing and maintenance plan costing $0.5m. To finance the development projects and the new manufacturing line, the company borrowed $4m from the bank which is to be repaid in instalments over eight years and has an interest rate of 5%. Developing new products and expanding production is important as the company intends to undertake a stock exchange listing in the next 12 months. The company started a number of initiatives during the year in order to boost revenue. It offered extended credit terms to its customers on the condition that their sales order quantities were increased. In addition, Darjeeling Co made an announcement in October 207 of its 'price promise': that it would match the prices of any competitor for similar products purchased. Customers who are able to prove that they could purchase the products cheaper elsewhere are asked to claim the difference from Darjeeling Co, within one month of the date of purchase of goods, via its website. The company intends to include a refund liability of $0.25m, which is based on the monthly level of claims to date, in the draft financial statements. The finance director informed the audit manager that a problem arose in June 208 in relation to the mixing of materials within the production process for one particular product line. A number of these faulty paint products had already been sold and the issue was identified following a number of complaints from customers about the paint consistency being incorrect. As a precaution, further sales have been stopped and a product recall has been initiated for any of these specific paint products sold since June. Management is investigating whether the paint consistency of the faulty products can be rectified and subsequently sold. Required: (30 marks) (a) Explain why analytical procedures are used during THREE stages of an audit. (5 marks) (b) Calculate THREE ratios, for BOTH years, which would assist you in planning the audit of Darjeeling Co. (6 marks) (c) Using the information provided and the ratios calculated, describe three audit risks, and explain the auditor's response to each risk in planning the audit of Darjeeling Co. Note: Prepare your answer using two columns headed Audit risk and Auditor's response respectively. (6 marks) (d) Describe substantive procedures the auditor should perform in relation to the faulty paint products held in inventory at the year end. ( 3 marks)